Strong business credit can play an integral role in the growth of a small business. Once established, it signals to lenders, vendors, and other interested parties that your business is reliable and trustworthy. As a result, you can unlock funding, competitive loan terms, and various other opportunities. But how do you get started and is your business eligible? The good news is—most U.S. businesses are, and the process is often easier than you’d expect.

Many small business owners underestimate the role of business credit until they face financing roadblocks. In fact, 75% of small businesses struggle to get funding due to poor or limited credit, underscoring why building business credit early is so important.

Read on for a step-by-step guide on how to build business credit from scratch.

What is business credit and why does it matter?

Business credit generally refers to a company’s creditworthiness, which is determined by the information in its business credit reports. When your business borrows money from an entity that reports to one of the business credit reporting agencies, the credit account will show up on your business credit report. Over time, all your credit records will tell a story about how your business manages credit. That story is often of interest to third parties, such as lenders, vendors, investors, and potential partners, who want to evaluate the risk your company presents.

But why does that matter to you? Business credit is important to small business owners for a variety of reasons, including:

- Access to financing: Lenders are more likely to approve your business for loans and credit lines if it has good credit.

- Better financing terms: The better your business credit, the better financing terms you can get. That can mean larger loan amounts, lower interest rates, longer repayment terms, and lower fees.

- Flexibility with suppliers: Vendors and suppliers may offer net payment terms to buyers with good credit, allowing you to pay for goods and services weeks or months after receiving them.

- Lower business insurance premiums: If a business insurance provider checks your company’s credit, good scores may reduce the cost of your premiums.

- Separation of business and personal finances: Strong business credit can help you access financing without personal guarantees. That means your company can qualify for loans or credit lines on its own, limiting your personal liability.

- Support growth: A solid credit profile can help you qualify for contracts, leases, investments, and partnerships.

How does business credit work?

By building strong business credit, you’re creating a public record that serves as proof that your company can be trusted. That can help you on many fronts, from loans and partnerships to insurance and leases.

Business credit works much like personal credit, except the credit bureaus report on the activity of businesses rather than individuals. The three main business credit bureaus are Dun & Bradstreet (D&B), Experian, and Equifax. Each collects information on the credit accounts of businesses and creates reports that others can request. As a result, if you own a business, third parties such as lenders, suppliers, investors, vendors, and potential partners may look to your business credit reports to vet you.

What types of information get reported on business credit reports? Each credit bureau structures its reports differently, but they commonly include:

- Company profiles: Basic business details, such as name, address, time in business, number of employees, business identification numbers, and key personnel.

- Proprietary credit ratings: Bureau-specific scores and ratings. For example, one of Dun & Bradstreet’s ratings is the D&B Delinquency Score, which predicts the likelihood that a company will pay its bills in a severely delinquent manner on a scale of 1 to 100.

- Payment history: The payment history of a business’s trade lines, which is a credit bureau’s report of the customer’s payment history on their credit account established with a vendor, supplier, or lender, including their timely and delinquent payments.

- Collections: Records of payments that have gone to collections, including the dates they were closed, disputed amounts, and collected amounts.

- Credit summaries: A summary of your total credit amount, bankruptcies, liens, judgments, collections, past due payments, credit history age, and more. For example, check out this D&B sample business credit report.

Together, this information creates a detailed picture of how a company manages its credit obligations, which is very useful for those deciding whether to extend credit or do business with it.

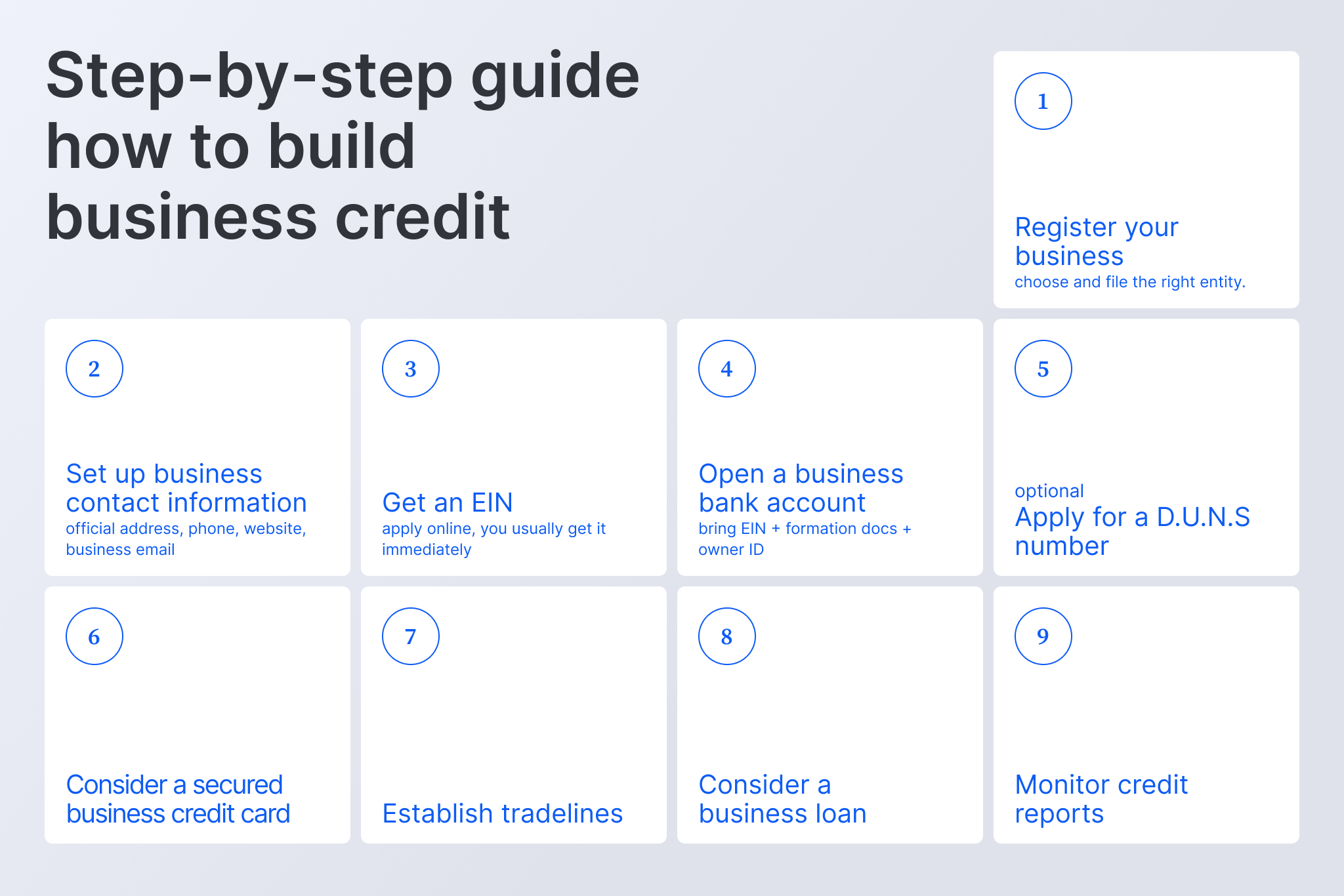

How to build business credit (step by step)

Not sure how to start building credit for your small business? Here are 9 key steps:

- Choose a legal structure and register your business

- Set up business contact information

- Get an EIN from the IRS

- Open a business bank account

- Apply for a D-U-N-S number (optional)

- Consider a secured business credit card

- Consider vendor/supplier tradelines

- Consider a business loan

- Track the results

1. Choose a legal structure and register your business

Before you can build business credit, you need a formal business identity. That starts with choosing a legal structure—such as an LLC or corporation—and registering it with your state. Registration is typically required for all structures, except for sole proprietorships or general partnerships.

Depending on your industry and location, you may also need to register for permits or licenses at the state or local level. And if you’re a sole proprietor who wants to operate under a name other than your own, you’ll likely need to file a “doing business as” (DBA) or fictitious business name.

2. Set up business contact information

Another key step is to set up a dedicated business phone number, physical business address, and email address (preferably domain-based). Then, keep the information consistent everywhere—on your bank accounts, credit applications, licenses, tax forms, and online listings. Inconsistent information can lead to delays, denials, or even errors on your credit reports.

3. Get an EIN

Next, get an Employer Identification Number (EIN). An EIN is a nine-digit number the IRS uses to identify the tax accounts of businesses. While only federally mandatory for certain types of business, EINs are often required if you want to open a business bank account, obtain credit accounts, and apply for business licenses. You can apply for one for free through the IRS website.

4. Open a business bank account

The next step is to set up a dedicated business bank account, which separates your business and personal finances. It can also signal to those you pay or who pay you that your company is a legitimate operation. Beyond credibility, a business account is often required when applying for credit. Lenders may request business bank statements to verify revenue, and might only deposit funds or accept payments through a business account with a name that matches your business name. This separation is crucial when you consider that 70% of small business owners use personal credit for business purposes, impacting both their personal and business finances. Opening a dedicated business account helps prevent that overlap while building credibility for your company.

5. Apply for a D-U-N-S number (optional)

All three business credit bureaus report business credit information and provide business identification numbers, but they don’t all work the same. Experian and Equifax only create business credit reports for companies once they’ve received tradeline information for those companies from third parties.

D&B, on the other hand, allows you to add yourself to its database by requesting a D-U-N-S number. You can apply for free on the D&B website and will typically get it within 30 days. Once registered, your business will be established with D&B, and third parties will be able to confirm that it’s an active business.

6. Consider a secured business credit card

Once your business is set up and registered, it’s time to start building positive credit records. However, it can be hard to get approved when your business doesn’t have any credit history yet. A good place to start is with a secured business credit card that reports to one or more business credit bureaus.

While you’ll need to deposit collateral upfront to gain access to the credit line, it can be worth it to establish your company’s first credit account. If you manage the account well, some card providers will eventually return your collateral and “graduate” your company’s account to unsecured status. Best practices include making all your payments on time and keeping your credit utilization below 30%.

7. Consider vendor/supplier tradelines

Another way to build a positive credit account is through vendors and suppliers. If you partner with either, you can ask if they offer net payment terms and report to one or more business credit bureaus. If they do, you’ll be able to obtain the products or services and then pay for them by the allowable due date — often 30, 60, or 90 days later. The extra time you’re given may be considered credit and can help you build a positive payment history, as long as you make your payments by the agreed-upon deadline.

Once your tradelines are open and you’re consistently making payments, monitoring your business credit becomes essential. Strong credit not only positions your business for better financing but also improves approval odds. In fact, businesses with strong credit are 41% more likely to be approved for loans and credit, unlocking greater flexibility and growth opportunities.

8. Consider a business loan

Business loans can also help you build business credit. To qualify, you’ll often need steady personal and business cash flow, a year or so in business, decent personal credit, and, sometimes, a personal guarantee. If your company is brand new and doesn’t have cash flow yet, startup loans also exist, but can be harder to get. You can find business loans from online lenders like OnDeck, traditional banks, credit unions, or financial companies that offer invoice financing. However, when choosing a lender, ensure it reports credit accounts to the business credit bureaus.

9. Track the results

Keeping tabs on your business credit can be more difficult than tracking personal credit because you’re not entitled to free reports each year. However, it is possible. Here’s how it works:

- D&B: D&B offers credit report monitoring services through three D&B Credit Insights tiers that range from $0 to $149 per month.

- Experian: You can purchase your company’s CreditScore Report for as low as $49.95 or opt for ongoing monitoring through the Business Credit Advantage subscription for $199 per year.

- Equifax: Business credit reports aren’t for sale or automatically available, but you can contact the company to request yours if you’re applying for credit and are concerned about inaccuracies.

Tips on building business credit

Building business credit isn’t necessarily hard, but it does require you to take the above steps and exhibit certain behaviors over an extended period of time. Here are a few tips that will ensure you stay on track.

Pay on time or early

When it comes to building credit, nothing matters more than your payment history. Make sure that each of your payments is made on time—or better yet, early. Consider scheduling automatic payments or monthly reminders.

Manage utilization

For revolving credit lines, keep your credit balances low compared to your maximum credit limits. Aim to use less than 30% of your available credit at any time. For example, if you have a credit line of $10,000, keep your outstanding balance at or under $3,000. Doing so shows that you can handle credit responsibly without overextending.

Diversify credit mix strategically

As your business grows, layer in different types of credit, such as vendor accounts, credit cards, credit lines, and different types of loans. A diversified mix helps round out your profile and demonstrates stability.

Monitor credit regularly

Check your reports with Dun & Bradstreet, Experian, and Equifax on a regular basis, such as monthly. Monitoring ensures you can track progress, spot errors, and course correct before they cause too much damage.

Stick with it

Business credit takes time to build. Expect it to take several months to start seeing meaningful growth and a few years to establish a strong profile. But if you stay consistent, good scores will follow.

Start your business credit journey

The key to building strong business credit is proving that your business is able and willing to consistently make credit payments on time. It’s better to have fewer credit accounts that are always paid on time than more accounts with occasional missed or late payments. As Christopher Decker, Senior Inside Sales Leader at Dun & Bradstreet put its, “Credit is never an issue until it becomes one, so being proactive as a business to understand where you are at all times is of the utmost importance.”

As long as you meet all your payment obligations, it won’t be long before your business credit starts growing and you can reap the benefits.

Read more to see how Lili can help you build your business credit profile.

🎧 On the go? Listen to our podcast episode, “Mastering Business Credit,” for a clear, actionable breakdown of how to establish and grow your business credit from day one.