Take a quick tour of the tools inside the Lili account. Banking, bookkeeping, invoicing, and taxes, all in one place.

Business banking built for

your small business

A powerful banking platform that supports your business, not the other way around.

Banking services are provided by Sunrise Banks, N.A., Member FDIC

Run your business without the usual banking fees

Minimal fees15. Clear terms. No surprises.

Built for how you actually operate

Less time managing money. More time running your business.

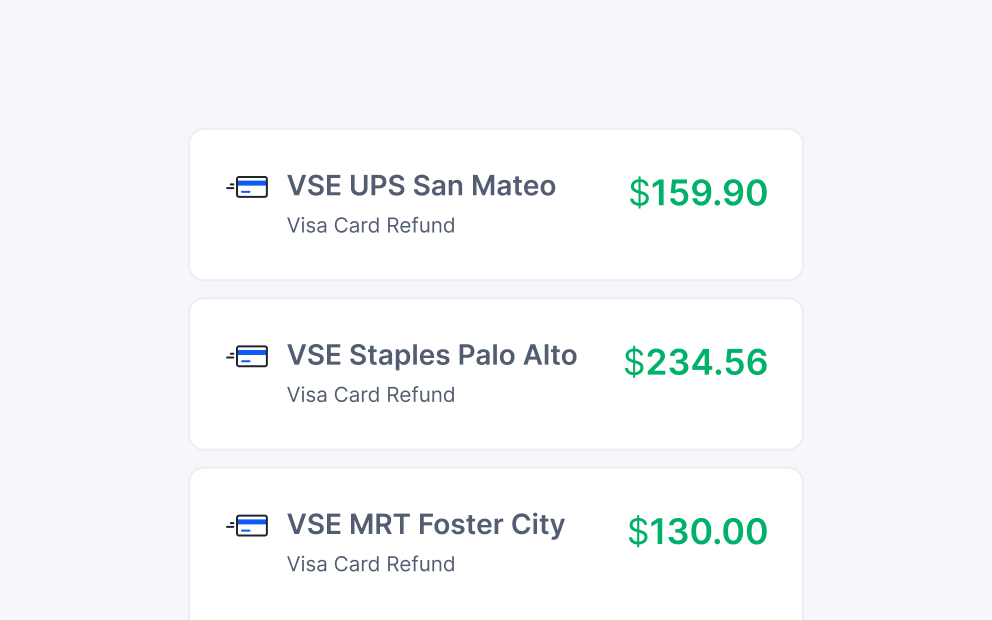

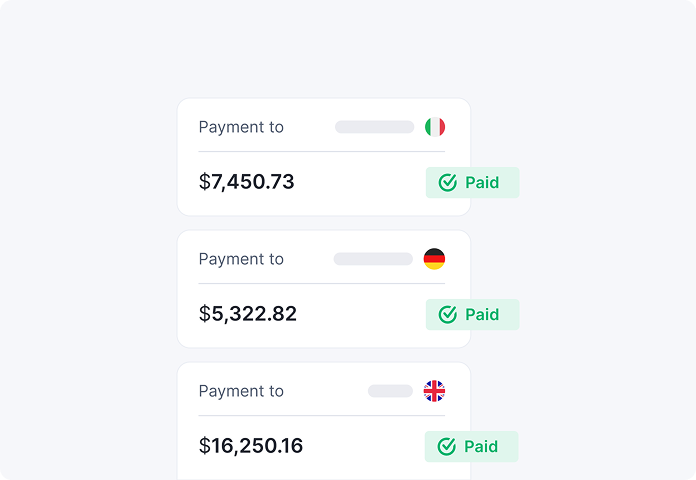

Payments that keep you moving

Send and receive funds quickly, with limits designed for growing operations.

Support that shows up when it matters

83% of customers rate Lili support 9 or 10.16

Keep banking from becoming

another task on your list

Banking services are provided by Sunrise Banks, N.A., Member FDIC

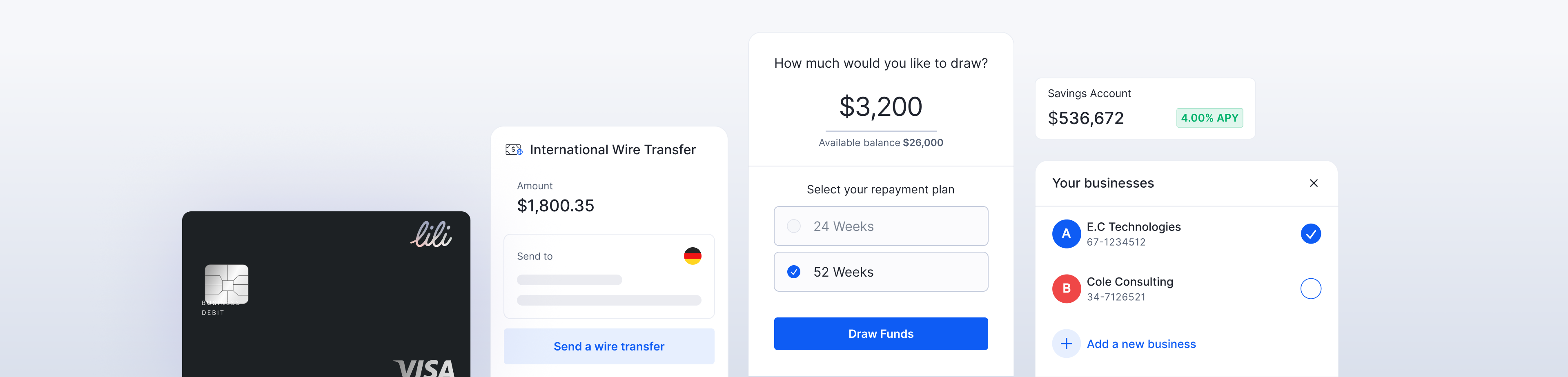

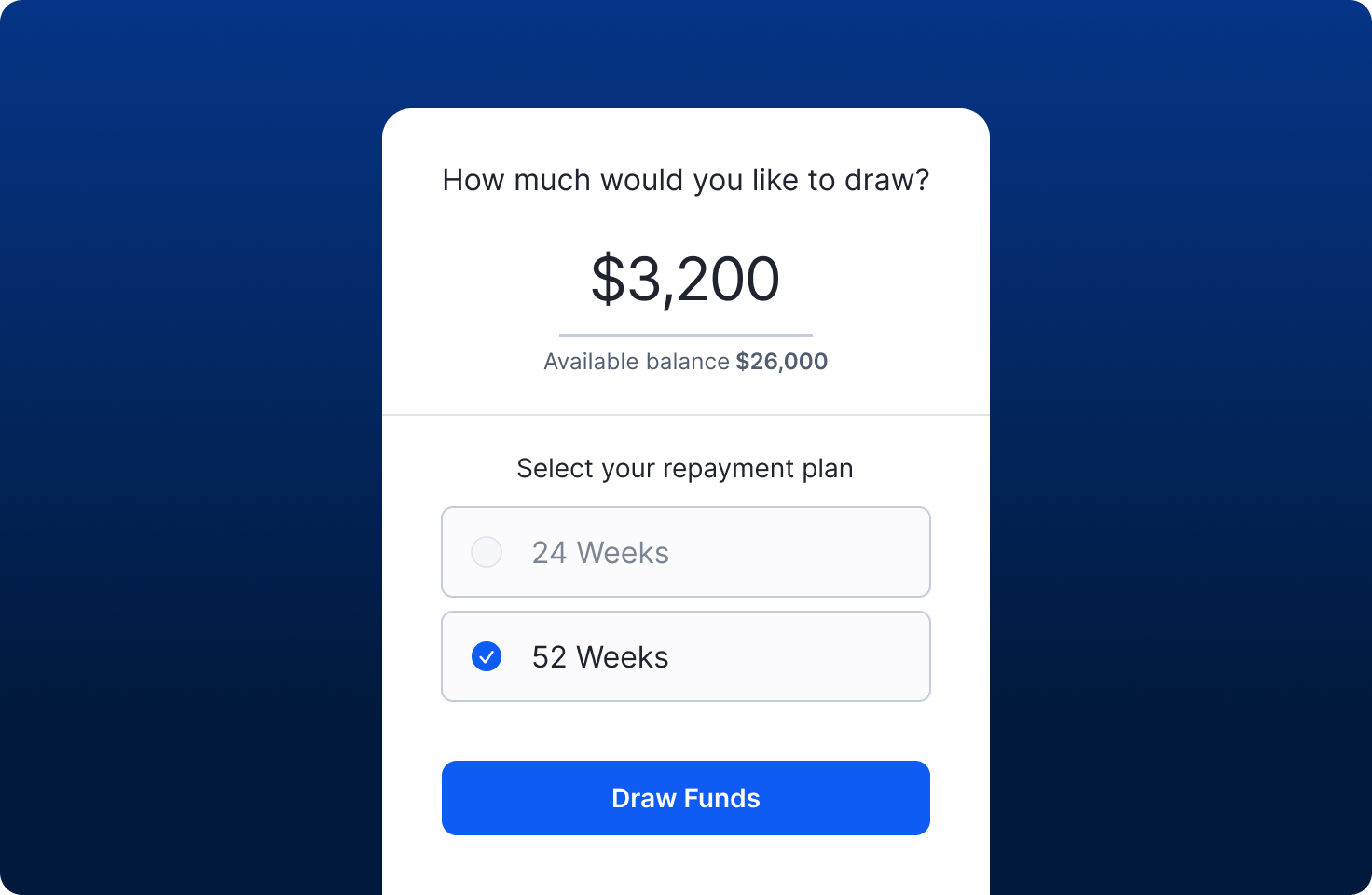

Flexible credit that grows with you

Get access to lending options without slowing down your operations.10

Put your money to work, securely

Earn more on your operating cash without sacrificing access.

Designed for teams and shared operations

Keep financial operations aligned as your business grows.

Works with the tools you already use

Connect with 50+ business integrations across accounting, payroll, and payments.

More value where it matters most

Apply in minutes. No branch

visits. No paperwork delays.

1. Enter your business information

2. Verify your identity

3. Access your account immediately

Banking services are provided by Sunrise Banks, N.A., Member FDIC