Fill in some basic personal information.

Profit and Loss Statement

Guide & Templates

Looking to understand the financial performance of your business? Review our guide to Profit & Loss statements and get a head start in preparing one with our free downloadable profit and loss statement templates.

What is a Profit and Loss Statement?

A profit and loss statement, or P&L statement, is a financial document that helps you understand your business’s profitability over time. By contrasting your business income with your expenses, profit and loss statements help track your overall profits and identify periods of loss.

A P&L statement includes three primary sections: business expenses (money going out), revenue (money coming in), and net income (the difference between the two, commonly referred to as your profit margin).

Small businesses often use profit and loss statements to demonstrate their profitability to potential investors or when applying for a bank loan. P&L statements are one of the essential financial statements for businesses, along with balance sheets and cash flow statements. They are necessary for proving the status your business finances, and an important tool for you to assess whether your business is in the black (profitable) or the red (operating at a loss).

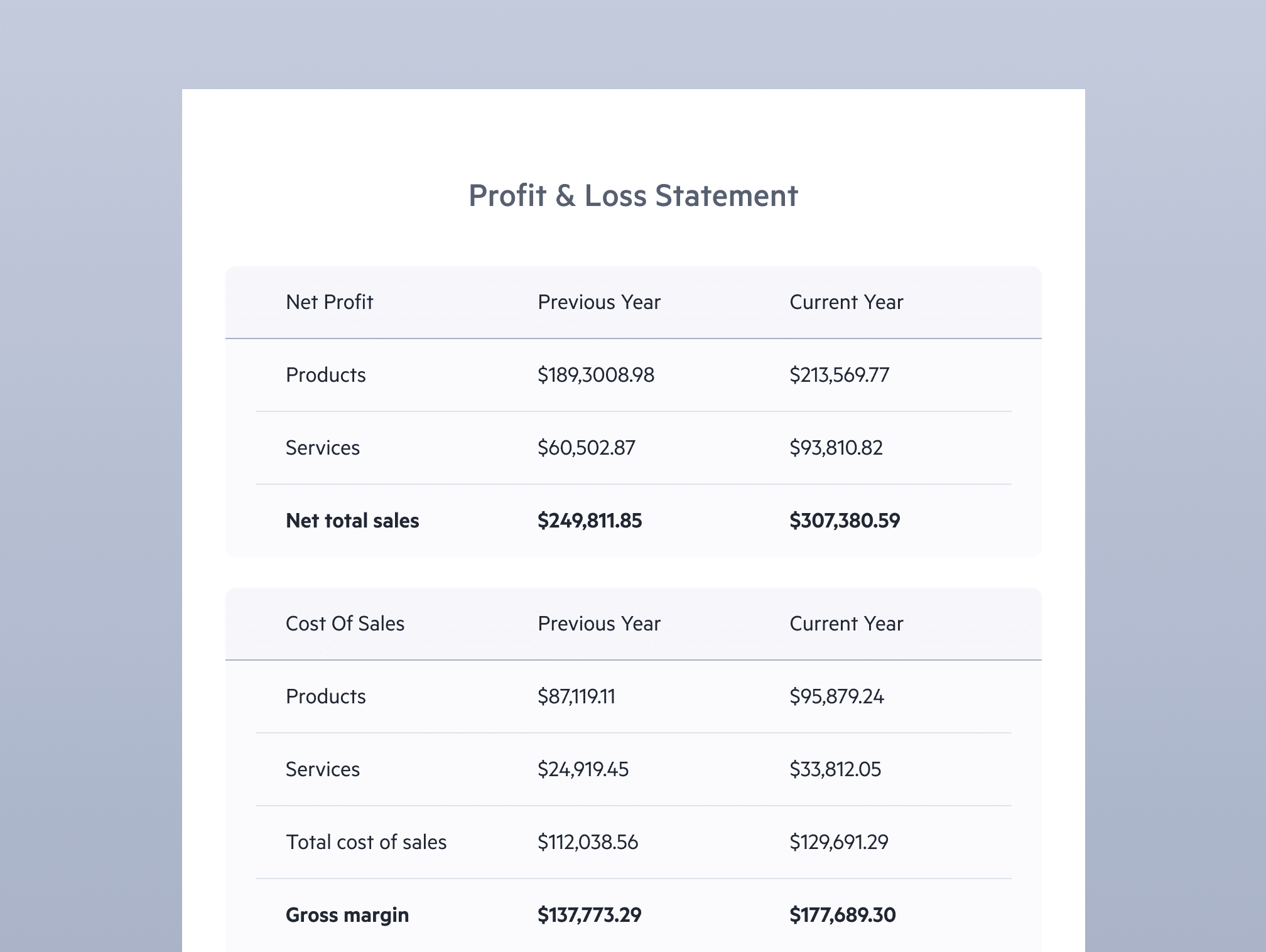

Profit and Loss Statement

examples and templates

Creating a Profit and Loss statement for the first time can be overwhelming, but you can use this example to understand how a P&L statement should look.

Get a better idea about how to evaluate your business’s profitability with this P&L statement example.

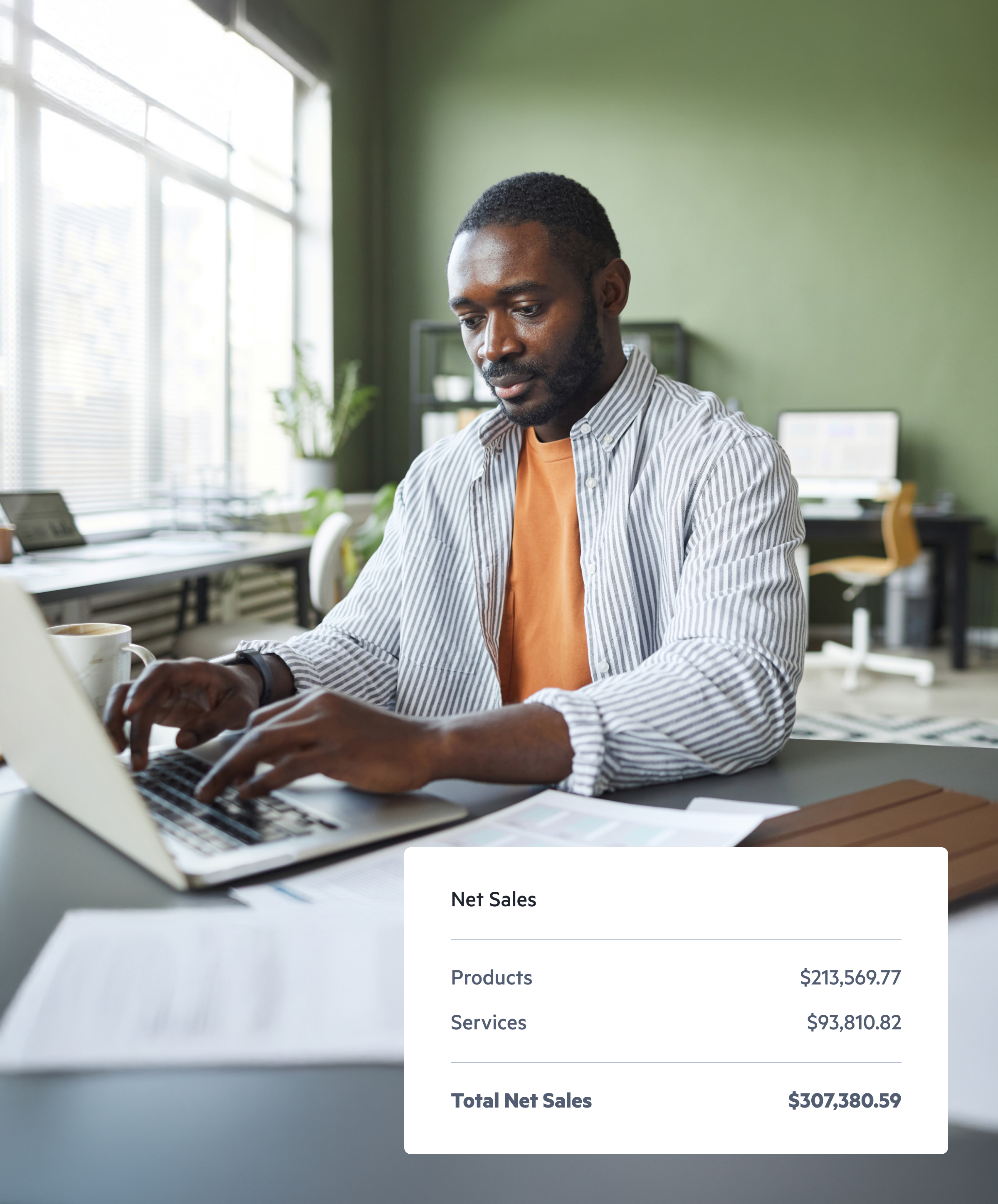

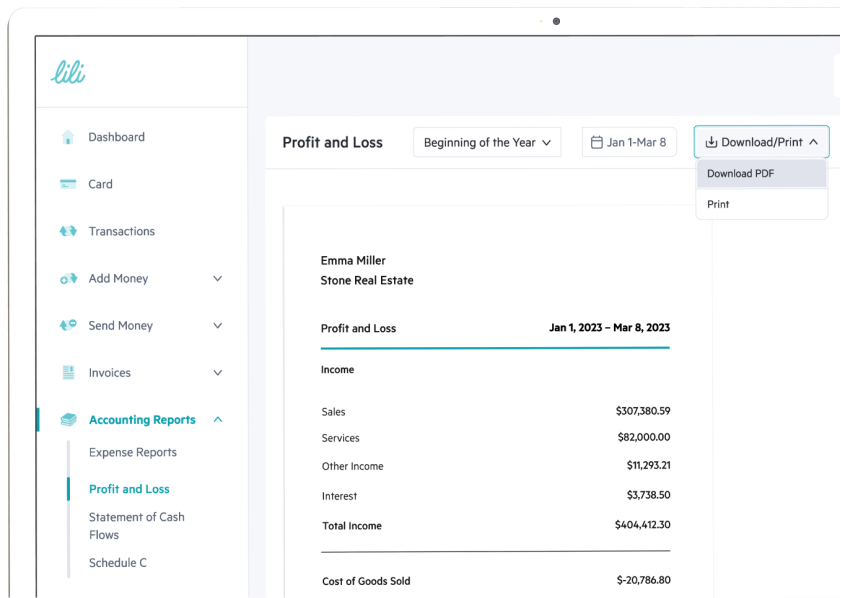

Lili prepares P&L statements for you

Lili’s Accounting Software automatically generates financial reports based on your transaction categorization, including Profit & Loss statements.

How to create a Profit and Loss Statement

Set your time range

Determine the period of time for which you need to create a profit and loss statement. This can be anything from a month to a financial quarter or even a year.

Input profits and losses

Identify all revenue and expenses for the selected period of time, and input this information into your P&L statement template.

Customize for your business

All of our free profit and loss statement templates are customizable to your needs! Edit or remove line items that are not relevant to your business, or add in lines as you go to fit with unique revenue sources and business expenses.

Check Excel formulas

Don’t assume the formulas are acting as they should! Double check formulas for fields such as Total Expenses and Net Profit, making sure the calculations are filling correctly.

Save your results

Save a copy of this P&L statement for your business records, or convert it to a PDF and share with the appropriate parties (e.g. an investor or lender).

What is the purpose of a P&L Statement?

A profit and loss statement is helpful for your own understanding of your business’s financial health. It is a quick way to check whether your business is operating at a profit or a loss, helps you review expenses to understand where you can increase spend (or where you need to cut costs), and helps you check in on the quality of your profit margin.

P&L statements are also a helpful way to outline your business’s current and projected profitability to any outside entities that may require it. Investors will want to see that you are operating at a profit, or have a pathway to future profitability. Lenders will need to see where your business is at financially right now, and how you plan to improve in the future. Business finances naturally will ebb and flow, and a profit and loss statement can demonstrate how these changes pan out over time.

Profit & Loss Statement Format

A profit and loss statement includes a number of elements that are relevant to your business finances, including:

Net sales/Revenue

Your total business revenue for the given period of time. This may look different depending on your accounting processes and the type of business you are running.

Cost of Goods Sold (COGS)

Expenses associated with producing the products or services you provide, such as raw materials, employee wages, and shipping expenses.

Business Expenses

Operating expenses related to selling and marketing, and administrative expenses associated with your business that are not directly related to the production of goods or services. Examples of such expenses include rent, advertising, and software subscriptions.

Net Income

Your pre-tax income.

Earnings per Share (EPS)

Net income divided by the number of shares for the given period of time.

Depreciation

Value lost by depreciating assets such as equipment, inventory, vehicles, and property during the specified period of time.

Earnings Before Interest, Tax, Depreciation, and Amortization (EBITDA)

Earnings for the selected period of time after subtracting all internal costs, but before subtracting external costs (interest, tax, depreciation, and amortization).

Frequently asked questions

Yes, you can create your own profit and loss statement! A P&L statement can be manually prepared either by starting from scratch, or by using a statement template, like the downloadable statements templates available above.

Streamline your business accounting with Lili

Simplify your bookkeeping with instant transaction categorization, and gain clarity about your business’s financial status with income & expense insights and auto-generated financial reports. Make it easier to balance your books with Lili’s Accounting Software.