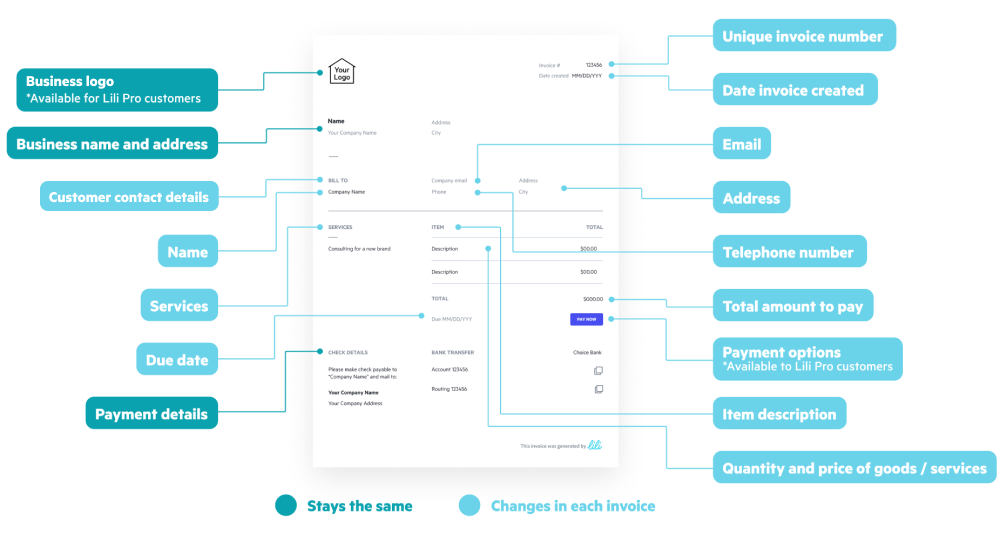

Choosing the right invoice format for you ultimately depends on your preference and business needs, but there are some advantages and disadvantages to each that you should consider!

Word Invoice Templates

Microsoft Word has customizable invoice templates with pre-built fields and lines that are easy to fill and send. The main drawback of using Word is that you have to actually have Microsoft Office in order to use it, as does the recipient of the invoice to avoid formatting issues. If the recipient has a different version of Word, formatting may be altered due to compatibility issues as well.

Excel Invoice Templates

Due to its nature as a spreadsheet software, Microsoft Excel has invoice templates with formulas incorporated to automatically calculate totals with ease. Unfortunately, Excel faces the same issue as Word, making it difficult for recipients to view an invoice if they don’t have the needed software.

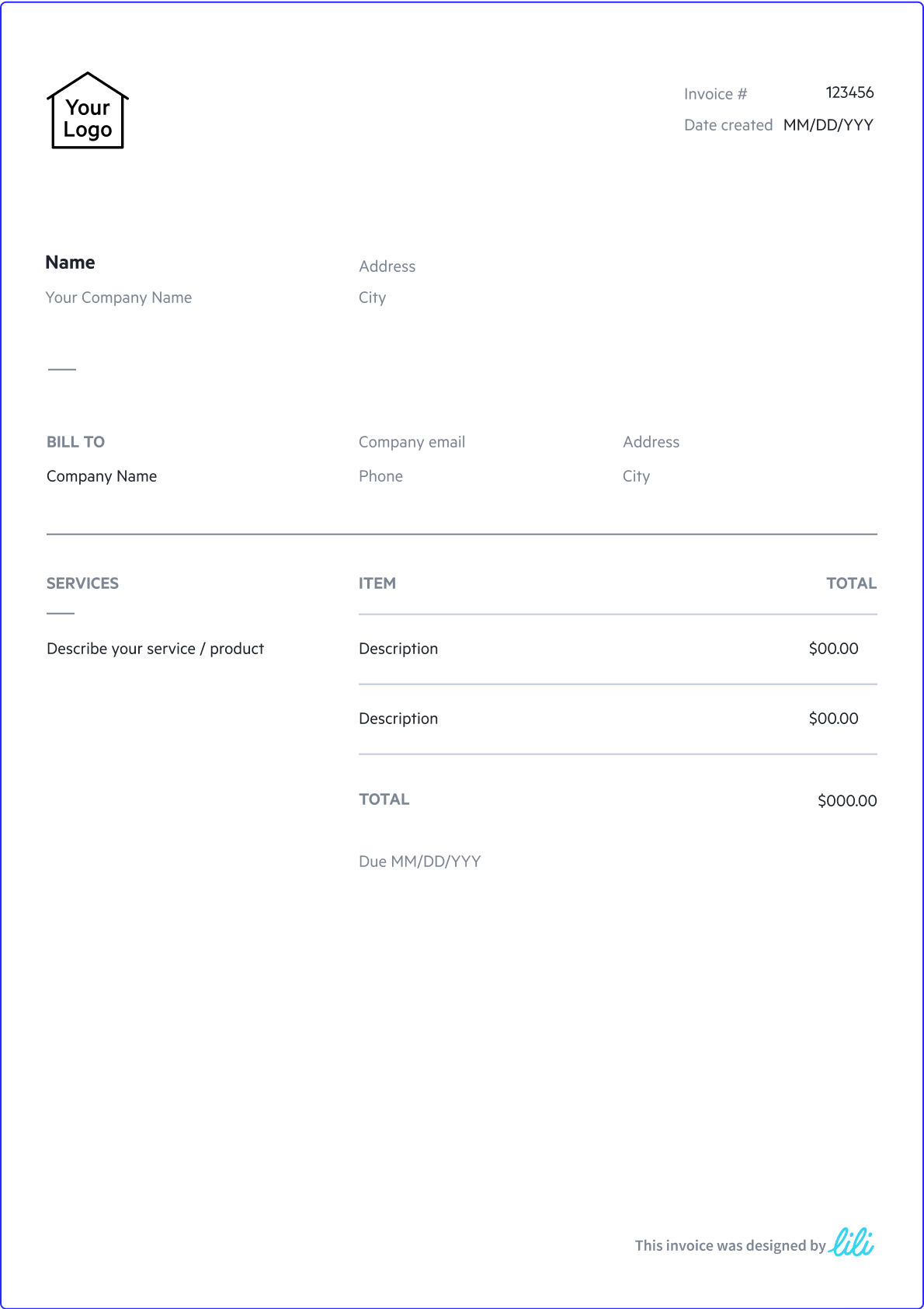

Google Docs Invoice Template

If you don’t have Microsoft Office access, Google Docs is an excellent Word alternative. This clean, simple Google Docs invoice template will work well for any business. To use this template, select File > Make a Copy to save it to your own Google Drive before inputting your information and branding. Similar to Word, Google Docs doesn’t have formula capabilities, meaning you’ll need to manually input all the information.

Google Sheets Invoice Templates

As Google’s alternative to Microsoft Excel, Sheets offers many of the same benefits in a free, cloud-based platform. Use formulas to calculate quantities and totals, streamlining your invoice-building process. Google Sheets has many invoice templates available in their template gallery with formulas already in place so you don’t have to be a spreadsheet expert to use them.

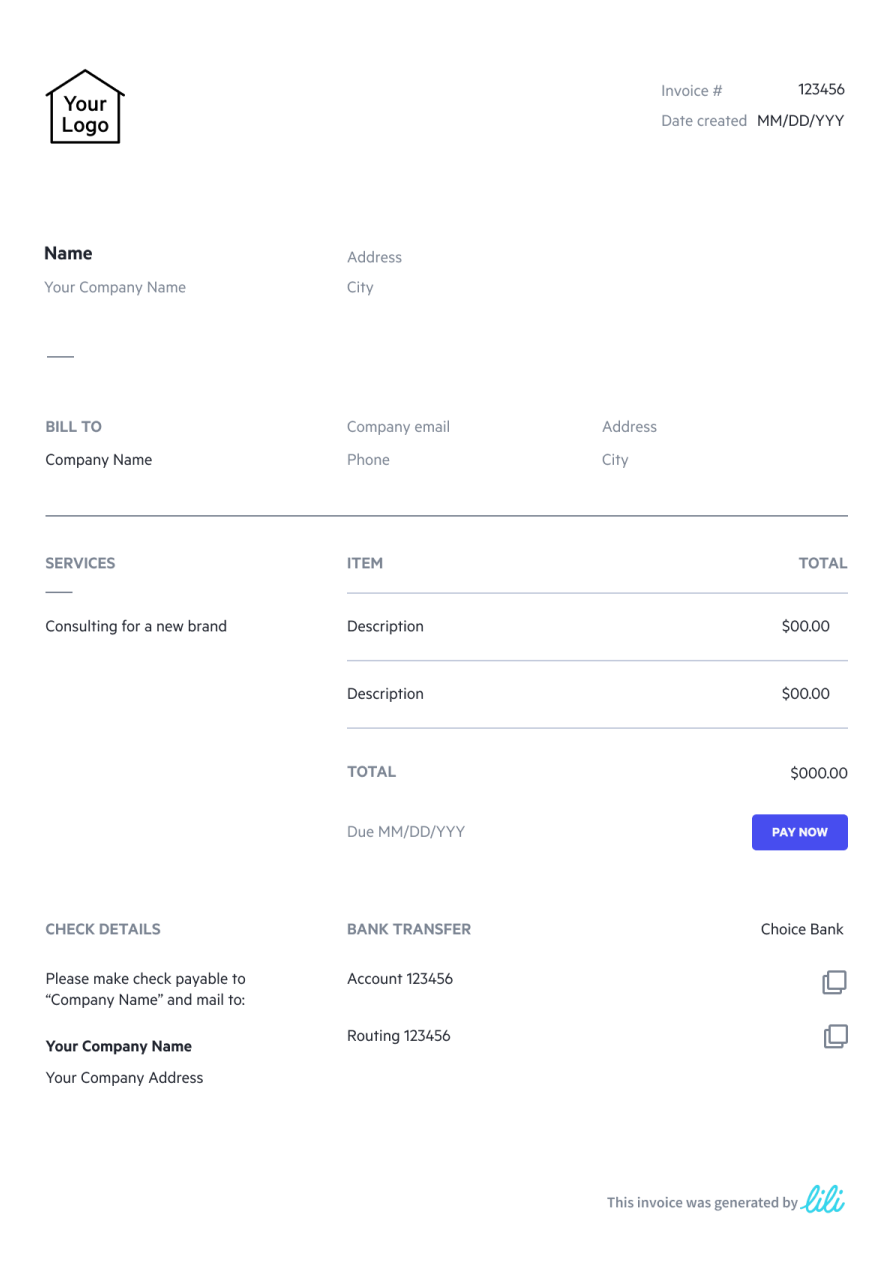

PDF Invoice Templates

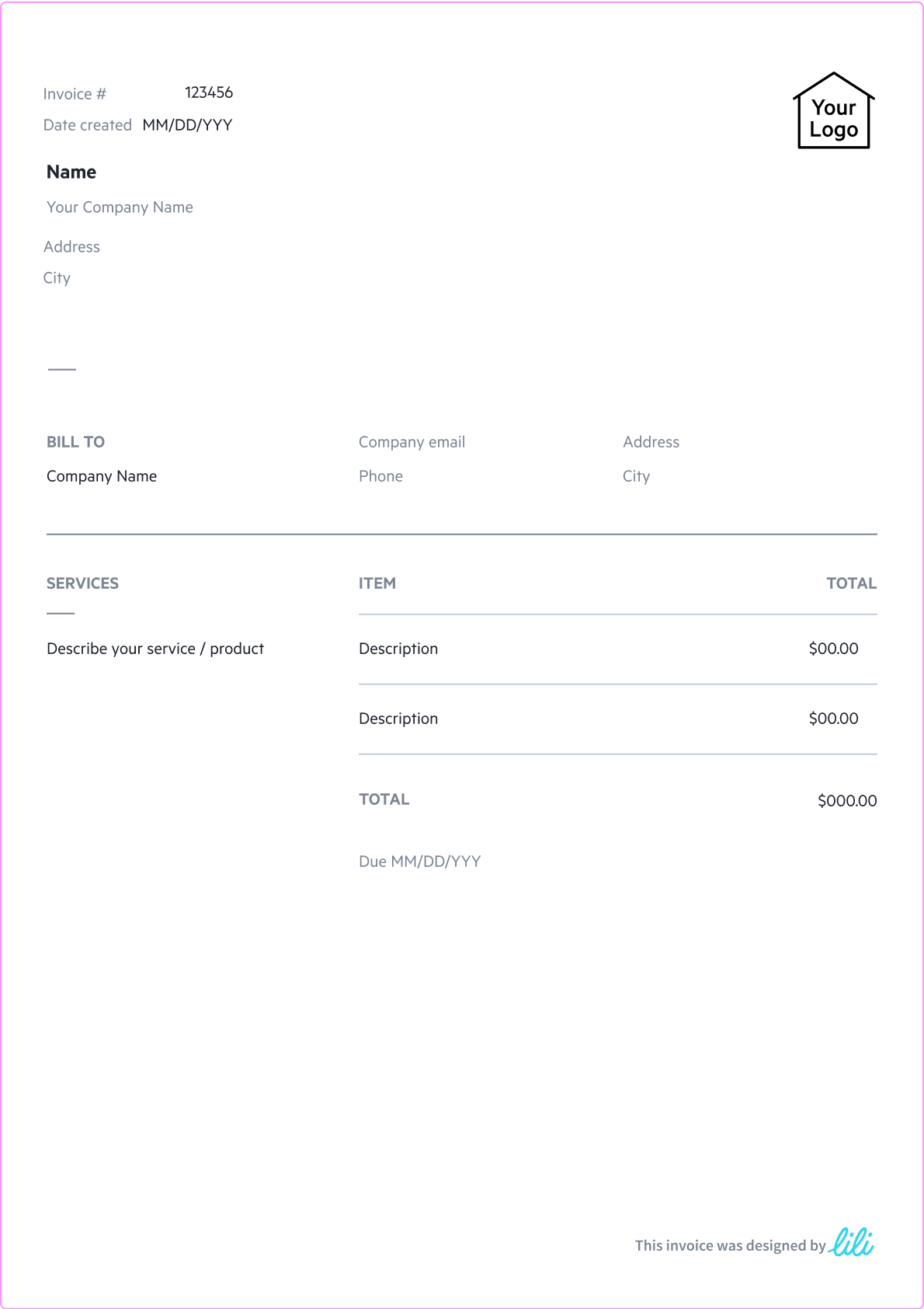

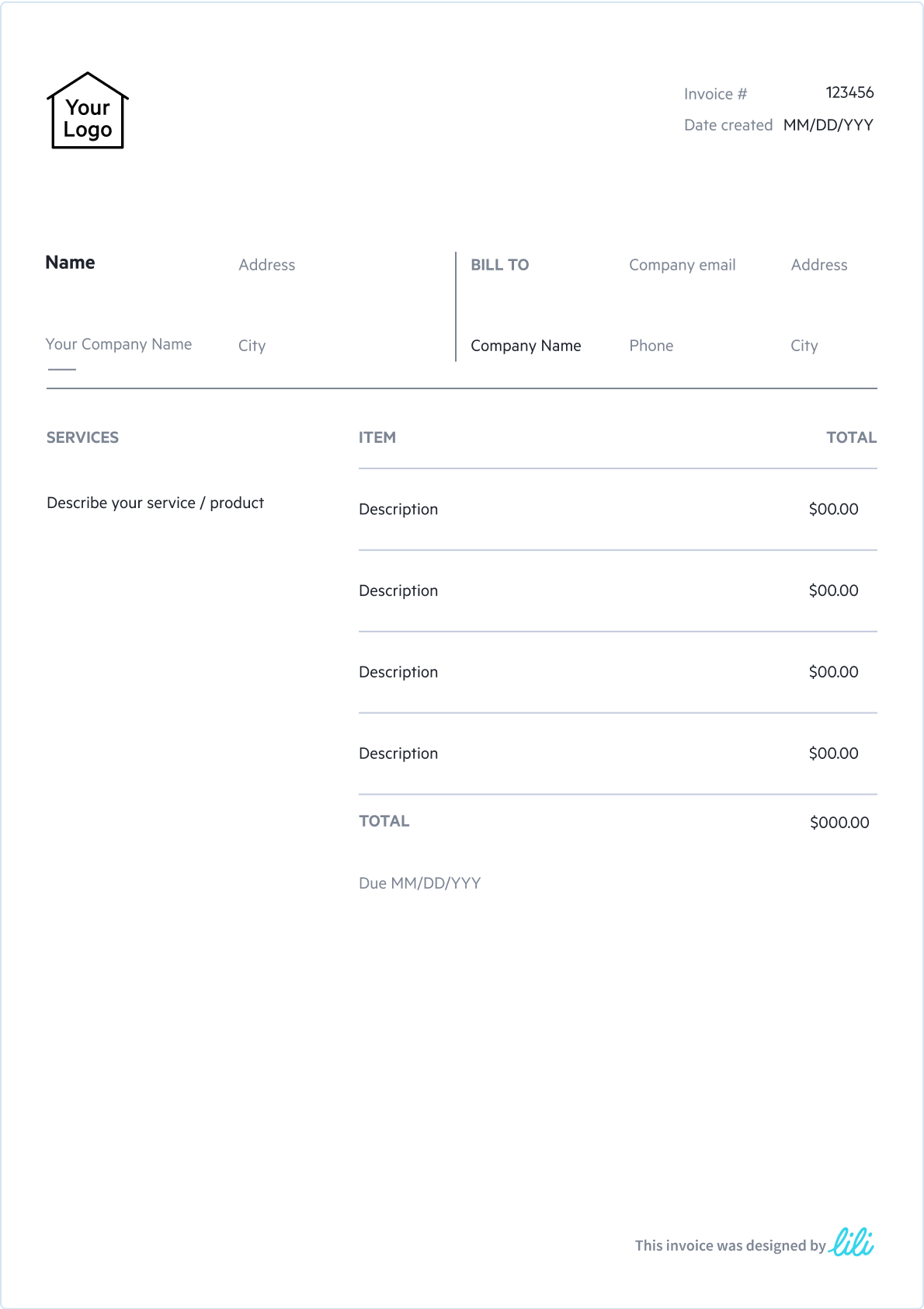

The primary benefit of PDF invoice templates is that they don’t have any risk of formatting errors and the recipient doesn’t need any special software or account to access them. With a PDF invoice template, you can easily download, print out, and email invoices to customers rather than sending them an external link. Our PDF invoice template is designed for easy customization and simplicity of use to make invoicing your clients a breeze.