Fill in some basic personal information.

Expense Reports

Guide and Templates

Tracking business expenses is an integral part of business accounting. This is where expense reports come in.

Our guide to expense reports outlines their purpose and structure, reviews how to create one manually, and includes a few free expense report templates to help you get started.

What is an expense report?

An expense report is a form that enables a business to organize and track business-related costs. Expense reports contain an itemized list of expenses and are typically generated monthly, quarterly, or annually–especially if you have employees who need to be reimbursed for business-related expenses.

Expense reports can be used to track a variety of business-related costs, such as:

- Transportation and mileage

- Business-related meals, lodging, and other travel expenses

- Office supplies or raw materials

- Utilities

- Rent

- Software subscriptions

- Any other purchase necessary for your business

Expense reports concentrate all business expenses in one document and present them in an organized, clear manner. Even if you don’t have a large team, this is crucial for any business, as proper expense reporting not only helps avoid the organizational challenge of keeping track of each individual invoice, bill, and receipt (as well as the risk of losing any of them), but also facilitates proper budgeting and spend control. And, come tax season expense reports ensure a smoother tax preparation process.

What is the purpose of expense reports?

An expense report is most frequently used either by employees to request reimbursement for business-related expenses or to track write-offs for annual tax deductions.

Employees need to keep track of business-related expenses so they can request reimbursements at the end of each quarter. This may include dinners with clients, mileage driving to and from the office and various job sites, gas and other transportation expenses, hotels for business trips, and anything else they need to do their job. Employees will often submit their expense report to their finance team along with receipts as proof of each expense reported.

All businesses—whether or not they have employees—can use expense reports to keep track of write-offs for annual tax filing. These can be the same as expenses employees may report (and will include any reimbursements made to employees), but will also include larger scale business expenses such as rent, utilities, insurance, equipment, and other business purchases.

Regardless of the size of your business, an expense report is a great way to track and summarize business expenses. This can help you better understand where your money is going to help you cut costs or adjust how you allocate your funds.

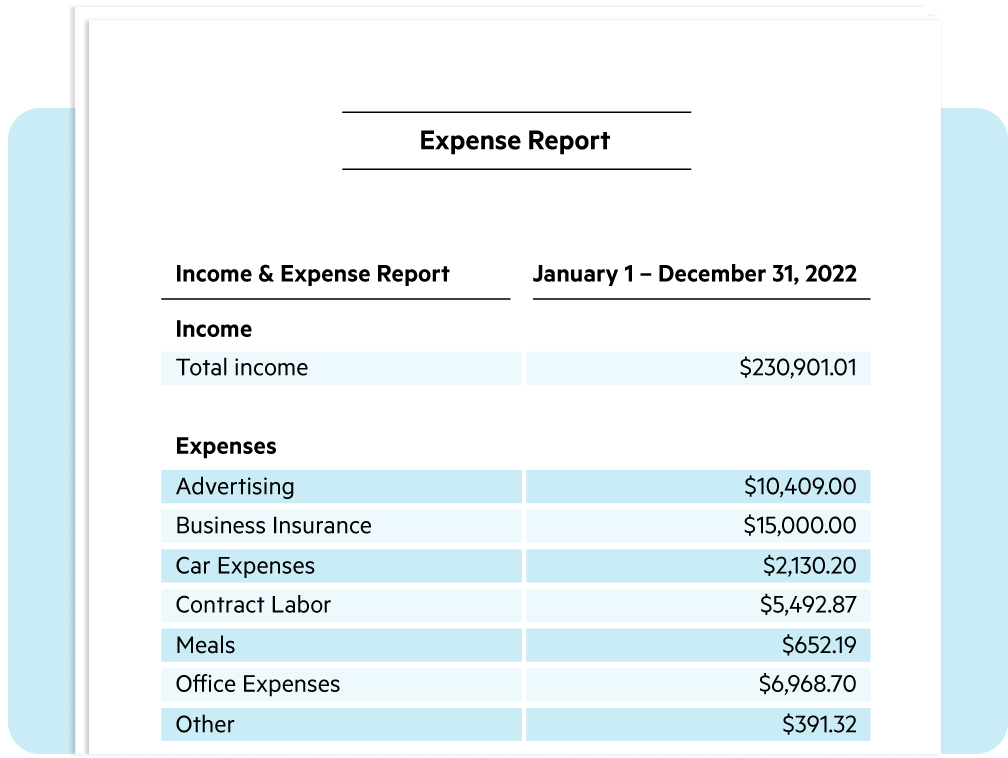

Expense report templates

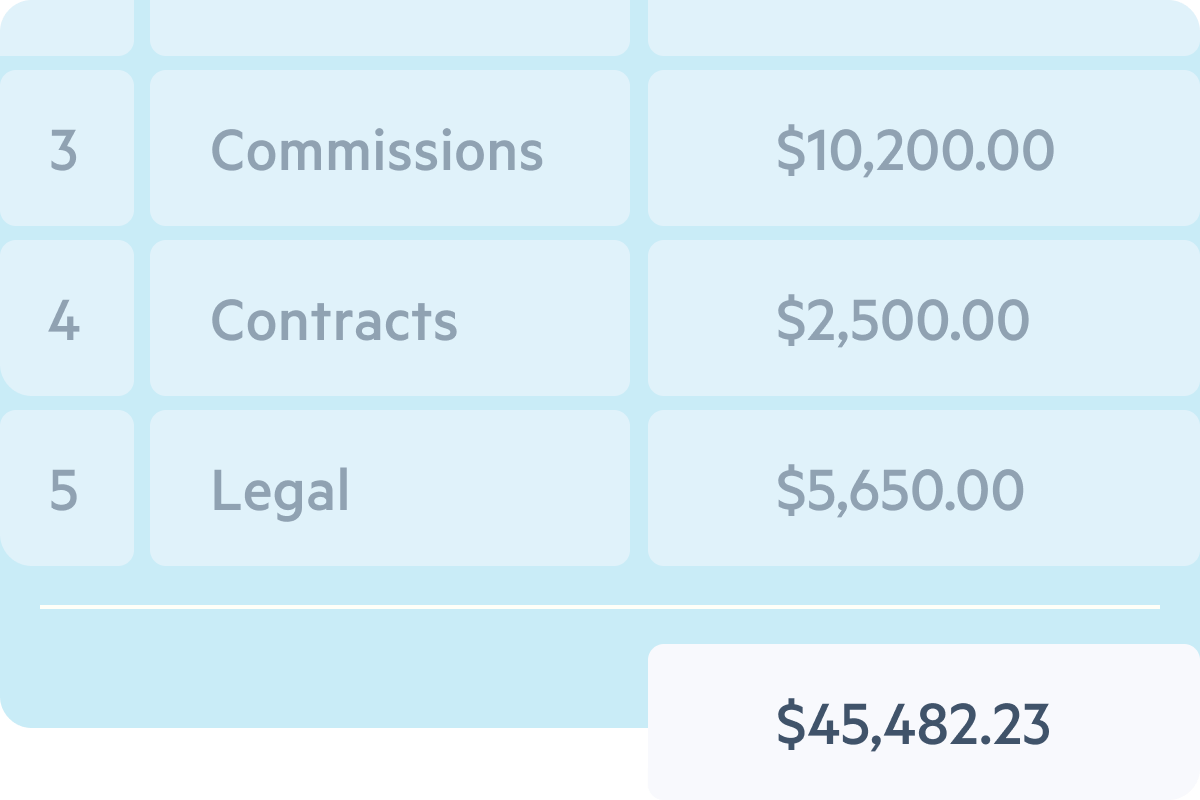

This simple expense report template provides a straightforward layout that enables an employee to list and tally business expenses according to category and provide expense details including the category, a short description, and comments.

Built-in formulas sum up expenses per category, per day, and allow for the inclusion of any advances received before calculating total reimbursement.

Streamline your business accounting with Lili

Simplify your bookkeeping with instant transaction categorization, and gain clarity about your business’s financial status with income & expense insights and auto-generated financial reports. Make it easier to balance your books with Lili’s Accounting Software.

How to create an expense report

Below is a step-by-step guide to manually creating an expense report.

1. Choose an expense report format

Start by choosing your preferred format for the report, or by selecting from one of our free expense report templates. Fill in all applicable identification details including your company name, your name, and the date range to which the expense report applies.

2. Customize report sections

Make sure all of the sections are relevant to what you will be reporting, and adjust the section names to fit with your unique business needs. Include a column for identifying the IRS-specific category for each expense, such as:

- Advertising

- Car and truck expenses

- Commissions and fees

- Contract labor

- Legal and professional services

- Rent or lease

- Repairs and maintenance

- Travel and meals

- Utilities

3. Produce bank statements

Collect bank statements for the expense reporting period. This will make it easier for you to find each expense and all the information you need to include on your expense report.

4. Input expenses

Start adding your expenses to the expense report, filling in all the necessary information for each individual expense. Report your expenses in chronological order with the most recent at the end—this is especially helpful if you intend to report as you go rather than at the end of a year or quarter.

5. Calculate total expenses

If you’re filling out an expense report manually, you’ll need to calculate the total expenses for the reporting period at the end, especially when requesting reimbursement or reimbursing an employee. With our free expense report templates, the total will automatically be calculated.

6. Save and submit the report

Double-check that all the information included is correct, then save the report and submit it to the relevant parties. Be sure to attach all relevant receipts when sending the report for reimbursement.

Frequently asked questions

Creating a simple expense report involves recording basic information about each expense, including:

- The date of the expense

- A short description

- The relevant expense category (e.g. transportation, meals, etc.)

- The total cost

You can find a downloadable template for a simple expense report in the Expense Report templates section of this guide.

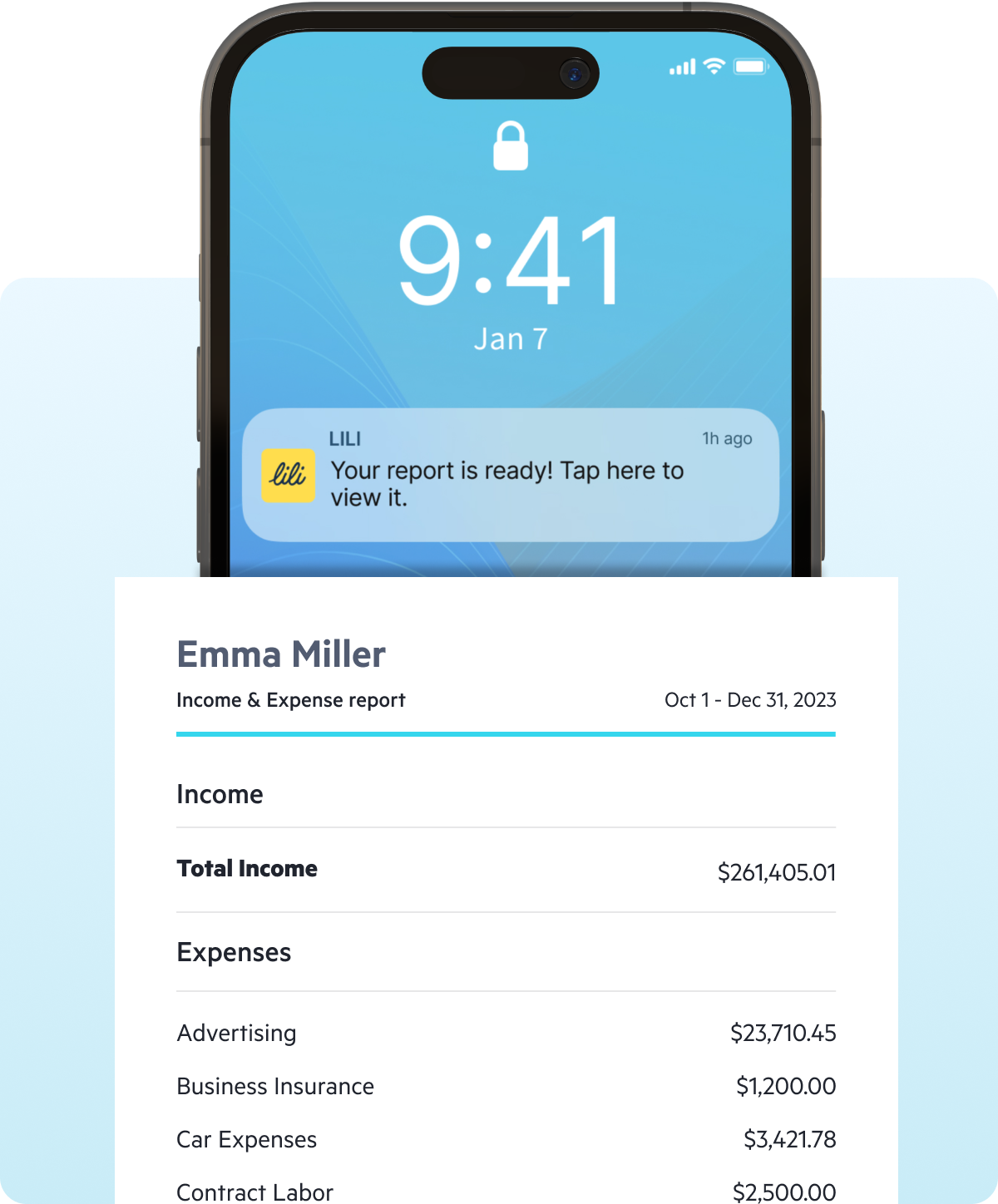

Automate your expense reporting with Lili

Filling out an expense report can take valuable time and energy. Lili’s accounting software automates expense reporting with monthly, quarterly, and annual expense reports available.

By using Lili to track and report business expenses, you can keep all your transactions and bank statements in one place and even scan receipts to attach to expenses digitally. Say goodbye to scrambling to collect bank statements and track down a bunch of loose receipts, and say hello to expense tracking made simple with Lili!