Fill in some basic personal information.

1120-S?

If you’re running any business, you’ll need to know everything concerning your tax obligations and the tax forms to file to have a trouble-free record with the IRS.

For an S-corp owner, Form 1120-S is the most important.

Here’s what you need to know about Form 1120-S, including what’s on it, how to fill it out, and when to file it. But that’s not all. We’ll be answering some common questions at the end of this guide.

Form 1120-S is the annual federal income tax return used for S-corporations.

Don’t confuse Form 1120-S with Form 1120 and Form 1120-C.

Form 1120 is the U.S. Corporation Income Tax Return for C-corps.

Form 1120-C is the U.S. Income Tax Return for Cooperative Associations, like farmers and electric cooperatives in rural areas.

According to the IRS, a corporation or other entity must file Form 1120-S if:

S-corps, therefore, should only file Form 1120-S once they receive confirmation that the IRS accepted their Form 2553 election.

For clarity, S-corps should have no more than 100 domestic shareholders (foreign owners are not permitted) and are pass-through entities for tax purposes.

Pass-through entities are business organizations whose profits flow to the individual shareholders. The business is not taxed on the profit. The shareholders pay tax on their respective share of profits.

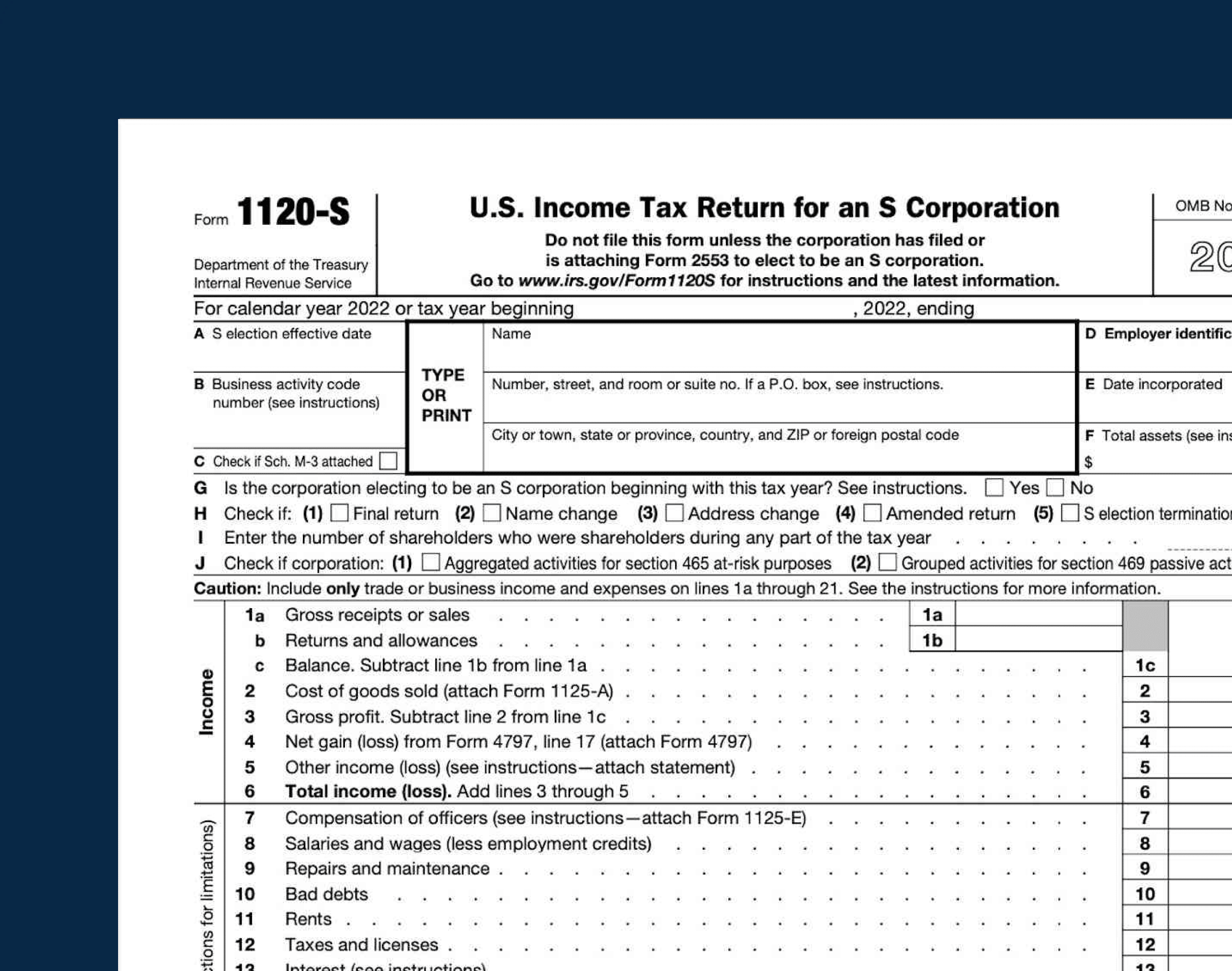

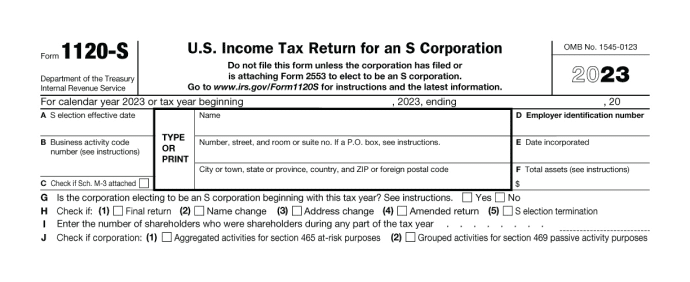

Form 1120-S is a five-page document requiring a broad range of information, including the address of the business, business income, itemized deductions, and estimated tax payments.

In addition, Form 1120-S has five schedules, including the crucial Schedule K, which tabulates individual shareholders’ pro rata share of profits.

Before filing Form 1120-S, you’ll need to have the following items ready.

With Lili, categorizing your transactions is quick and painless. And, when tax season rolls around, Lili generates prefilled IRS tax forms (including Schedule C, Forms 1065 & 1120-S) based on what you’ve already categorized, so you can save time and money during tax prep!

Avoid the headache next tax season and open a Lili account today.

Below is a breakdown of Form 1120-S by section, providing detailed instructions so you can follow along as you fill out each part.

Source: IRS.gov

Much of the information required in this section, including the business address, business activity code (per the IRS database), date of incorporation, and the EIN, can be obtained from the legal documents of the company such as the Articles of Incorporation.

For Total Assets in Line F, you will need to fill out Schedule L first, but only if Schedule L applies to you.

Schedule L only applies if a corporation’s total receipts or total assets was more than $250,000 during the year under consideration.

If Schedule L doesn’t apply to your business, you will leave Line F blank.

Here, an S-corp needs to input information relating to its main business income, excluding tax-exempt income, returns and allowance amounts, and its costs of goods sold.

For clarity, Line 4’s net gain (loss) from Form 4797 relates to gains or losses on the sale of assets used in business.

You may also have other income on Line 5. This would include things like royalties or income from non-core business activities.

In this part, S-corps should input deductible expenses. These include officers’ compensation, salaries, wages, repairs, bad debts, and rent, among others.

Under other deductions (Line 19) enter the total allowable business deductions that aren’t deductible elsewhere on page 1 of Form 1120-S.

For this, you’ll need to attach a statement listing each deduction included on this line, specifically by type and amount.

This section relates to the tax and tax payments. Since S-corps are pass-through entities, generally S-corps don’t make estimated payments because they don’t pay income tax.

But there are some unique taxes an S-corp may need to record in this section. That includes things like capital gains or losses and certain fuel taxes.

After you complete the entire tax return, you and your paid tax preparer (if applicable) will sign and date the bottom of page 1.

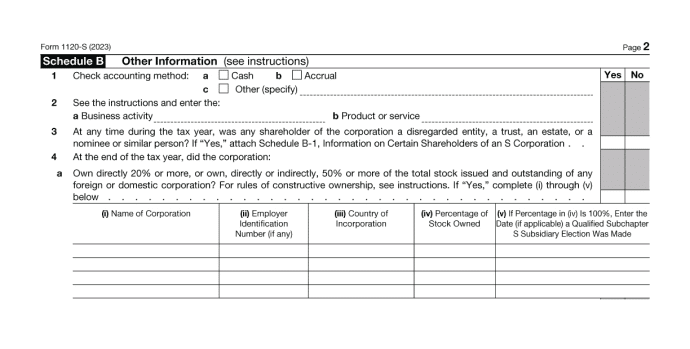

Schedule B is the longest section on Form 1120-S. It covers the entire page 2 of the form and part of page 3.

The following is a snapshot.

Source: IRS.gov

This section includes several questions that require Yes/No answers. This will require someone with an in-depth knowledge of the S-corp, particularly its financial information and its ownership.

That said, Line 14(a) relates to payments that would require an S-corp to file Form 1099. Typically, these are payments of $600 or more in a single calendar year, paid to independent contractors or self-employed individuals.

If an S-corp made such payments, it will need to file a separate Form 1099 for each recipient.

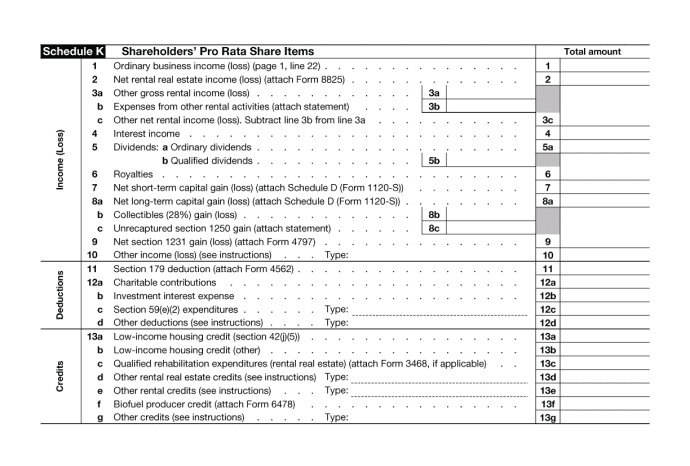

Schedule K is a summary schedule of all shareholders’ shares of the corporation’s income, deductions, and credits that pass through to the shareholders.

All corporations must complete Schedule K.

Here’s what the top of Schedule K looks like.

Source: IRS.gov

Remember not to confuse Schedule K and Schedule K-1.

While Schedule K is a summary, Schedule K-1 shows each shareholder’s separate share of the amounts on Schedule K.

Note: A dated receipt must support charitable contributions on Line 12a.

This is an S-corp’s balance sheet and should typically agree with the corporation’s books and records.

Schedule L is only required for S-corps whose assets are over $250,000.

Schedule M-1 reconciles income per the books of account with income per return. This is because the rules of financial accounting (Generally Accepted Accounting Principles) often differ from tax accounting rules.

Some things that can appear on Schedule M-1 are:

S-corps with revenues of less than $250,000 for the tax year and assets of less than $250,000 at the end of the tax year are not required to fill out Schedule M-1.

This schedule reports the accumulated adjustment accounts (AAA) and provides a more detailed look at the shareholders’ capital accounts.

Schedule M-2 is on the last page of Form 1120-S.

Form 1120-S is the tax return used by S-corps to report their tax information to the IRS.

Remember, filling out Form 1120-S can be time-consuming. It can also be expensive, especially if you choose to engage a CPA.

However, with Lili’s Tax Preparation software, you’ll receive a prefilled Form 1120-S based on the expenses you’ve already categorized using the Lili platform, in a process that is smooth and painless. To bid goodbye to your tax-filing headaches, open your Lili account today.

Take a quick tour of the tools inside the Lili account. Banking, bookkeeping, invoicing, and taxes, all in one place.