For many small business owners, tax time may seem burdensome and overwhelming. Incomplete records, uncategorized expenses, and limited time to file tax paperwork all add to the anxiety, leaving them frazzled.

And the IRS doesn’t make it easy on you. There are hundreds of deductions available for small business owners. But how do you know what’s deductible? And what isn’t?

According to the Internal Revenue Service (IRS), a tax-deductible business expense must be “ordinary” (common and accepted in your industry) and “necessary” (helpful and appropriate) to operate your business.

Not knowing which tax deductions you’re eligible for could cost your business a lot of money.

That’s why we put together this guide to help you better grasp what business expenses to write off on your tax return and lower your income tax bill.

What is a tax deduction?

A tax deduction—or tax write-off—refers to any business deduction the IRS allows to lower your taxable income. Generally, these are the costs of doing business. You’re simply subtracting your qualifying expenses from your revenue to help reduce the amount of money you owe the IRS.

Business tax deductions fit into specific reporting categories, like home office expenses, advertising, business travel expenses, and more.

Suppose your revenue is $120,000 for 2023, and you paid $3,000 for marketing services. You can claim this expense as a tax deduction, meaning the taxable income will be $117,000—not $120,000.

Don’t confuse tax deductions and tax credits, even though both help reduce the amount you owe the IRS.

Tax credits are more valuable because they provide a dollar-for-dollar reduction in your tax bill, while tax deductions only reduce your taxable income.

Governments offer tax credits generally to encourage certain good behaviors, such as investing in research and development, purchasing electric vehicles, or installing solar panels.

So, if your tax bill is $15,000, for instance, and you’re entitled to a $5,000 tax credit for buying an electric vehicle, the credit will cut your tax bill by $5,000—to $10,000.

How tax deductions work

Tax deductions are calculated based on your expense reports. This underscores the importance of keeping accurate, up-to-date records of the actual expenses you paid for.

It may help to create a system that categorizes your costs to match what’s on IRS forms so you won’t miss any potential deductions.

Our Tax Preparation software enables you to categorize each transaction in real-time so you can maximize your business tax deductions and reach tax season organized.

Common tax deductions for small businesses

The IRS Publication 535 offers comprehensive guidance on what to write off. However, you can research further in case you have an expense that doesn’t fit neatly into an IRS tax category.

Here’s a list of some of the common ones for small business owners.

Advertising and marketing

If you pay to advertise, publicize, or promote your small business or campaigns to acquire or retain clients, those costs are 100% tax deductible.

The IRS allows you to deduct these expenses provided they’re ordinary, necessary, reasonable, and directly relate to your business activities.

This can include things like:

- Influencer marketing

- Production costs for advertising materials (business cards, logos, etc.)

- Media advertising costs (TV, print, radio, or online)

- Event sponsorships (excluding lobbying or sponsoring political events/campaigns)

Automobiles

Deducting expenses for business use of a car or motor vehicle isn’t straightforward. You can remove the driving costs for business purposes as long as your records are good, accurate, and up to date.

If you’re self-employed, you can score a tax deduction if you use your personal car for business (for example, a trip to visit a client site). The amount you deduct depends on the type of vehicle, purchase price, and what you use it for in your business.

You can use two different methods to calculate motor vehicle tax deduction:

- Actual expense: You must track your mileage plus all car expenses (insurance, gas, repairs) and deduct the business percentage of those costs. You may be able to deduct a depreciation amount each year.

- Standard mileage rate: You’ll deduct a set amount per business mile driven. The IRS sets the amount each year. And 2022 had two rates due to high inflation. The rate for the first six months of the year was 58.5 cents per mile. And the rate for the last six months of 2022 was 62.5 cents per mile. Using the standard mileage method, you don’t need to track what you spend on car expenses—just your business mileage and total annual mileage.

Bad debts

Debts your clients, customers, or patients owe that you can’t collect are bad debts.

You can write off bad debts from your business income at the end of a year as an expense of doing business. That implies you must use the accrual accounting method, where you report income in the tax year you earned it, regardless of when you are paid.

With the cash accounting method, you don’t record income until you’re paid, so you can’t deduct bad debts, and there’s no tax benefit.

Review all your accounts receivable at the end of the year to identify which ones are likely to become bad debts, then deduct the total expense on your business tax return.

Bank fees

Whether you’re operating a sole proprietorship, limited liability company (LLC), or partnership, it’s always good to have a separate bank account and credit cards for your business.

If you incur monthly or annual bank fees, service charges, transfer fees, merchant or third-party payment processor fees, you can deduct them on your tax return.

Books and professional journals

You can deduct your business reference books, professional journals, and subscriptions to technical, medical, or trade journals and magazines. But they must be related to your business to be claimed as a deduction.

Business equipment and office supplies

This category includes any tangible property you use in your business to make a profit. That includes things like machinery, fixtures, furniture, office machines, electronic devices, computers, and more—not buildings or land owned by the business.

You must depreciate equipment over its useful life since you’ll continue using it for multiple years. The IRS lets you claim a portion of its cost on your taxes over a period of years, eventually decreasing its remaining value.

But sometimes, you can skip depreciation and write off the entire cost in the first year. Section 179 depreciation allows business owners to deduct the cost of tangible property they bought in one lump sum.

Office supplies like postage stamps, paper, staples, sticky notes, tape, printer ink and toner, pens, paper plates, and more—which you use for your business during the year are also 100% tax-deductible.

Business insurance

The business insurance expense cost is 100% deductible if it’s ordinary and necessary to run your business. State laws, contracts, and industry regulations require most modern businesses to carry a form of business insurance, such as:

- Accident and health insurance

- Casualty and theft insurance

- Workers’ compensation insurance

- Professional liability or malpractice insurance

- Motor vehicle insurance (for business vehicles)

Business loan interest

Paying interest on loans isn’t fun. But if it’s for your business, it’s generally tax deductible. Make sure the business loan is in the company’s name and you make payments.

Business meals

Following law changes in the Tax Cuts and Jobs Act (TCJA), the IRS issued guidance on business expense deduction for meals.

You can deduct business-related meals at a 50% rate and temporarily deduct 100% through December 31, 2022, for qualifying business meals.

To be eligible for the deduction, the IRS requires that:

- An employee or taxpayer must be present at the meal.

- The meal must not be “lavish or extravagant.”

- The expense must be ordinary and necessary for running your business.

- The meals may be provided to potential or current business clients, customers, consultants, or similar business contacts.

There are specific guidelines on the 50% limit. For instance, you can’t claim the miles you drove to and from the restaurant, but you can deduct tax and tip.

And if entertainment is involved, like taking a potential client to a baseball game, the cost of the food must be separate from the cost of the ticket to the game. That’s because entertainment expenses are not a business tax deduction.

For easier calculation, record and document the following information for each outing:

- Date and place of the meal

- Amount

- Business relationship with the person you dined with

- Purpose of the meal

- What you discussed

Employee expenses

Salaries, wages, recruitment and hiring costs, awards, bonuses, employee benefits (dependent-care assistance, retirement plans, educational assistance, flights, meals, and lodging), and even vacation time paid to your workers are tax-deductible if:

- The salary is ordinary, necessary, and reasonable

- The services were actually provided

Workers’ compensation insurance is also tax deductible, if applicable in your state, as are costs of outsourcing to freelancers, independent contractors, copywriters, or agencies. This can also include professional fees from business advisers, lawyers, and more.

Rent

If you rent office equipment or property for business (warehouse/storage or other office space), you can deduct the rental payments as a business expense in the year they’re paid.

You may claim certain home office deductions, like repairs, mortgage interest, property taxes, maintenance, and some utilities, as long as the house meets the “exclusive and regular use” requirements.

Equipment leasing also qualifies as a tax deduction under rental or lease payments as long as you have the actual lease—not a conditional sales contract.

Software subscriptions

Internet services, domain registration, web hosting, online tools, and apps you use daily in running your business are deducted as office or utility expenses.

If you run your business out of your home, factor in the exact square footage you use for business to calculate the amount you can claim.

Expensing these costs also comes with benefits if you use them solely to run your business. For instance, if you pay subscriptions for tools like Skype, Hootsuite, or Evernote, you can deduct 100% of the cost on your tax return.

Start-up expenses

The costs you incur to get your business up and running are tax deductible. Registration fees, legal costs, office supplies, and marketing expenses related to starting up your business can help reduce your tax bill. Just remember that they need to be ordinary and necessary for your company.

Tax and licenses

You can also deduct various taxes (payroll, personal property, state income, excise, sales, fuel, and more) on your tax return.

Annual fees paid to obtain or renew required business licenses that are ordinary and necessary are also tax deductible.

Nondeductible small business expenses

There are a few exceptions to the expenses you may associate with your business that are non-deductible, such as:

- Lobbying expenses

- Political contributions

- Fines and penalties for breaking the law

- Federal income tax payments

- Tax penalties or interest you incur

- Charitable contributions

- Certain interest costs that must be capitalized

- Entertainment

- Business clothing (except uniforms worn only to work)

- Personal care expenses (gym memberships, haircuts, manicures, etc.)

- Personal travel expenses

Remember, tax-deductible expenses must be “ordinary and necessary” to qualify for a deduction on your business tax return. That’s why it’s important to research the rules and check with a certified public accountant (CPA) or other tax professional to be sure.

Maximize your business tax deductions with Lili

Taxes are business as usual, but there are dozens of tax deductions that can help you lower your tax bill. To use these deductions, you must prove the associated costs and fees, which means keeping proper, organized records and receipts.

Not sure how to do it? Our Tax Preparation software can help.

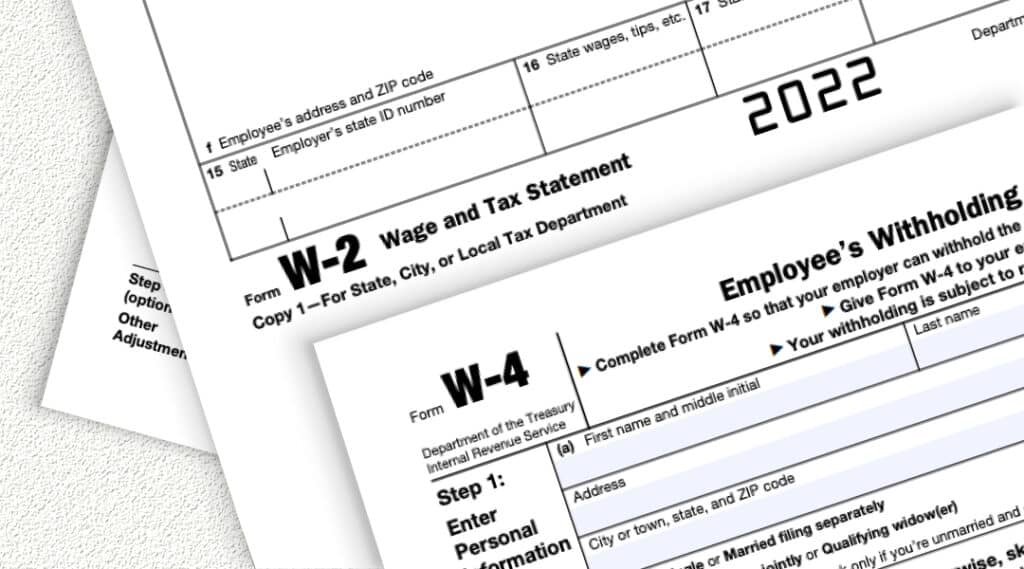

Our Tax Prep software makes tax season simpler by enabling you to instantly categorize business expense and income transactions, automatically set aside a percentage of your income to cover your tax payment, and generate prefilled tax forms, whether Schedule C, Form 1065, or Form 1120-S.

Open a Lili account today and maximize your business tax deductions!