Fill in some basic personal information.

Schedule SE: Filing Instructions for the Self-Employment Tax Form

Overview and Filing Instructions

Selling on Etsy or eBay. Driving for Uber or DoorDash. Freelancing as a photographer or graphic designer.

If you’re self-employed or in regular employment with a side hustle, it’s crucial to know what Schedule SE is.

In this guide, we’ll review Schedule SE, including its purpose and how to fill it out, as well as an overview of self-employment tax itself.

Written by Melissa Pedigo, CPA

Written by Melissa Pedigo, CPA

What is Schedule SE?

Schedule SE is the form you use to determine the amount of tax you owe to the IRS on your self-employment income.

For clarity, a schedule is just an extra sheet you may need to fill out in addition to your Form 1040 for certain specific types of income or deductions.

Form 1040, used by U.S. taxpayers to file their annual personal income tax returns, can include more than a dozen schedules. The most common are:

- Schedule A: For those who want to itemize their deductions and not claim the standard deduction

- Schedule B: For those reporting their interest and dividend income

- Schedule C: For certain business owners who must prepare a business tax return

- Schedule D: For those who need to report capital gains or losses

- Schedule EIC: For those claiming the Earned Income Tax Credit, and

- Schedule SE: For those in self-employment who need to figure out the tax due to the IRS

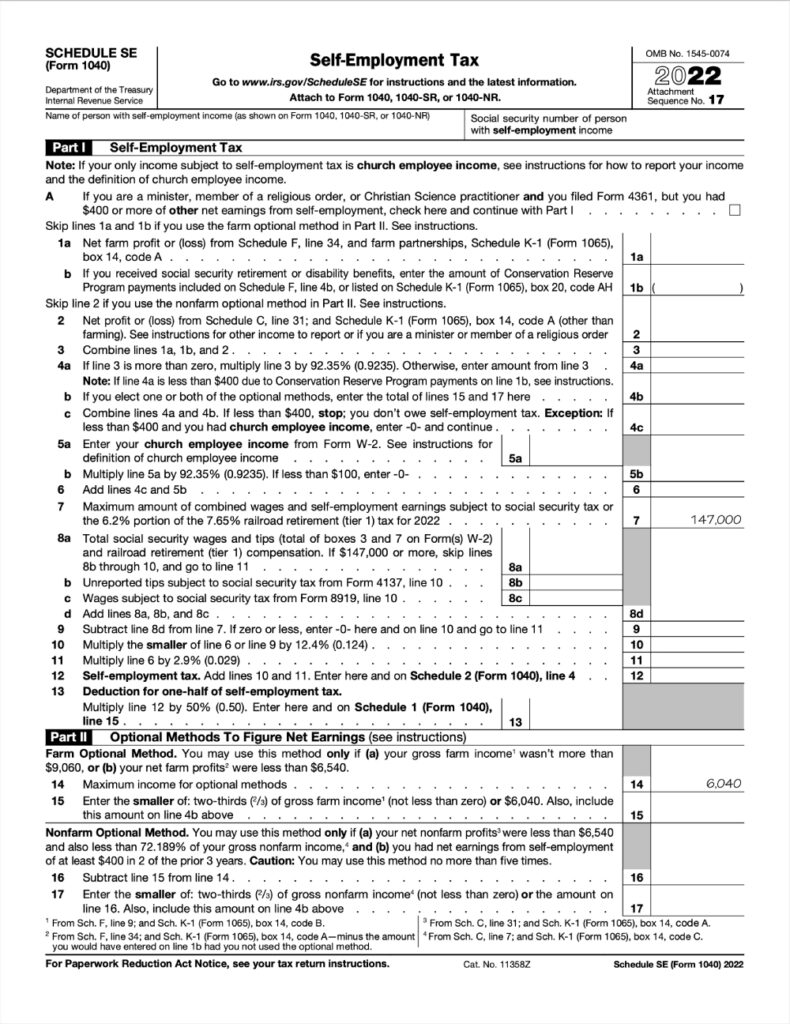

Here’s what Schedule SE looks like:

Who needs to file Schedule SE?

Fun fact: the acronym SE stands for self-employment. Therefore, anyone who has earnings from self-employment will probably need to complete Schedule SE.

But, there are thresholds. Generally, you need to file Schedule SE if your net earnings from self-employment in a year are at least $400.

Simplify Tax Season with Lili

Lili makes it easier to be self-employed: instant expense categorization, income tracking & reporting available in the Lili App, and automatic saving for tax payments. When tax season arrives, you’ll be able to prepare, file and pay your taxes worry-free with the help of Lili!

Avoid the headache next tax season and sign up with Lili today.

How to know you’re self-employed for tax purposes

With few exceptions, you are deemed self-employed for tax purposes if:

- You run an unincorporated business as a sole proprietor or an independent contractor. For clarity, an unincorporated business is a business that is not a separate legal entity from its owner.

By default, the IRS treats a single-member domestic LLC as a sole proprietorship unless that business elects to be treated as a corporation or an S corporation. In that case, the IRS will not treat the owner as self-employed, but as an employee of the corporation.

- You are in a business partnership. Again, by default, the IRS treats a multi-member domestic LLC as a partnership unless that business elects to be treated as a corporation or an S corporation. In that case, the owners are employees, not self-employed.

- You are in business yourself, including any side hustles, part-time work, and gigs.

Now, for example, let’s say Brian works as a data scientist in a Chicago-based financial services company. On the side, Brian does several online gigs related to data science. Is Brian an employee or self-employed?

Here, Brian is both an employee and self-employed. He’s an employee of the financial services company and self-employed for his online side gigs. Therefore, he’ll need to fill out Schedule SE.

But wait a minute. What about Schedule C?

The relationship between Schedule SE and Schedule C

You can view Schedule C as a small stream that feeds Schedule SE, a big river. There’ll be no Schedule SE without Schedule C, just as there can’t be a river without the little streams that feed it.

This is because, while Schedule SE requires your net earnings, it’s on Schedule C that you get to work out your net earnings by listing your business income against your business expenses.

After you figure out your net earnings from Schedule C, you’ll transfer this figure to Part 1, Line 2 of Schedule SE.

That said, Schedule C is not the only stream that flows into Schedule SE.

There are businesses that may need to use other forms besides Schedule C for filing out Schedule SE. These include:

- Farming: Before filling out Schedule SE, those in the farming business must fill out Schedule F instead of Schedule C.

- Partnership business: Before filling out Schedule SE, those in a partnership must fill out Schedule K-1 of Form 1065 instead of Schedule C.

Now let’s look at the tax itself.

What is self-employment tax?

Self-employment tax is assessed on the self-employed to fund Medicare and Social Security.

Self-employment tax is the equivalent of the Federal Insurance Contributions Act (FICA) tax for employed people.

Here are other things you should know about self-employment tax.

- The tax rate for self-employment tax is 15.3% comprising 12.4% for the Social Security component and 2.9% for the Medicare component.

- The 12.4% Social Security component of the self-employment tax only applies to the first $160,200 for the 2023 tax year. There’s, however, no limit to the 2.9% Medicare component of the self-employment tax.

- Usually, the amount subject to self-employment tax is 92.35% of your net earnings from self-employment.

Consider this example.

Suppose Brian’s net earnings from self-employment for 2023 are $180,000. How much is Brian’s self-employment tax?

- Step 1: Determine the income amount subject to self-employment tax. This will be 92.35% × $180,000 = 166,230.

- Step 2: Calculate the self-employment tax’s 12.4% Social Security component bearing in mind the income limit. For 2023, only net earnings of up to $160,200 are subject to the Social Security tax of the self-employment tax. This translates to $19,864.80 (12.4% × 160,200).

- Step 3: Calculate the 2.9% Medicare tax component. This comes to $4,820 (2.9% × 166,230).

- Step 4: Find the total self-employment tax by adding the Social Security tax component and the Medicare tax component. This comes to $24,684.80 (19,864.80 + 4,820).

Therefore, the self-employment tax for Brian for 2023 will be $24,684.80.

How to fill out Schedule SE

Below is a detailed breakdown of the information you need to fill out in each section of the Schedule SE form.

Schedule SE is a one-page form comprising two parts:

- Part 1—for self-employment tax

- Part 2—Optional methods to figure net earnings

While Schedule SE has two parts, for a vast majority, Part 1 will be the one to fill out. And that’s the one we’ll concentrate on.

You’ll start by filling out your name and Social Security number.

Source: IRS.gov

If you grow crops or raise cattle for a living and as a business, you’ll need to put your net income in line 1a. You’ll get this amount from Schedule F.

Source: IRS.gov

Farmers who receive payments from the Conservation Reserve Program will need to input this figure in line 1b. The effect will be to reduce their taxable income as CRP payments are not rental income for federal tax purposes.

In line 2, you’ll enter your net profit from your non-farming business, as shown below. In most cases, you’ll take this net profit figure from your Schedule C.

Source: IRS.gov

Coming to line 3, you’ll need to add all the lines above before multiplying the figure you get by 92.35% in line 4a as follows:

Source: IRS.gov

You may need to skip 4b, as this applies to individuals who have elected the optional method. And, unless you have church employee income, you’ll only proceed to 4c if your 4a is more than $400, the minimum self-employment net income that is subject to tax.

If you have church employee income, you’ll input this figure in line 5a. Subsequently, you’ll multiply the 5a figure with 92.35% in 5b as follows:

Source: IRS.gov

In line 6, add the figure from line 4c (the maximum non-church income that is subject to tax) and the figure from line 5b (the maximum employee church income subject to tax). Line 7 is the maximum amount subject to the Social Security tax, which, for 2023, is $160,200.

Source: IRS.gov

Lines 8a-d relate to earnings from a job you already paid Social Security tax on.

If you have already paid Social Security tax on all of your income, meaning your line 9 is zero, you’d jump to line 11 to calculate your Medicare tax, your only remaining self-employment tax obligation.

Line 12 is a summation of the Social Security component and the Medicare component of the self-employment tax. Line 13 requires you to multiply your self-employment tax by 50%. You can claim this deduction on Schedule 1 of Form 1040.

That’s it! The “optional methods” in Part 2 relate to those whose self-employment income is less than $6,540.

Frequently Asked Questions

Self-employment income is income earned from performing personal services “but which cannot be classified as wages because an employer-employee relationship does not exist between the payer and the payee”, as per the IRS.