Establishing a U.S. business as a non-resident entrepreneur is appealing for many reasons—from the large consumer market and robust legal protections to the abundant capital opportunities. However, once you do, cross-border transactions can quickly create a drag on your business. While opening a U.S. bank account seems like an obvious solution, doing so often proves difficult for non-residents. The good news is, it doesn’t have to be. Read on to learn about the main challenges you should anticipate when opening a U.S. bank account as a non-resident and how you can overcome them.

Are you an entrepreneur who resides in the UK, Canada, Italy, China, Brazil, or Spain? Learn how Lili can help you remotely open a U.S. bank account today.

Why Open a U.S. Business Bank Account as a Non-Resident Entrepreneur?

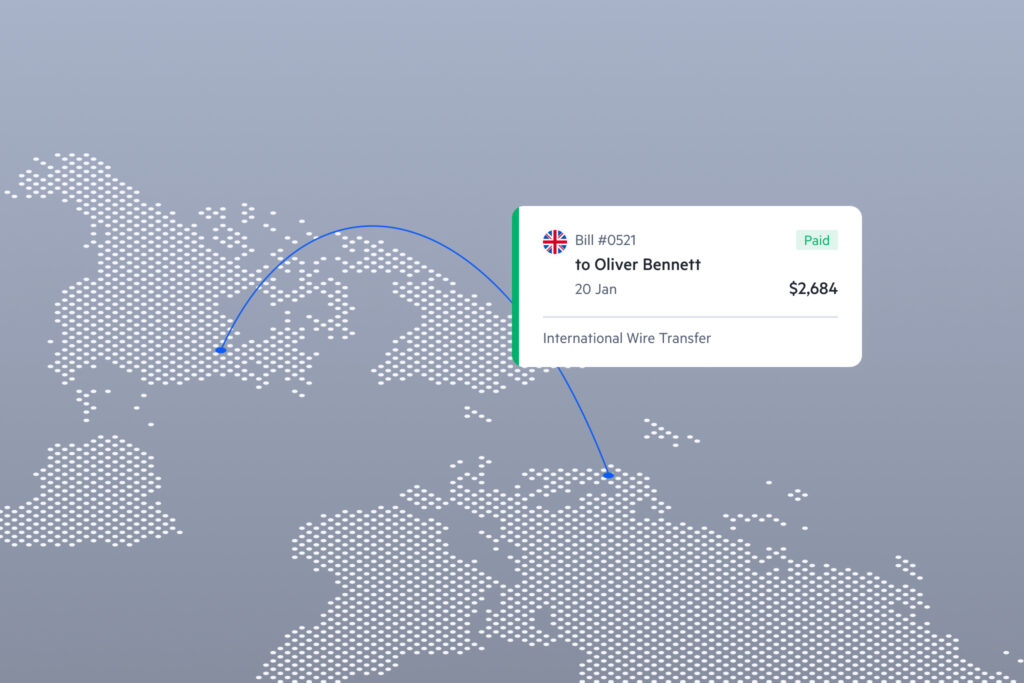

U.S. bank accounts can help non-resident entrepreneurs streamline operations and stay competitive. One of the biggest advantages is that it allows you to send and receive payments to and from your home country. As a result, you can reduce cross-border transfer fees, currency conversion costs, and processing delays.

“Transferring funds across borders comes at a steep price—payment gateways can eat up as much as 5% of their revenue, not to mention additional currency exchange fees,” explains Liran Zelkha, Lili’s Chief Technology Officer and Co-Founder. “These costs not only shrink profit margins; they also put international entrepreneurs at a disadvantage compared to U.S.-based businesses that aren’t burdened by such expenses.”

Beyond reducing the need for cross-border payments, a U.S. bank account can offer various other benefits. For example, it allows you to schedule automatic payments with U.S. service providers, separate out your U.S. business finances, and build a financial track record that may lead to future financing.

7 Challenges You May Face Opening a U.S. Bank Account as a Non-Resident

As a non-resident looking for a U.S. bank account, you may encounter roadblocks that make you question whether it’s even possible. To help you navigate the process, here are 7 common challenges to be aware of.

1. You Must Have a Registered U.S. Business

Before you can open a U.S. business bank account, you’ll need to register your business in the U.S. Doing so requires you to:

- Select a business structure: Choose the structure that best suits your business, such as a Limited Liability Company (LLC) or C-Corporation.

- Choose your business name:When registering your LLC or corporation, you’ll need to select a legal business name.

- Consider a DBA name: If you plan to operate under a different brand name with the public, you may also want to consider applying for a trade or fictitious name (often called a Doing Business As name).

- Choose your business’s home state: Select a home state for your business and register it with the state’s authorities.

- Appoint a registered agent: Appoint a registered agent in your chosen state. The agent is needed to accept service of any legal process on your business, such as subpoenas or lawsuits.

- File formation documents: File the required formation documents in your chosen state, such as the articles of organization or incorporation. You will also want to create an operating agreement.

- Apply for an Employer Identification Number (EIN): Obtain an EIN from the IRS, which gives your business a unique identifier for tax, payroll, and banking purposes.

- Research other requirements: You may need to take additional steps unique to your location or business, such as getting permits, licenses, or trademarks.

These steps won’t guarantee approval with every U.S. bank, but they’re required to have a chance at it.

2. Physical Presence Requirements

U.S. banks must follow the Beneficial Ownership Rule, which requires them to verify the beneficial owners of legal entities, such as corporations and LLCs, when those entities apply for bank accounts. For reference, beneficial owners include individuals who have a significant responsibility to control, manage, or direct a legal entity—such as executive officers or senior managers—and any individual who owns 25% or more of the company.

While banks are only required to verify the name, birthdate, address, and identification number of beneficial owners, some require owners to apply in person. That can, unfortunately, mean an inconvenient and expensive trip to the U.S. if you’re a non-resident living abroad.

However, it’s important to note that other banks and alternative providers of bank accounts, like Lili, offer fully remote applications. When that’s the case, you can complete the whole process online from abroad and won’t have to worry about an impromptu trip.

3. Documentation Challenges

Opening a U.S. bank account as a non-resident can also present challenges due to the paperwork requirements. U.S. banks require various documents during the application process, such as:

- Federal Employer Identification Number (EIN): Proof that your business has an EIN via a CP-575 confirmation letter or a 147C replacement confirmation letter.

- Corporate documents: Proof of your entity’s establishment, such as articles of incorporation, certificate of incorporation, operating agreements, organizational minutes and bylaws, or certificate of good standing.

- Beneficial ownership information: Documents verifying beneficial owners. Two forms of personal identification are often required (e.g., foreign passport, foreign driver’s license, individual taxpayer identification number, foreign voter registration card, major debit or credit card, etc.).

- Proof of foreign address: A document that proves your address in your home country (e.g., bank account statements, utility bills, etc.).

- Proof of business address: A document that proves you have a physical business address in the U.S. (e.g., utility bill, rental agreement, etc.).

It’s relatively easy to gather these documents and bring them to a nearby branch when you’re local, but it can be difficult to provide them when you’re in a different country. While some banks offer convenient upload capabilities on their websites, others may require you to deliver the paperwork via fax or mail, or in person.

4. Social Security Number (SSN) Requirements

U.S. banks typically require beneficial owners to provide their Social Security numbers (SSNs) during the application process. Without one, you may be unable to apply at certain banks or have to undergo a complicated manual application process. However, some banks anticipate non-resident applicants and allow other types of identification numbers, such as Individual Taxpayer Identification Numbers (ITINs), during their normal application processes. Others don’t require a SSN or ITIN, just an EIN.

5. Physical U.S. Address Requirements

Most U.S. banks require businesses to have a physical address in the U.S. to be eligible for a deposit account. And your registered agent’s address won’t work. If your business has a brick-and-mortar location in the U.S., this won’t be an issue. If it doesn’t, you may run into denials. However, some banks, including Lili, will allow you to qualify with a foreign business address alone.

6. Country Sanctions or Warnings

The U.S. Office of Foreign Assets Control (OFAC) maintains a list of active sanction programs by country. Further, the Financial Action Task Force (FATF) publishes black and grey lists, which identify countries with weak measures to combat money laundering and terrorist financing. Being from a country on either list can make approval for a U.S. bank account difficult—or impossible.

7. Non-residents Are Generally Higher Risk

U.S. banking laws require rigorous Know Your Customer (KYC) and Anti–Money Laundering (AML) checks. For non-residents, the verification process is more complex because banks have to access international ID databases, validate foreign business documents, and assess the legitimacy of overseas business activities. Non-resident applicants also represent a higher risk profile due to potential difficulties in legal recourse and collection activities. While some U.S. banks rise to the challenge and create procedures to support foreign business owners, others shy away from the added complexity.

Lili Simplifies U.S. Bank Account Access for International SMB Owners

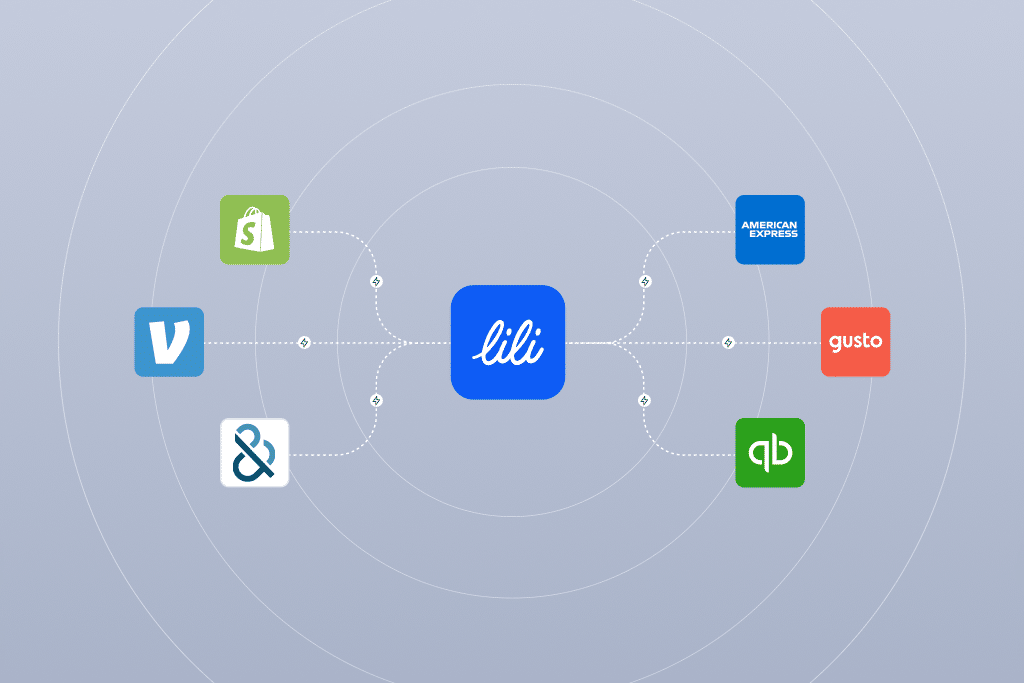

To successfully open a U.S. business bank account as a non-resident entrepreneur, you’ll need to register your business in the U.S. and get an EIN. From there, look for banks or bank platforms that cater to international business owners. At Lili, part of our mission is to help U.S. business owners streamline operations no matter where they’re based. To achieve that, we’ve launched Lili Connect—an embedded finance solution that removes the barriers between eligible non-residents and U.S. bank accounts.

Now available to entrepreneurs in various countries, Lili Connect allows you to open a U.S. business bank account remotely. Once you pass the verification process, you can easily access U.S. banking without leaving your home country (or even your office chair). And the Lili platform goes beyond banking, helping you establish business credit and streamline payment processing, invoicing, and tax management.

Lili Connect highlights:

- Supports fully remote applications for foreign applicants

- Makes it easy to send in your paperwork online

- Allows you to use a foreign business address

- Caters to eligible non-resident entrepreneurs

Sound like a good fit? Open a U.S. business bank account with Lili today!