Simplify your bookkeeping with instant transaction categorization, and gain clarity about your business’s financial status with income & expense insights and auto-generated financial reports. Make it easier to balance your books with Lili’s Accounting Software.

Balance Sheet

Guide and Templates

A balance sheet is one of the key documents used in assessing the financial health of a business. This guide outlines the components of a balance sheet and provides templates and examples, so you can generate one for your business.

What is a balance sheet?

A balance sheet is a financial statement that outlines the relationship between assets, liabilities, and owner or shareholder equity at a specific time. It compares what is owed (liabilities) with what is owned (assets) to demonstrate equity and the financial health of a business. It is used alongside the other core financial statements—profit and loss statements and cash flow statements—to evaluate business performance.

Because a balance sheet provides a snapshot of the financial status of the business at a given time, it is helpful for displaying equity to a business’s shareholders and potential investors as it clarifies exactly what their shares are worth at that time. Alongside other financial statements, it is an essential component in presenting a business’s profitability.

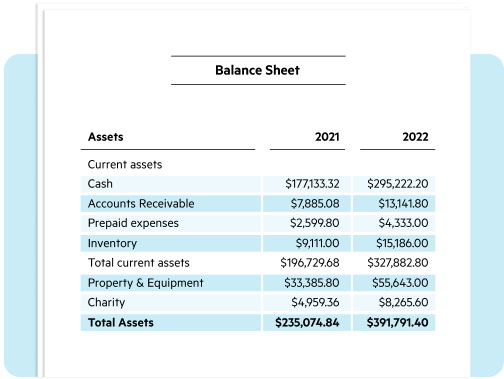

Balance sheet templates and examples

This downloadable contains two balance sheet templates: one providing a year-over-year (YoY) comparison, and the other providing an overview of the current year’s assets and liabilities. Both templates enable a business to produce a clear picture of what it owns compared to what it owes.

Built-in formulas sum up total assets and liabilities, and calculate the balance, enabling a business to ensure its numbers are accurate.

What are the components of a balance sheet?

A balance sheet includes three categories: assets (what is owned), liabilities (what is owed), and owner’s or shareholder’s equity (who owns what). The main difference for a small business owner as opposed to a large corporation with multiple shareholders occurs in the equity portion, but the specifics of assets and liabilities depend on the size of the business.

1. Assets

Assets are what a business actually owns, either in outright cash form or that has the potential to become cash when liquidated. Assets are where a business’s quantifiable value lies, regardless of whether the asset is expected to directly become cash in the near future or not.

Current assets are cash and any assets that are expected to convert to cash within a year, such as:

- Cash and cash equivalents

- Prepaid expenses

- Inventory

- Accounts receivable

- Marketable securities

Noncurrent assets are those that won’t convert to cash within the next year, making them longer-term investments. Noncurrent assets are typically more common for larger businesses and corporations, as they may include:

- Land

- Patents

- Trademarks

- Brands

- Goodwill

- Intellectual property

- Equipment used to produce goods/perform services

Equipment used to produce goods or perform services is a common noncurrent asset for both small businesses and corporations, while the other asset types are more common for large-scale operations.

2. Liabilities

Liabilities include anything a business owes to debtors or other creditors, both long- and short-term. These negatives against a business’s total value are any expenses a business is financially and legally required to pay in total, usually to a lender.

Current liabilities—similar to current assets—are those due within a year when the balance sheet is created. While an outstanding loan may be considered a current liability once it is within a year of being due for complete payoff, more often current liabilities fall into the following categories:

- Payroll expenses

- Rent payments

- Utilities

- Debt financing

- Accounts payable

- Other accrued expenses

Longer-term loans and debts are considered noncurrent liabilities because of the lengthier timeline of the obligation. These typically include:

- Leases

- Loans

- Bonds payable

- Pension provisions

- Deferred tax liabilities

3. Equity (Owners' or Shareholders')

Owners’ or Shareholders’ Equity is what belongs to the owners of a business (the remaining assets) after accounting for liabilities.

For small businesses, this is often much simpler, as equity belongs to a single shareholder (the owner), however larger companies may have multiple shareholders among whom the equity is divided.

There are two main parts to shareholders’ equity: money and earnings.

- Money is what a shareholder contributes to the business in exchange for ownership or “shares”.

- Earnings are what the business generates over time separate from shareholder contributions.

A shareholder’s equity is the combination of money and earnings relevant to their share of the business.

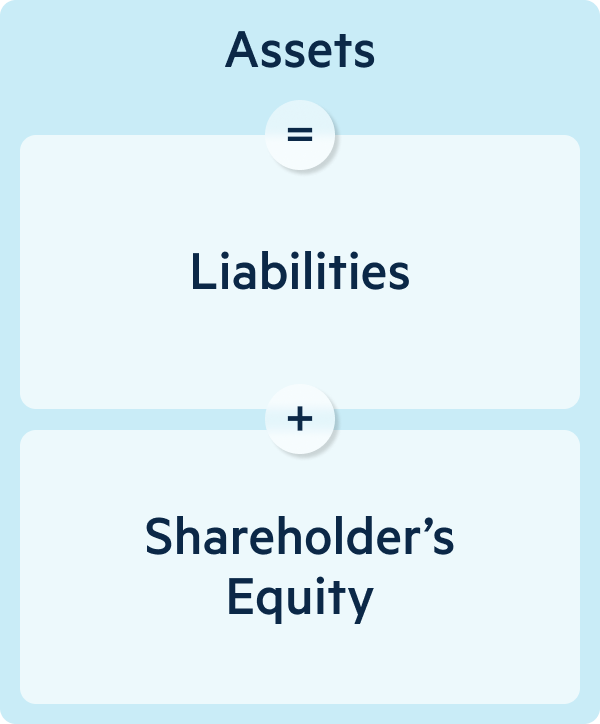

Balance Sheet Equation: How Does it Work?

A balance sheet should always result in total assets and total liabilities tallied up to the same amount, with shareholders’ equity factored into the liabilities.

The balance sheet equation is as follows:

Assets = Liabilities + Shareholders’ Equity

or

Shareholders’ Equity = Assets – Liabilities

Both sides of the equation should equal the same number in order for a balance sheet to be accurate and balanced. This is due to the fact that what the business owns (assets) has been acquired through debts (liabilities) and investments (shareholders’ equity). Therefore, assets should always equal liabilities plus equity, and equity should always equal assets minus liabilities.

If the sides of the equation don’t balance for the given period of time, this indicaes that data is either missing or entered inaccurately. There should be no possible scenario where a correct balance sheet is unbalanced.

The Importance of a Balance Sheet

Balance sheets are beneficial for small businesses and corporations alike, as they provide valuable financial information about the business. Balance sheets are useful for:

- Demonstrating success. When a balance sheet compares two or more financial periods, it can demonstrate business success or show areas of weakness financially.

- Determining risk. A balance sheet outlines all debts and liabilities to help a company understand if it has borrowed too much or needs to liquidate more assets.

- Securing capital. Balance sheets are required to obtain business loans from most lenders and investors, as they demonstrate to the lender a business’s ability to repay debts and increase profitability.

- Measuring financial health. Balance sheets not only demonstrate potential profitability, but they also can reveal the liquidity, solvency, and cadence (turnover) of a business, which can be helpful to compare with competitors and internally assess financial performance.

- Luring and retaining talent. When looking to hire lucrative employees, a balance sheet can demonstrate job security and the stability of the business they’re being offered a position with. Sharing a balance sheet with potential new hires may not be common practice for small businesses, but public companies are legally obligated to disclose this information, so it’s important that it looks reliable!

Frequently asked questions

Balance sheets are an important part of an accurate assessment of the financial status of a business, used both by the business itself and by external actors like lenders and investors. A balance sheet has several purposes that apply to businesses of any size, including:

- Assessing the financial health of a business in general

- Demonstrating the growth and success of a business

- Determining financial risks (i.e. excessive debt)

- Securing loans and investments

- Acquiring talent to help the business achieve further growth

Streamline your business accounting with Lili