Fill in some basic personal information.

1065?

If you’re in a business partnership, Form 1065 is one of the most important tax forms that apply to you and that you’ll want to know more about.

This article provides a detailed, step-by-step guide to Form 1065, including helpful tips on who needs to file it, instructions for how to file it, and the information you’ll need to have ahead of time.

IRS Form 1065 is officially known as the US Return of Partnership Income. Form 1065 is the tax form partnerships need to file in order to report their annual financial information to the Internal Revenue Service (IRS).

Here’s how it works:

For tax, partnerships are known as “pass-through” or “flow-through” entities. Whatever profit they earn keeps moving, not stopping at the partnership.

Since a partnership’s profit is still flowing through to another person, the IRS doesn’t prematurely tax the partnership. Instead, it’s the person at the tail end of this income “flow”—the individual partners–that the IRS taxes.

But if partnerships are not taxed, you may ask, what is the purpose of requiring partnerships to file Form 1065?

Form 1065 details the income and expenses of a partnership and, of course, their end-year profit.

But while this information may be necessary for the IRS, the IRS will be keen to know each partner’s share of profits. This is the portion individual partners include in their income on Form 1040.

And this is where Schedule K-1 comes in.

Schedule K-1, one of several schedules in Form 1065, captures each partner’s share of profit or loss which is the amount each partner will eventually be taxed on.

So the purpose of Form 1065 is not only to provide the IRS with general information regarding how a partnership has performed in a year, but also to provide the IRS with information regarding each partner’s share of profit or loss.

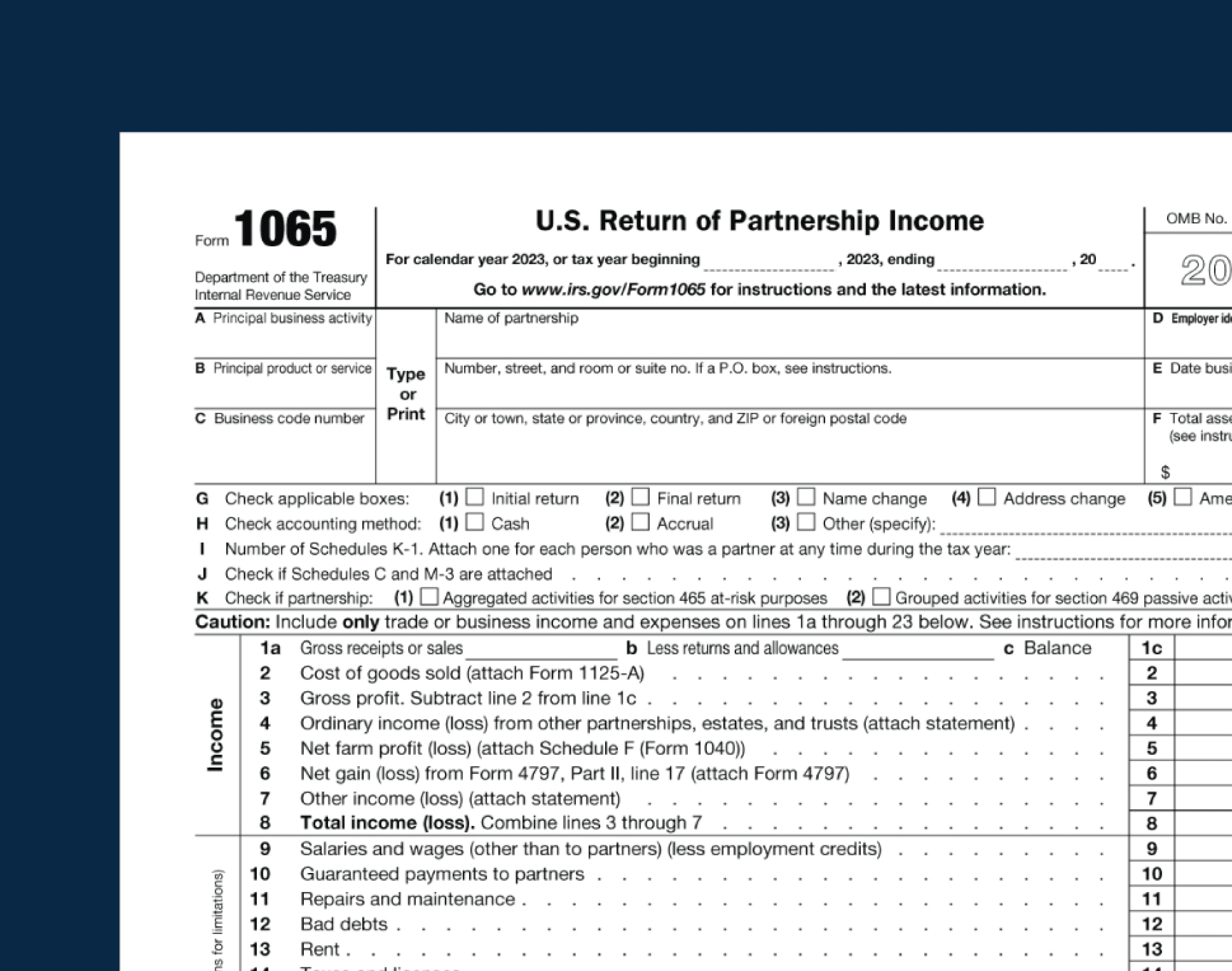

A picture, we’re told, is worth a thousand words. Here’s what Form 1065 looks like:

As you may notice, this is only the front page. Form 1065 is a five-page document. The remaining four pages are schedules, which we’ll review later in this guide.

While you should file all five pages, some schedules may not apply to your business. It’s ok to leave those blank when you submit your Form 1065.

All businesses formed as partnerships need to file Form 1065. These include:

Yes, but it depends on the type of LLC.

Multiple-member LLCs: By default, the IRS treats LLCs with more than one owner as a partnership. Unless, of course, the LLC elects to be treated as a corporation.

Single-member LLCs: Conversely, the IRS treats single-member LLCs as “disregarded entities.” For clarity, a disregarded entity is a business that the IRS doesn’t treat as separate from its owner. Therefore, the income of a “disregarded entity” is treated as the owner’s income and will get reported on Schedule C of Form 1040.

For that reason, multiple-member LLCs are required to file Form 1065, while single-member LLCs are not.

With Lili, categorizing your transactions is quick and painless. And, when tax season rolls around, Lili generates prefilled IRS tax forms (including Schedule C, Forms 1065 & 1120-S) based on what you’ve already categorized, so you can save time and money during tax prep!

Avoid the headache next tax season and open a Lili account today.

For Form 1065, here’s a list of the information you’ll need to prepare:

Other information you’ll need:

With all of the above information, you’re now ready to fill in your Form 1065.

Below are step-by-step instructions for filling out Form 1065, for all sections and schedules.

As you can see below, Boxes A to K at the top of Form 1065 mostly require general information.

Source: IRS.gov

So, aside from the name of your partnership and its address, here’s where you’ll need to input your:

But hold on. You may not need to fill in total assets if, according to question 4 of Schedule B, your receipts for the year were not more than $250,000 and your total assets are not more than $1 million.

A few notes for specific lines:

For Box G, an initial return is the first tax return your partnership files after it’s formed. So, if this is your second or subsequent year, don’t check Box G.

Conversely, a final return informs the IRS that you’re winding down. So if you’re still in business, you shouldn’t check this box.

Additionally, the purpose of an amended return is to change the details on a filed return. Don’t check that box if this is not what you’re doing.

Finally, the boxes for name and address change are only relevant if you’ve had a change of name or address.

Lines H and I are self-explanatory.

And line J only applies to businesses whose receipts and total assets are of a magnitude that make them liable to file Schedule M-3.

Line K generally doesn’t apply to most small businesses unless you have several business activities across different industries that you’re aggregating. Chances are, you’re not.

Let’s jump to the next section.

Here’s what this section looks like:

Source: IRS.gov

On line 1-a, you’ll enter your gross receipts and income. But be careful here. This figure will depend on whether you’re preparing your books under the cash or the accrual method. Also, this amount applies explicitly to your ordinary business income.

Other income categories, such as interest income, investment income, and dividends, go on line 7.

On line 1-b, enter your returns and allowances. Returns are products returned by your customers, while allowances refer to financial settlements you made that relate to the supply of defective merchandise.

After calculating your gross receipts, if you sell products, you’ll complete Form 1125-A to calculate your cost of goods sold. You enter this number on line 2.

Here’s what Form 1125-A looks like:

Source: IRS.gov

If you have other income or losses from estates or trusts owned by your partnership, farming operations, or selling business property, you’ll enter those figures on lines 4-7.

The deductions section of Form 1065 lets you list your business expenses to offset your business income.

You can deduct the following business expenses:

You can also deduct other business expenses like postage, office supplies, janitorial services, and travel costs even though there aren’t lines dedicated to these expenses. This is where line 20, ‘Other deductions’, comes in.

If you need to include expenses on line 20, attach an itemized statement of the expense types you’re claiming.

As we mentioned earlier, partnerships generally aren’t subject to income tax. The partners pay tax individually on their share of the partnership’s income. There are a handful of rare instances when a partnership will owe. But we won’t discuss them here.

➡️ Don’t forget to have a partner sign and date the bottom of page 1 of Form 1065.

Here’s the first page of Schedule B:

Source: IRS.gov

With 30 line items that span two pages (pages 2 and 3), Schedule B is the most comprehensive section of Form 1065. These line items are questions that generally require a simple “yes” or “no” answer.

Most of these answers will require an in-depth understanding of your business. While you can complete this section yourself, especially if you know your business inside and out, a few questions may require the help of your CPA.

🚨The most important part of Schedule B is including a partnership’s representative designation. This is the person with the authority to act on behalf of the partnership. It can be a partner or someone else, like a corporate attorney. But this person must:

Schedule K appears on page 4. It summarizes all partners’ income, deductions, credits and aggregated values.

You should take note that Schedule K-1 differs from Schedule K.

Schedule K-1 captures each partner’s share of income, deductions, and credits. The sum of all the partners’ Schedule K-1s should agree with the figures on Schedule K.

Source: IRS.gov

Schedule L is the balance sheet of your business.

However, if your answer was “yes” to question 4 on Schedule B, you’ll want to skip it.

If you answered “no” to question 4 in Schedule B, get a copy of your company’s balance sheet, pick up a pen, and get down to work!

Source: IRS.gov

As with Schedule L, Schedule M-1 is only required if you answered “no” to question 4 in Schedule B.

If relevant for your business, Schedule M-1 is where you’ll reconcile the difference, as is often the case, between net income per your financial statements and net income per your tax return.

Source: IRS.gov

Schedule M-2 is like Schedule L and M-1. You only complete it if you answered “no” to question 4 in Schedule B.

If relevant for your business, Schedule M-2 is where you’ll record any changes in the partners’ capital accounts.

Source: IRS.gov

As you can see, completing Form 1065 isn’t rocket science, but it can be overwhelming. Accurately summarizing your partnership income and deductions is not exactly a walk in the park.

If you’re looking to save yourself a headache in preparing the figures you need for Form 165 (and for your business taxes, in general), Lili’s Tax Preparation software do the hard work for you and, most importantly, at a fraction of the cost you may pay to engage a CPA.

Partnerships and some multi-member LLCs use Form 1065 to report tax data to the IRS.

Take a quick tour of the tools inside the Lili account. Banking, bookkeeping, invoicing, and taxes, all in one place.