Lili, the leading financial platform that offers business banking, credit building, and accounting solutions for small and mid-sized businesses, today announced an increase in FDIC insurance coverage to $3M through partner bank Sunrise Banks, N.A., and a new tiered high-yield savings structure offering up to 4.00% Annual Percentage Yield (APY)¹, which is up from 2.5%. Business savings balances over $500,000 now earn 4.00% APY, while balances under $500,000 continue to earn 2.50% APY– more than 9x higher the national average.

This expansion provides SMBs with greater financial security, confidence, and control—helping them safeguard and grow their businesses without extra effort. Previously, Lili offered customers a maximum of $250,000 of FDIC insurance coverage and is now providing SMBs with significantly more security for their funds.

“By extending FDIC insurance up to $3M and offering one of the highest APY rates on the market, we are ensuring that entrepreneurs can confidently safeguard and grow their hard-earned money, no matter the size of their business,” says Lilac Bar David, co-founder and CEO of Lili. “This is about more than protection – it’s about empowering our customers to grow without limits.”

Per the FDIC website, “The standard maximum deposit insurance amount is $250,000 per depositor, per insured bank, for each account ownership category.” Lili is offering much higher coverage for banking customers in an effort to encourage SMBs to grow their businesses. Lili’s banking offering is built with flexibility and transparency, with no minimum balance requirements, hidden fees, overdraft charges, or in-network ATM fees.

Beyond savings and protection, Lili’s financial platform also simplifies and streamlines the payment process for SMBs, enabling them to make fast payments that support their business operations. Business owners can accelerate transfers from merchant accounts and ecommerce platforms and send and receive funds via Express ACH, wires, and expedited same-day checks.

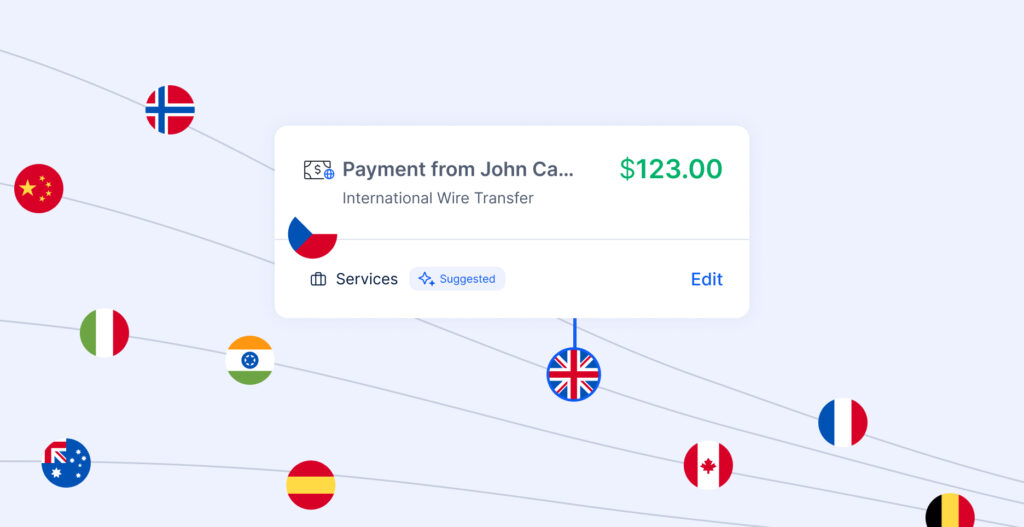

Additionally, Lili enables business owners to expand beyond U.S. borders with the ability to send and receive payments in more than 32 countries across North America, Europe, and Asia, and in over 130 currencies worldwide. With Lili’s international payment features, funds can be transferred via wire in as little as 24 hours.

1 The Annual Percentage Yield (“APY”) for the Lili Savings Account is variable and may change at any time. The disclosed APY is effective as of November 11, 2025. Must have at least $0.01 in savings to earn interest. 2.50% APY applies to balances of up to and including $500,000. 4.00% APY applies to balances over $500,000 and up to and including $1,000,000. Any portions of a balance over $1,000,000 will not earn interest or have a yield. Available to Lili Pro, Lili Smart, and Lili Premium account holders only.