As the holidays quickly approach, small business owners are gearing up for the busiest season of the year. According to a recent Constant Contact study, 60% of SMBs generate up to half of their annual sales during the holiday season. It’s a high-stakes stretch that requires strategic spending to maximize returns.

This year, the National Retail Federation expects overall holiday spending to increase by about 4%, hitting $1.15 trillion. On the individual level, consumers are planning to spend an average of $890 per person on holiday gifts, food, decorations, and other seasonal items—the second highest amount in the NRF’s 23-year survey history.

Given how intense the holiday season can be, the key is figuring out how to boost revenue without overspending in the process. Read on to find 5 practical strategies that can help you optimize your holiday spending.

5 tips on striking the right balance between spending and saving

The holidays bring a myriad of extra expenses that leave small businesses spending more than usual. While doing so can be justified, there’s a point of diminishing returns you don’t want to cross. Here are 5 steps that can help you strike the right balance.

1. Audit your category-specific budgets

Before heading into the holiday season, schedule a quick audit of your holiday budget. Review each spending category, such as inventory, labor, and marketing, in the context of forecasting data and market research. Look for areas where it can make sense to reduce, cut, or reallocate spending. Small adjustments across a few categories make a meaningful difference. The goal isn’t to strip everything down, but to make sure your spending aligns with your priorities and revenue goals. A quick final audit can keep your holiday budget lean and focused on the areas that you predict will provide the most ROI.

2. Spend conservatively at the outset

Another practical way to avoid overspending is to spend conservatively at the outset of the season and then scale up based on the actual results. For example, instead of ordering inventory based on the forecasted best-case scenario, begin with a solid baseline that covers you as you gauge demand. The same approach can apply to staffing—you schedule the base coverage you need, but keep a few employees on call in case it gets busier than expected.

This approach can work well across many holiday expenses. However, you’ll also want to consider the potential costs of starting conservatively and ensure they don’t outweigh the benefits. For example, on the inventory front, consider how quickly your suppliers can restock items and whether bulk pricing discounts will make larger orders more cost-effective.

3. Leverage integrated banking and accounting tools to streamline operations and eliminate last-minute costs

Another way to keep holiday spending under control is to use technology that can do some of the heavy lifting for you. For example, inventory management software can track what’s moving in real time and send you restocking alerts so you’re not caught off guard. Further, scheduling tools that allow for shift swapping and real-time schedule updates can help reduce coverage gaps and unnecessary overtime. And on the financial side, accounting, tax, and reporting tools can help you effortlessly stay on top of your results and bookkeeping as the busy season ensues. Together, tools like these can help keep you out of the weeds so you can stay focused on the bigger picture.

4. Shop smart and stay resourceful

Once the holidays ramp up, you can find yourself with less bandwidth for decision-making. However, one area where it pays to stay vigilant is your costs. Whether it’s inventory, shipping, décor, marketing, or event supplies—take a moment to compare pricing and look for the best option. Try to avoid impulse buys that feel urgent in the moment but don’t truly support your long-term goals. And if you already have items you can reuse this season, such as decor, displays, or gift wrapping materials, be sure to use them. Keeping your resourceful mindset online amid the chaos can help to keep costs under control, which you’ll be thankful for come January when the dust settles.

5. Regularly review and adjust throughout the season

Even with a solid, data-backed plan for the end of the year, the holiday season can move in unexpected directions. Scheduling weekly or bi-weekly check-ins throughout December gives you a chance to review performance across key areas and spot trends early. You may even want to put different people in charge of monitoring different areas. From there, you can make small adjustments that keep spending aligned with what’s actually happening. For example, you might rework schedules to better match traffic patterns and reallocate marketing spend toward the channels performing best. A bit of flexibility and responsiveness can ensure your spending stays aligned.

Cheers to a festive and profitable holiday season!

November and December tend to be the most profitable months for many small business owners. Spending more this time of year can certainly make sense, but there is a point where additional spending doesn’t lead to any more revenue. Auditing your costs and strategies across various categories can help you strike the right balance.

It’s also important to stay on top of your reporting and documentation throughout the holiday season. Adjustments often need to be made mid-season, so plan to check your metrics regularly. Further, having a system that keeps your records organized will help you start January off with a clean slate.

Lili supports SMBs through the holidays and beyond!

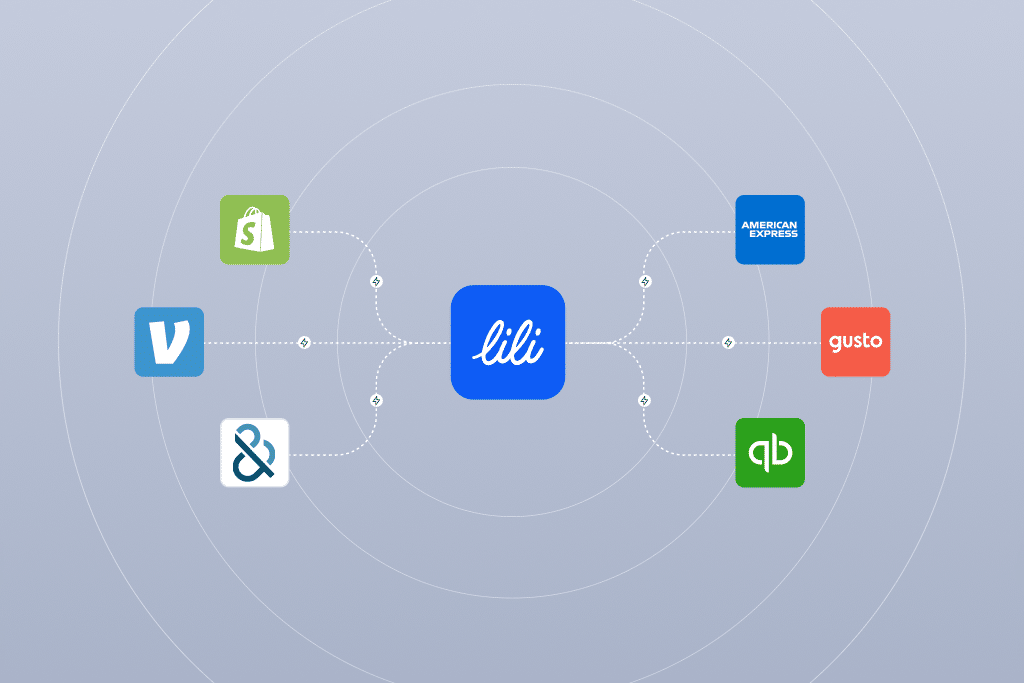

Lili helps small business owners stay on top of their banking, accounting, taxes, and credit all on one user-friendly platform. You can log in to quickly check your metrics, so you’re never wondering where you stand. Plus, you won’t have to worry about expenses getting away from you amidst all the holiday hustle and bustle. The platform allows you to upload expense receipts as you make purchases, and Lili automatically categorizes them for you. You can also automatically transfer funds into a 4% APY business savings account throughout the holidays, so you have a cash flow cushion waiting for you in January and beyond. Click here to learn more!

Lili wishes you a festive and profitable holiday season that helps you end 2025 on a high note.