Fill in some basic personal information.

Understanding Form 1099-K: Reporting Requirements for 2024

Overview and Reporting Rules

Gone are the days of accepting cash or waiting for a check to arrive in the mail. Accepting credit cards has become the norm, and virtual payments via Venmo and Cash App speed up the collection process.

If you accept debit and credit card payments for your work or use payment processors like Cash App, Venmo, or Stripe, you’ll likely receive a Form 1099-K in January.

In this guide, we shine the spotlight on what Form 1099-K is, its purpose, how to read it, and its 2024 reporting requirements. And, we’ll answer some of the most frequently asked questions at the end.

Written by Melissa Pedigo, CPA

Written by Melissa Pedigo, CPA

What is Form 1099-K?

Form 1099-K is a tax form containing a summary of the payments you received in a calendar year through:

- a payment card such as a debit card, credit card, or stored-value card (aka a gift card), or,

- a third-party network transaction such as PayPal, Stripe, or Venmo.

It’s crucial to note that the payments on Form 1099-K cover business transactions only.

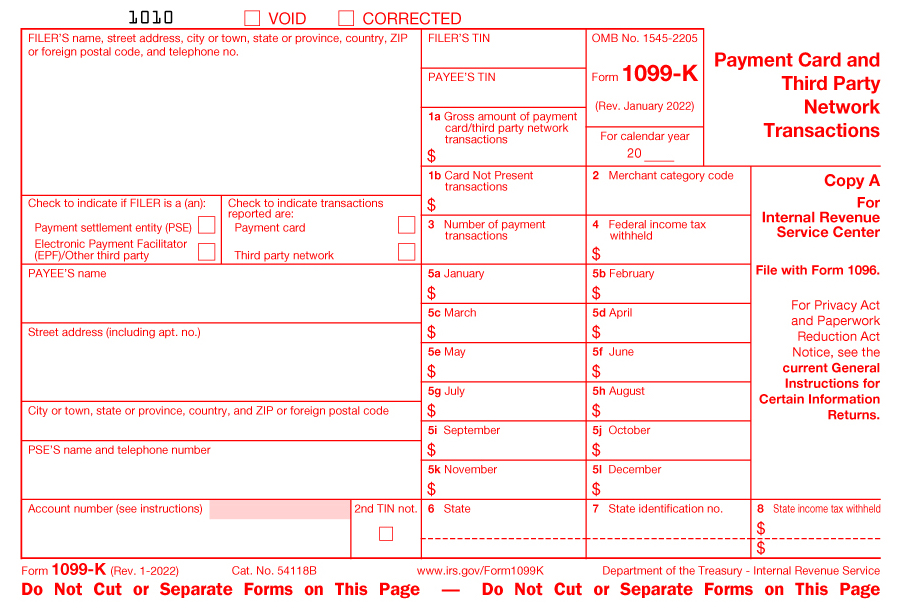

Here’s what Form 1099-K looks like:

Who should receive Form 1099-K?

Not everyone who has a Venmo, Stripe, or PayPal account—and receives money through that account—will receive Form 1099-K.

- First, it will depend on how you set up that account: whether you set it up as a personal or business account. You’ll receive Form 1099-K if you set up your account as a business account.

- Second, it will also depend on how the payer tags the payment. PayPal, for instance, provides the option of tagging a transaction as either “goods and services” or “personal/friends and family.”

Transactions on Form 1099-K are those that relate to “goods and services” and not “personal/friends and family.”

Also, aside from you as the business owner, other entities that will receive a copy of Form 1099-K are:

- The IRS

- Some state taxing authorities

What if you use your Venmo or Cash App account for personal transactions and business activity?

First, you should immediately open a separate business account to avoid blending your finances. If you’re using one account for personal and business transactions, you risk having personal transactions reported to the IRS on Form 1099-K.

Second, you’ll need to review your company’s financial records to divide the 1099-K information into personal and business. This will probably be an unpleasant task. Keep detailed records to support your calculations in case the IRS has questions.

This is another reason it’s vital to have separate business accounts for your Venmo, PayPal, and bank accounts–so your personal and business activities don’t get commingled.

This brings us to why the IRS created Form 1099-K.

Why Form 1099-K exists and what it means for your taxes

The main purpose of Form 1099-K is to improve voluntary tax compliance by helping taxpayers operating businesses accurately report their company’s income. This ensures that business owners like yourself pay the correct amount of tax to the IRS.

So here’s what to do with a 1099-K:

After you receive your Form 1099-K, and it’s been issued for a transaction for your business account (not a commingled account like we discussed above), compare it with your business records to ensure it’s accurate. If you find errors, contact the issuer to get it corrected and have an updated form issued.

Note: You may receive several 1099-Ks.

For example, let’s say you’re a graphic designer with three clients, A, B, and C.

If client A pays you through PayPal, B through Stripe, and C through Venmo, you’ll receive not one but three Forms 1099-K.

This brings us to another distinction.

Form 1099-K comes from the payment processor, not your client.

That means receiving two tax forms for the same transaction is possible. Let’s look at an example:

You’re a graphic designer. Your client paid you $22,000 in 2023 for work you completed, and they paid you via PayPal.

If your PayPal account is set up as a business account, you’ll receive a Form 1099-K from them. Your client may also send you a Form 1099-NEC or 1099-MISC. This is where excellent business bookkeeping is critical.

The IRS will have information about your business receiving $44,000 ($22,000 via PayPal and $22,000 from your client). But you’ll only report $22,000 on your business tax return. If the IRS sends you a notice, you’ll need to have the paperwork to show you only earned $22,000.

But, what happens if Form 1099-K never arrives?

What if you don’t receive Form 1099-K?

“Where’s my 1099-K?”

“I didn’t receive a 1099-K, what should I do?”

Your payment processor is responsible for sending a copies of the Form 1099-K to the IRS and the state tax authority. The copy sent to you is purely informational–it’s not used to file your taxes, rather it confirms your reported business transactions and provides information that can help complete your tax return.

Even if you don’t receive Form 1099-K, you’ll still need to report your business receipts on your income tax return. This one of the main reasons for keeping your business books organized.

Generally, all your business revenue is taxable. It’s not contingent on whether or not you receive a 1099-K for it.

Form 1099-K requirements for 2023, and beyond

Update: On November 21, 2023, the IRS released Notice 2023-74, announcing a delay of the $600 reporting threshold for Form 1099-K for calendar year 2023. For calendar year 2023 (the 2024 tax season), third-party payment networks who issue Forms 1099-K are only required to report transactions where gross payments exceed $20,000 and there are more than 200 transactions.

For the 2022 calendar year, Form 1099-K was issued to those:

- Who received more than $20,000 through card payments or through a third-party payment network such as PayPal, AND

- Whose number of transactions through a platform was over 200 in a calendar year.

Following the 2021 tax year, the IRS announced it would be making sweeping adjustments to these thresholds, lowering the threshold from $20,000 to $600 and removing the requirement regarding the number of transactions entirely. However, the IRS ultimately delayed these adjustments, treating the 2022 tax year as a transition year with no changes to the reporting thresholds from the previous year. The new threshold was to be implemented for the 2023 tax year (the current tax year). However, this has been delayed again.

So, for the current tax year, the 1099-K reporting requirements remain as they were in years past–issued for accounts whose gross payments exceed $20,000 & have greater than 200 transactions.

For the 2024 calendar year (the 2025 tax season), the IRS is planning to institute a threshold of $5,000, and are currently inviting feedback regarding this new threshold.

How to read Form 1099-K

Below is a detailed breakdown of the actual form so you can understand all the boxes–and there are a lot of boxes.

You can get a copy of Form 1099-K here.

This is worth emphasizing: you don’t fill out form 1099-K. Third-party payment processors, or payment settlement entities (PSEs), whose platform you are using to transact payments, provide this form to you. Your work is simple–to review the form and ensure it’s correct.

Form 1099-K has several boxes. Some are relevant to you and some are not. We’ll explain which ones to be mindful of below.

Filer’s name, address, and TIN

This information is letting you know who is sending you this form. Make sure you’ve used their service in the year, as you don’t want your revenue overstated to the IRS.

Source: IRS.gov

1a: Gross amount of payment card

Source: IRS.gov

This is the total amount of payments the third-party processor processed on your behalf for the calendar year. This is the gross amount; this figure doesn’t include any discounts or transaction fee adjustments.

This may be the most critical box and, tax-wise, the one that will mean the most to you.

Box 1b: Card not present

If you’re running a business that’s completely online, it means all the payments you receive will be “card not present” payments. The effect is that your 1a box and 1b box will display the same amount.

However, if your business also has a physical location, then the total of the card-not-present box will represent your online sales. And box 1a will differ from box 1b.

Tax-wise, this box isn’t important.

Source: IRS.gov

Box 2: Merchant category code

Ensure that the merchant category code agrees with the principal business or professional activity code you report on your Schedule C.

Source: IRS.gov

Box 3: Number of payment transactions

This box is a relic from the old reporting requirements that required over 200 transactions. You can ignore this box.

Source: IRS.gov

Box 4: Federal income tax withheld

Although it’s not common, the payment processor may have withheld federal income tax from some of your payments. If they do, they will record it in box 4.

Source: IRS.gov

Box: Payee’s name and address

These boxes should include your complete business name and business address.

Source: IRS.gov

Box: PSE’s name and telephone number

PSE stands for payment settlement entity, i.e. the payment processor. Their phone number is important, as it’s the one you’ll need to call if you notice a mistake on your 1099-K.

Source: IRS.gov

Box 5: Monthly boxes

These boxes are informational. You can usually ignore these boxes.

Source: IRS.gov

Box 6, 7, and 8: State information

If the payment processor withheld any state income tax from your payments, details about which state and how much was withheld are in these boxes.

Source: IRS.gov

What should you do if your 1099-K is wrong?

Below are two common errors that your Form 1099-K may contain and what you’ll need to do in each situation.

1) Shared credit card terminal

In some situations, you may find that multiple people and businesses share the same credit card terminal or merchant account.

You’ll need to contact the PSE to explain the problem and clarify the specific payments that apply to your business to ensure your company’s sales aren’t overstated.

2) If you changed your business name and the 1099-K has the old business name

You’ll want to call the PSE immediately to correct this.

The PSE may require you to prove that your business has a new name and that you are the owner. This can include copies of business registration documents from your state’s business registry department or correspondence from the IRS that shows the new name.

Simplify Tax Season with Lili

With Lili, categorizing your expenses is quick and painless. And, when tax season rolls around, you can easily access your business expenses within your Lili account, so you can accurately file your business taxes even if you don’t receive a Form 1099-K!

Avoid the headache next tax season and sign up with Lili today.

Frequently Asked Questions

Form 1099-K reports all the payments a business received for a particular year from card-based transactions and third-party payment networks such as PayPal and Venmo.

It’s intended to help business owners comply with tax reporting requirements.