Accurate accounting is important for any small business owner — not just for tracking performance, but for essential tasks like filing taxes, securing loans, and obtaining insurance. While managing it all might initially feel overwhelming, technology solutions can now handle much of the heavy lifting for you. Whether you’re just starting out or looking to refine your approach, read on for 8 essential steps to DIY accounting along with insights on how tools like Lili can simplify your financial management.

How to DIY your small business accounting

DIY accounting has a learning curve, but it becomes much easier once you grasp the basics and establish systems. Here are eight essential steps that will help you get up to speed faster.

1. Open a dedicated business checking account

One of the first things all small business owners should do is open a dedicated business checking account. All your business payments can then go into the account and your expenses can come out of it. This is helpful because you won’t need to sort through a mix of business and personal transactions to see what’s going on.

Additionally, if your business is an independent entity such as a corporation, you need to keep business and personal transactions separate to help prevent personal responsibility for business liabilities. For example, if your company defaults on a debt and you get sued, you can end up personally responsible if you have a history of mixing personal and business finances.

2. Choose an accounting method and period

The IRS requires you to choose an accounting method when you first file your taxes. The two main options are the cash and accrual methods, although you can opt for a hybrid of the two. The cash method involves reporting income in the year you receive it and deducting expenses in the year they are paid. The accrual method involves reporting income in the year you earn it and deductions when you incur them. For example, suppose you finish a $10,000 project in December but the client pays in January. Under the cash accounting method, the $10,000 payment would be recorded in January, whereas under the accrual method, it would be recorded in December.

The cash method is generally the more popular method. It’s simpler and offers more flexibility because you can defer income and deductions by delaying invoices and expense payments. Further, under the cash method, you’re taxed in the year you actually receive funds which helps to ensure you have the cash to pay your tax bill. On the other hand, the accrual method is more complex but may offer a more accurate picture of business performance. It’s also required by organizations that make over $25 million in sales for three years or if an inventory is necessary to account for your income.

In addition to choosing an accounting method, you’ll need to decide on the accounting period that works best for you. Many businesses use the calendar year but you can also select a fiscal year. The calendar year runs from the first of January to the 31st of December, while a fiscal year is a 12-month period that can start and end when you choose. When deciding, consider which period best suits your business cycle. For example, a fiscal year may be helpful for a school that wants to align taxes with its annual school schedule which generally runs from August to June.

3. Implement a bookkeeping system

While a dedicated business checking account provides a record of your business’s earnings and expenses, you’ll also need a separate record that accounts for all of your company’s financial activities. When creating one, you can opt for one of the following bookkeeping methods:

- Single-entry bookkeeping: Track revenue and expenses and add one accounting entry per transaction. For example, if your balance was $1,500 and you received a $500 payment, you would add a line recording the $500 payment amount and update your balance to $2,000.

- Double-entry bookkeeping: Track assets, liabilities, income, expenses, and equity. In this system, every transaction has a debit and credit side so results in two accounting entries. For example, if your company bought $1,000 of inventory, you would record a $1,000 credit to the asset account and a $1,000 debit from the liabilities account. Then, you’d update the balances on both.

Both methods can help you achieve the same goal, but single-entry bookkeeping is more simplistic while double-entry bookkeeping can provide a more comprehensive financial picture of your business.

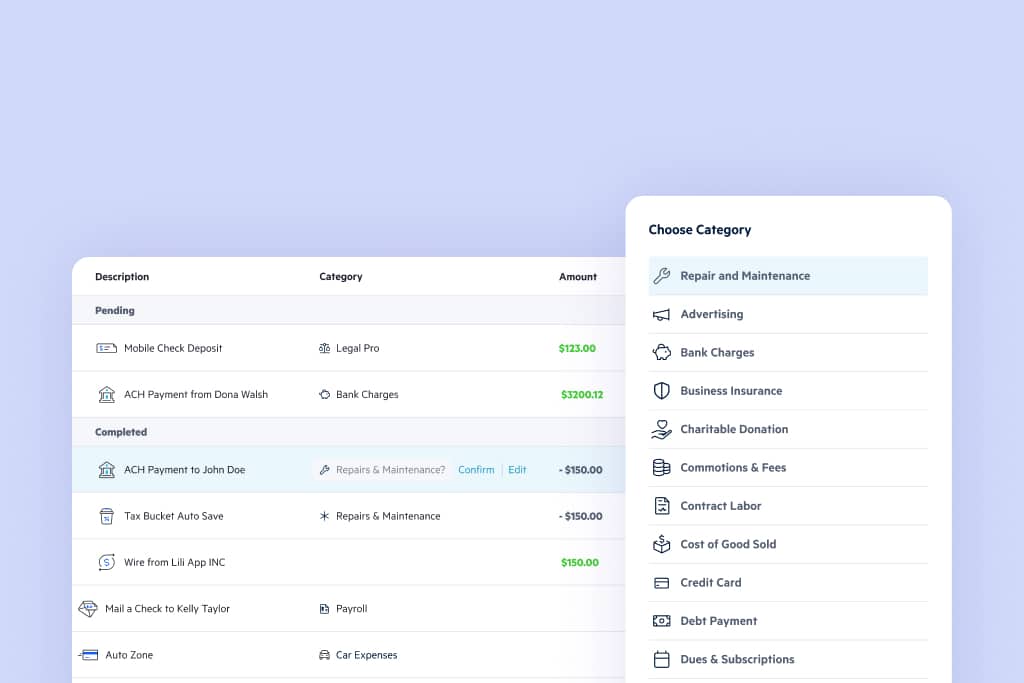

No matter which method you choose, software can help to make the process easier, more efficient, and less prone to errors. Lili, for example, allows you to effortlessly perform double-entry bookkeeping by syncing transactions from your bank account to your accounting record with a swipe and automatically reconciling bill payments.

4. Document and track deductible expenses as you go

While deducting expenses can save you money, one of the biggest headaches for small business owners is tracking them all. It’s easy to forget to log purchases or misplace receipts, which can lead to missed deductions and, ultimately, paying more in taxes than necessary. This can also create a lot of stress and scrambling at tax time, especially if you’re not prepared with the right records.

To reduce stress and ensure you don’t pay more than you need to, create a system to track and document deductible expenses as you incur them. You can do so by noting each expense in a spreadsheet and filing receipts in a physical folder with sections for each month. However, accounting software can help you seamlessly manage it all online. Lili uses AI to automatically sort the transactions in your business checking account into tax categories in real-time and allows you to attach a receipt to each transaction.

5. Set money aside for taxes

Taxes often consume a significant portion of a business’s revenue, and paying late can result in penalties and interest charges. Being so, it’s important to understand your tax liabilities upfront. Check with the IRS, your state tax authority, and your local government to find out the tax types, tax rates, and due dates that apply to you. It can be complicated, so you may want to consult a tax advisor.

Once you know how much to set aside for taxes, create a savings strategy. For example, a common practice is to automatically send 30% to 40% of each payment you receive into a tax savings account. Then, when a tax payment comes due, you can simply transfer the amount due from your tax bucket.

6. Simplify invoicing

If you invoice clients or customers, you’ll need an invoice template, the ability to accept payments, and an invoice management system. In many cases, business owners turn to software providers for help with all three. Lili, for example, provides fully customizable invoice templates and enables you to accept multiple payment methods (e.g. debit card, credit card, ACH, Venmo, PayPal, checks, and Cash App). You can also log into the Lili platform to track invoices and set automatic payment reminders for clients. Features like these make invoicing a breeze so you can focus on other parts of your business.

7. Automate recurring bill payments

Most business owners have recurring bills each month such as rent, utilities, software subscriptions, and insurance. As the accountant for your business, you’ll be responsible for paying everything on time. To ensure nothing falls through the cracks, make a list of all your bills and their due dates. Consider when you should pay each bill to maximize your cash flow and add the payments to your schedule.

To streamline the process, you can schedule automatic bill payments. For example, Lili allows you to upload bills (photos or documents) into the platform and automatically captures the relevant details. From there, you can set up reminders to ensure payments go out on time each month, and easily track their status. Automated bill reminders help you stay organized and save time each month, reducing the need to manually keep track of various payment deadlines.

8. Regularly review financial reports

When doing your own accounting, take a step back and review financial reports at regular intervals, such as weekly, monthly, quarterly, and annually. Doing so helps you understand how your business is performing and ensures you have enough liquidity to cover expenses. Additionally, it can help you spot trends and catch errors early.

While you won’t typically be able to auto-generate reports if you do your accounting manually, accounting software providers often provide them. For example, Lili offers customers ongoing financial insights along with on-demand expense reports, profit and loss statements, and cash flow reports. You can quickly get the information you need anytime with just a click.

Manage your business finances with ease and confidence

DIY accounting doesn’t have to be overwhelming. By learning what’s involved and building out systems, you can feel confident about your finances without spending hours managing them. If you’d like to level up, Lili’s all-in-one solution allows you to integrate your business checking account with powerful accounting tools that streamline invoicing, bookkeeping, bill pay, and even tax preparation.

Ready to get started? Learn more about how Lili’s accounting software can help you stay on top of your finances effortlessly.