Fill in some basic personal information.

Collecting payment with Stripe?

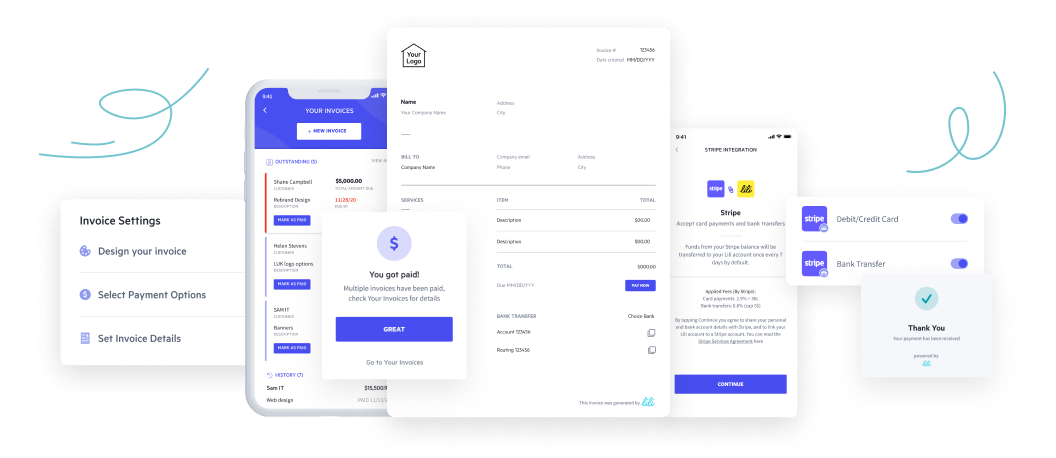

Use Lili’s Invoicing Software and make it easier to get paid!

Special discount: Get 30 days free plus 40% off Lili Smart fee for 3 months

Get 40% off Lili Smart fee for 3 months

When you bill customers with Stripe, transaction fees are deducted from received invoice payments. Use this calculator to easily determine Stripe fees and what you should charge to account for them.

Collecting payment with Stripe?

Use Lili’s Invoicing Software and make it easier to get paid!

When using Stripe to bill customers and collect payment for your business, both fixed rate and percentage-based fees will accrue. These fees vary based on payment type, currency, and payment method, making it difficult to calculate fees before sending an invoice. With our Stripe fee calculator, you can quickly determine what fees to expect so you can charge your customers accurately to account for these additional charges.

The most common Stripe fee is 2.9% + $0.30 per transaction, which can be accounted for easily with our Stripe fee calculator. For any additional fees, refer to the following table based on which Stripe tools you are using (current as of November 29, 2023):

Stripe Tool* |

Percentage of Amount Fee |

Fixed Fee (USD) |

| Payments (Cards + Digital Wallets) | 2.9% (+0.5% for manually entered cards) | $0.30 |

| Payments (ACH Direct Debit) | 0.8% ($5.00 cap) | No fixed fee |

| Checkout | No percentage fee | No fixed fee |

| Billing | 0.5% | No fixed fee |

| Invoicing | 0.4% ($2.00 cap per invoice) | No fixed fee |

| Terminal (In-Person Card Processing) | 2.7% (+1.5% for international cards) | $0.05 |

*Visit Stripe’s pricing details to see all of their features and related fees.

For international cards and digital wallets: an additional percentage-based fee of 1.5% and another 1% is charged if currency conversion is required, on top of the standard Stripe fee from the table above.

Our Stripe fee calculator makes accurately billing your customers a breeze! Follow these four steps to feel more at ease when sending an invoice with Stripe:

You shouldn’t have to lose hard-earned money to Stripe fees, and neither should your customers! Here are a few ways you can avoid or reduce Stripe fees:

When contacting the Stripe sales team, you can inquire about custom rates for your business and earn less costly transaction fees.

This may seem counterintuitive, but if you are sending several invoices each month, you may actually save money by paying more for a monthly Stripe plan instead of getting charged high percentages with every transaction.

Work out a plan with recurring customers to combine payments so you only pay the fixed fees one time.

With Lili’s Invoicing Software, you can send professional invoices to your customers and collect payments without worrying about unnecessary fees!

Seamlessly integrate your Stripe payment processing with your business checking account, and manage your payments conveniently within the Lili platform!

Easily create customizable invoices with Lili’s Invoicing Software in a few simple steps, with the ability to add all relevant details and showcase your branding!

Use this formula to easily calculate Stripe fees, regardless of the specific percentage or fixed fee:

(Invoice Total x Percentage Fee)/100 + Fixed Fee

Example 1:

You bill a client for $50 via the digital Payments tool.

The fees for a digital wallet are 2.9% of the total amount plus a fixed fee of $0.30, which comes out to $1.75.

After deducting fees, you will earn $48.25.

Example 2:

You bill an in-person customer for $15 using the Stripe Terminal for card processing.

The fees for Terminal card processing are 2.7% of the total amount plus a fixed fee of $0.05, which comes out to $0.45.

After deducting fees, you will earn $14.55.

Take a quick tour of the tools inside the Lili account. Banking, bookkeeping, invoicing, and taxes, all in one place.