Managing your accounting and payments in one platform simplifies your bookkeeping and gives you a clear picture of your financial position.

Managing your accounting and payments in one platform simplifies your bookkeeping and gives you a clear picture of your financial position.

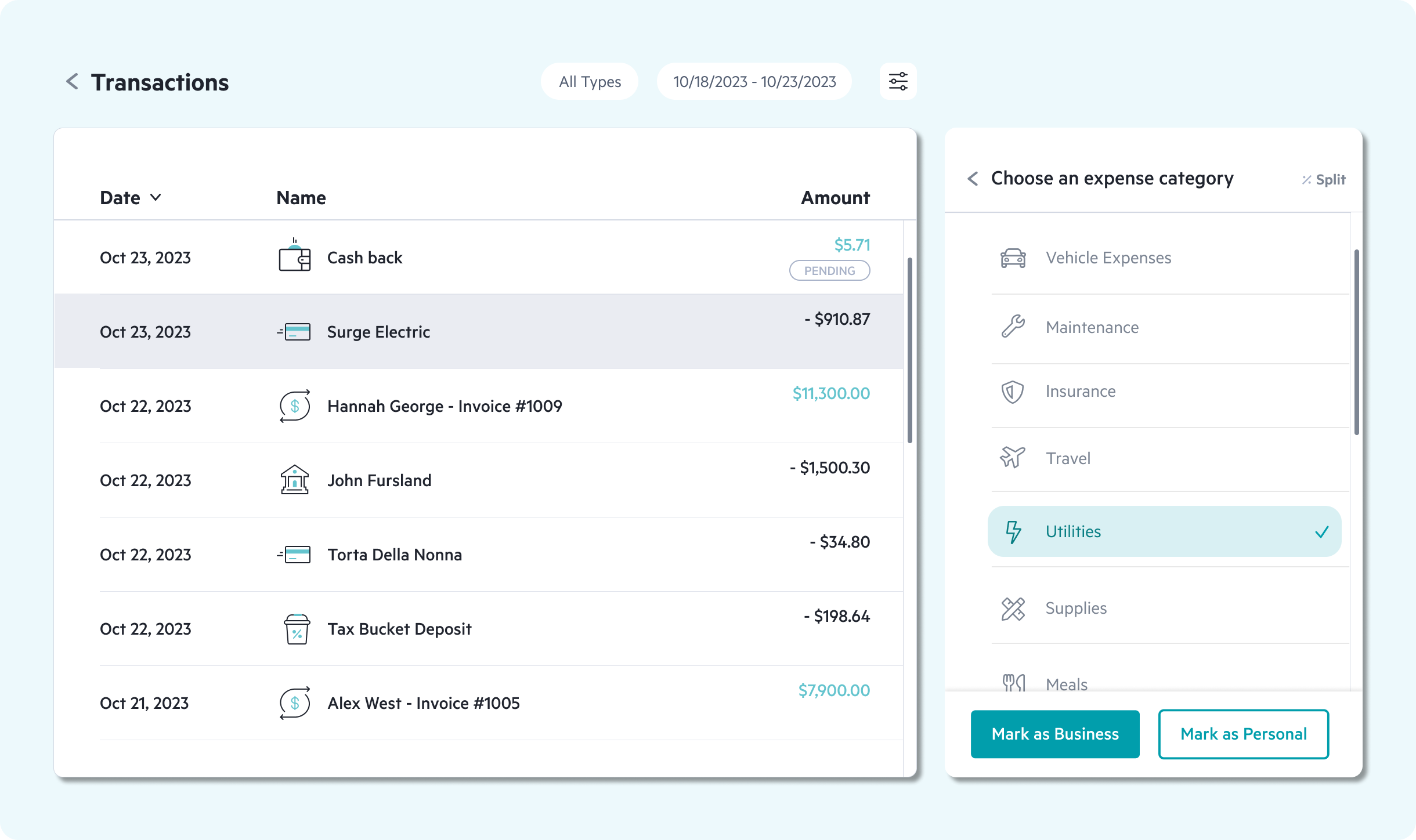

Categorizing transactions as you go is not only convenient, but it means greater accuracy in your bookkeeping and financial reporting, all of which will help maximize business tax deductions.

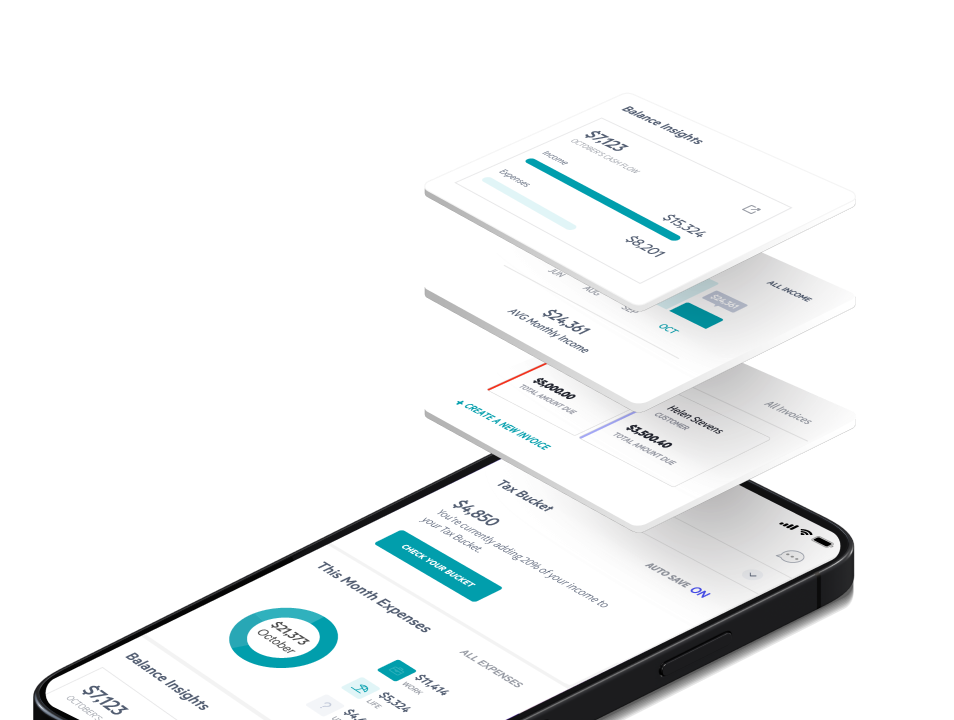

Instead of having to transfer data between your bank and accounting platform, and manually categorize past transactions, all it takes to keep your books up to date with Lili is a quick swipe in the Lili platform whenever you use your Lili Visa® Debit Card. And, with predictive transaction categorization2 powered by Lili AI, categorization becomes truly instant. Those categorizing swipes will also automatically generate financial reports and insights2, and streamline your tax preparation.

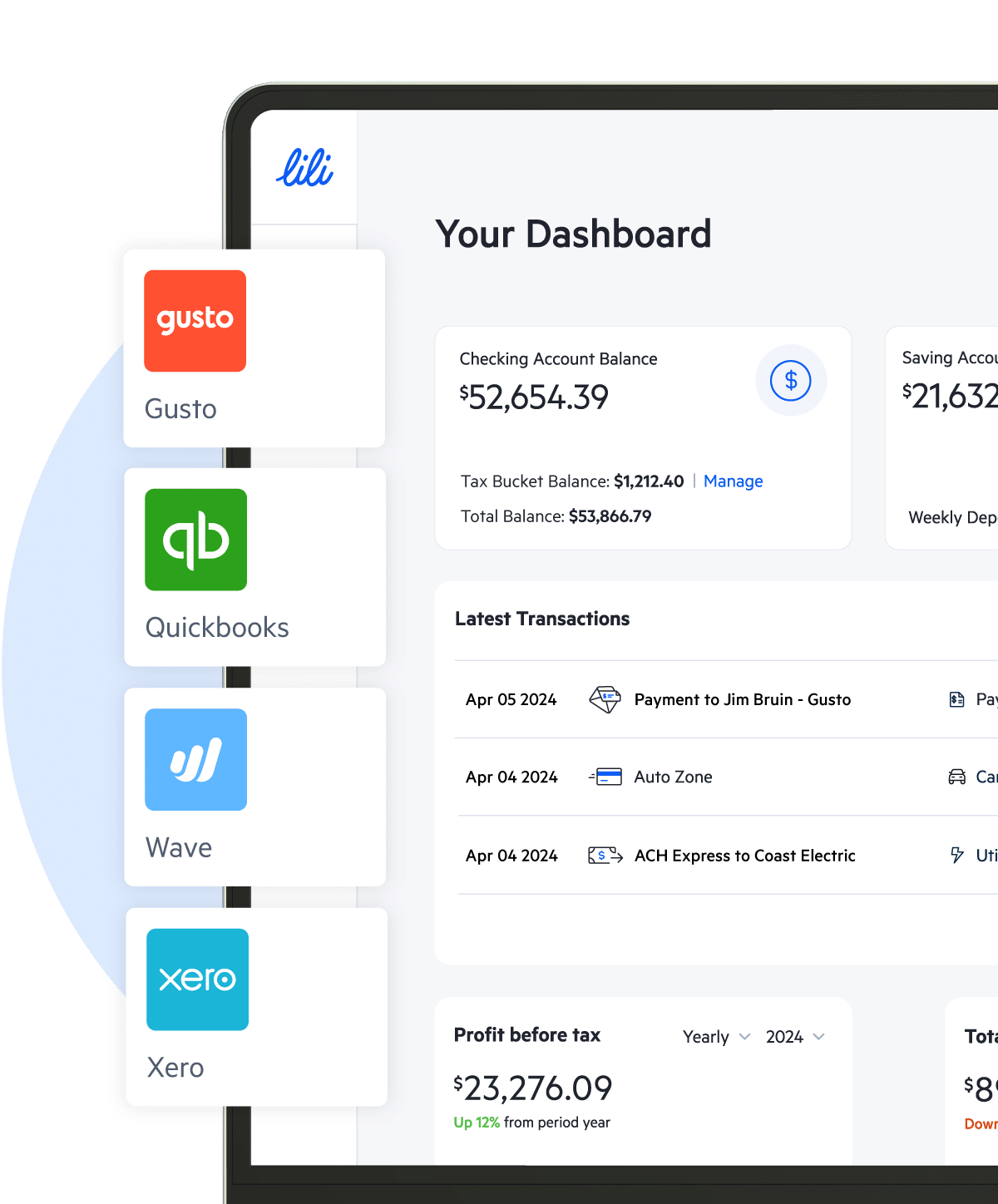

If you already use a third-party accounting solution, you can easily connect it with Lili and avoid any disruption to your business operations.

Stay in control of your cash flow with a Bill Pay solution that enables you to pay vendors faster, automates reconciliation, and syncs with your Lili bookkeeping.

Make unlimited business payments with no additional subscription fees2.

You can add money to your Lili account by selecting “Add Money” in the main menu of the Lili platform and choosing any of the following methods: