Lili, the award winning business banking platform with over 200,000 businesses served, today announced a major shift in its offering as it moves upmarket to serve growing, multi employee small businesses.

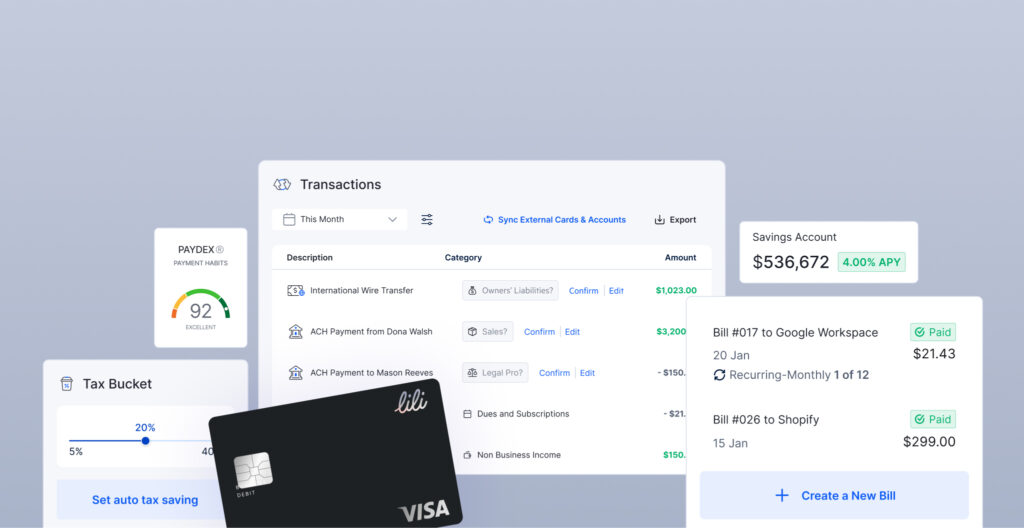

In 2026, Lili is making a decisive change to its business. After building its reputation with freelancers and solopreneurs, the company is now designed specifically for higher revenue, multi employee small businesses with more complex financial needs. Lili is backing that move by making advanced business banking, including $3M FDIC12 insurance, up to 4.00% Annual Percentage Yield (APY)3 on savings, and 7-day customer support.

As part of this shift, Lili is introducing $0 monthly fee online banking for small businesses in the US. The company’s Core plan now delivers full featured business banking with no hidden charges, high payment limits, and up to $3 million in FDIC insurance, removing cost barriers that often slow down scaling companies.

Lili’s free Core monthly plan is built for speed and volume. Businesses can send and receive domestic and international wire transfers9, access expedited check deposits11 and Express ACH, and securely grant access to accountants and team members. Companies can also earn up to 4.00% APY on business savings with no lockups, no minimums, and daily earnings on every dollar.

Built for growing businesses, Lili integrates seamlessly with the tools small businesses already rely on, including QuickBooks, Xero, Stripe, Shopify, and Gusto, allowing banking to fit naturally into existing workflows.

Lili operates as a digital first banking platform, delivering business banking through a streamlined online experience rather than physical branches. Lili is a financial technology company, while banking services including deposit accounts and FDIC insurance up to $3M are provided through a partnership with Sunrise Banks, a Member FDIC institution, and Lili’s sweep network of program banks.

“Small businesses do not stand still. As they grow, their financial needs become more complex, faster, and more demanding. We built Lili to support businesses as they scale,” said Lilac Bar David, CEO of Lili. “Making advanced business banking without a monthly fee is our way of removing friction and giving growing companies the infrastructure they actually need.”

3 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of January 13, 2026. Must have at least $0.01 in savings to earn interest. 2.25% APY applies to balances of up to and including $500,000. 4.00% APY applies to balances over $500,000 and up to and including $1,000,000. Any portions of a balance over $1,000,000 will not earn interest or have a yield. Available to Lili plans.

9 International wire transfers are only available to legal entity customers (LLCs, corporations, and partnerships). Transfers can be made to and from select countries. Please check your app for the most up to date list. Fees apply. Learn more here Sunrise Banks Account Agreement.

11 Expedited availability of funds is based on individual circumstances.

12 FDIC insurance only covers the failure of an FDIC insured bank. The standard FDIC deposit insurance limit is $250,000 per depositor, per FDIC insured bank, per ownership category through Sunrise Banks, N.A and the sweep program banks. See Sunrise Banks Account Agreement and Addendum to Sunrise Banks Account Agreement.

14 The Core banking account has no monthly fee. Monthly fees apply to the Pro, Smart, and Premium accounts. See the fee schedule here for details.