Fill in some basic personal information.

Easily connect PayPal to Lili and move money to your business checking account without delay!

Special discount: Get 30 days free plus 40% off Lili Smart fee for 3 months

Get 40% off Lili Smart fee for 3 months

When you get paid using PayPal, you’re charged transaction fees. Our PayPal fee calculator helps you understand the applicable PayPal fees based on the transaction amount and payment type, and what you should charge to account for it.

Easily connect PayPal to Lili and move money to your business checking account without delay!

When using PayPal to invoice your clients and collect payment, certain fees will accrue based on the payment type, currency, and payment method. It can be challenging to accurately calculate these fees before sending an invoice. Using our PayPal fee calculator, you can determine how much to bill your client to account for the transactions fees, so you don’t end up footing the bill.

PayPal charges merchants fees when they buy or sells goods or services or perform any other type of commercial transaction. Below is a list of common PayPal merchant fees (last updated December 7,, 2023):

Payment Type |

Percentage |

Fixed Fee (USD*) |

| PayPal Checkout/Guest Checkout | 3.49% | $0.49 |

| Pay with Venmo | 3.49% | $0.49 |

| Credit or Debit Card | 2.99% | $0.49 |

| Send/Receive Money for Goods and Services Fee | 2.99% | No fixed fee |

| Alternative Payment Method (APM) | 2.59% | $0.49 |

| Alternative Payment Method (APM) through Invoicing | 2.99% | $0.49 |

| QR Code transactions | 2.29% | $0.09 |

| QR Code transactions (via third party integrator) | 2.29% | $0.09 |

| Other Commercial Transactions | 3.49% | $0.49 |

*Visit PayPal’s merchant fees guide to see fixed fees in other currencies.

For international transactions, an additional percentage-based fee of 1.50% is charged for all commercial transactions on top of the standard PayPal fee from the table above.

Lili’s PayPal Fee Calculator is very simple to use! Follow these steps to feel more prepared to handle the fees when sending an invoice through PayPal:

The total PayPal fees will appear below the calculator, as well as the amount you will receive after fees are charged, and how much you should ask for to cover the fees.

Bookmark this page to refer back to anytime you need to calculate PayPal fees!

Percentage fees can really add up—especially for high-value transactions—but there are some things you can do to reduce or avoid PayPal fees altogether:

Per PayPal’s user agreement, you are not permitted to surcharge transaction fees to your clients, but that doesn’t mean you can’t cover the fees in the invoice total. If you have an average or common transaction amount you bill clients for, calculate a fixed “service fee” or “processing fee” based on that dollar amount and charge the same fee for every transaction.

PayPal fees are business expenses, so even if you can’t avoid them, by adding them as write-offs on your business taxes, you won’t have to pay taxes on that portion of your income later on.

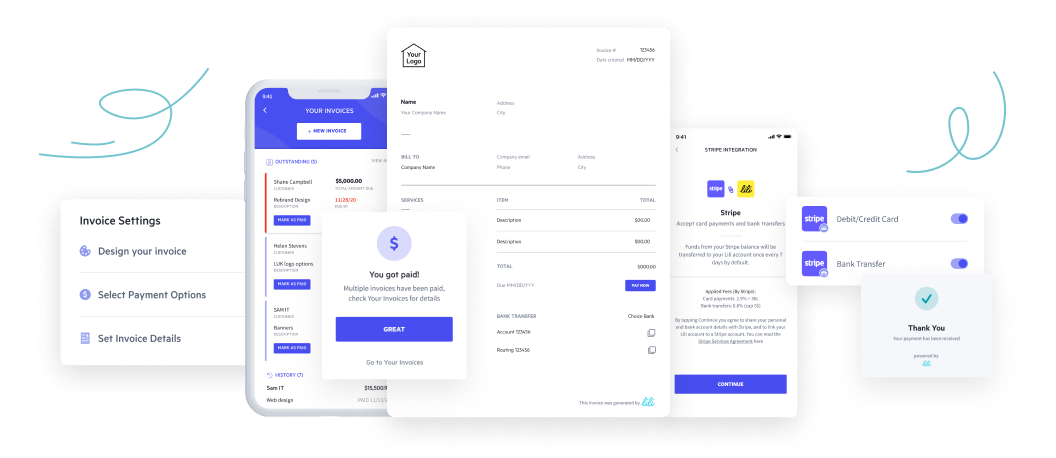

PayPal isn’t the only way to bill your clients! With Lili’s Invoicing Software, you can create professional invoices integrated with your Lili business checking account, then collect payment without transaction fees via ACH transfer, domestic wire transfer, or one of our many integrations, so you can avoid PayPal fees altogether.

With our seamless payment gateway integrations, your clients can fulfill invoices via any payment method: debit & credit cards, ACH transfer, domestic wire transfer, Venmo, Cash App, checks, and, of course, PayPal.

With Lili’s Invoicing Software, you can easily create and send professional custom invoices to your clients that clearly display account details and guide them through the payment process.

Because Lili’s Invoicing Software is part of the Lili platform, you don’t have to switch between services to manage your invoices and your payments. With Lili, everything is managed in one platform!

Use this formula to easily calculate PayPal fees, regardless of the specific percentage or fixed fee:

(Invoice Total x Percentage Fee)/100 + Fixed Fee

Example 1:

You send an invoice to a client for $500 to be paid via PayPal Checkout or Guest Checkout.

The fees for receiving money via PayPal Checkout/Guest Checkout are 3.49% of the total amount plus a fixed fee of $0.49, which comes out to $17.94.

After deducting fees, you will earn $482.06.

Example 2:

You charge a client via QR code for a service totaling $165.

The fees for a QR code transaction are 2.29% of the total amount plus a fixed fee of $0.09, which comes out to $3.87.

After deducting fees, you will earn $161.13.

Take a quick tour of the tools inside the Lili account. Banking, bookkeeping, invoicing, and taxes, all in one place.