You’re ready to set the wheels in motion for your handcrafted ice cream food truck. You’ve perfected your recipes and have your eye on a partially converted school bus that will serve as your meals on wheels.

You’re set to join the ranks of the 32.5 million small business owners in the U.S.

But where do you go from here?

Before you go out and buy that old school bus, you’ll want to get your business in the government’s good graces by obtaining your business licenses.

We’ll get you up to speed by explaining the different types of business licenses your company may need. And we’ll provide you with a step-by-step guide so you can be on your way to scooping ice cream.

Business License or LLC. Which Comes First?

In most states, you’ll form your LLC before securing any business licenses since registering your business as an LLC is one of the first steps you’ll take as an entrepreneur.

Although you may not need a business license to form your company, you will almost certainly need one (or more) to operate in your state legally.

But before we dive into business licenses, let’s be clear about what we won’t be discussing in this article.

What We Won’t Discuss

You’re here because:

- You’ve already formed your LLC or

- Decided that an LLC is the best entity type for your business but haven’t formed one yet

So we won’t be discussing why an LLC is better than a sole proprietorship or DBA. And we won’t walk you through the steps on how to start an LLC.

But if you do need resources related to starting an LLC, check out the SBA’s resources. And SimplifyLLC has detailed LLC formation guides and info on costs you can expect for each state.

Let’s get to what you came here for – business licenses for your LLC.

Business Licenses for LLCs

Most small businesses will need licenses to operate. But which ones do you need? It’s not crystal clear because there are:

- Local licenses

- State permits

- Federal permits

- Industry-specific licenses

- General licenses

To help you understand it all, we’ll break them down into the different government levels so you can get a better idea of what you need.

Business License Type: Local

Local business licenses are issued by counties, cities, or towns to small businesses operating within their geographical boundaries.

Typically these licenses are general because the state handles industry specialty licenses.

The most common local licenses businesses may need include:

- Local business operations license – Allows your business to operate in the city or town.

- Where to apply: Check with your city’s tax collection or manager’s office to learn how to apply.

- Building permit – Ensures safety regulations are met when building a new structure or renovating an existing building.

- Where to apply: Check with your city or county’s building department if you plan to build or remodel a location.

- Fire department permit – Confirms that business locations meet fire code requirements.

- Where to apply: Contact the administrative office of your local fire department to discover if your business will need it.

- Health and safety permits – Verifies businesses comply with health safety standards. Especially important for companies handling food (e.g., restaurants, long-term care facilities, or child care services).

- Where to apply: Consult with your city or county’s health department for information on safety regulations.

You may not need all of these local permits. But not having a required license may result in costly fines, so do your homework.

Business License Type: State

Once you get your local permits, you want to consider the state licenses you’ll need.

State licenses can be broken down into general and industry-specific.

Business License Type: State General Licenses

Types of general state business licenses include:

- Sales tax permits – For businesses selling taxable goods or services.

- How to apply: Contact your state’s Department of Revenue (or equivalent agency) to determine if you’re required to collect sales tax based on what your company sells. Most states allow you to apply for a sales tax permit online.

- Reseller licenses – Allows companies that buy and resell goods to avoid paying sales tax when purchasing the items you will resell.

- How to apply: Check with your state’s Department of Revenue if you plan to resell purchased items.

- State general business license – Although this isn’t a thing in most states, this is usually synonymous with forming your business with the Secretary of State. Registering your company acts as a quasi-state business license.

- How to apply: Consult with the state’s Secretary of State for business registration requirements.

Beyond the general business licenses, your company may need specialty permits based on your industry.

Business License Type: State Specialty Licenses

Be aware of required specialty licenses if you work in a regulated industry.

Because each state is different, we couldn’t possibly cover every type of specialty license. But here are some of the more common ones for small business owners:

- Food preparation permits

- Liquor licenses

- Occupational or professional licenses (e.g., cosmetology or massage therapy)

- Child care facility permits

- Environmental permits

- Health and safety licenses

Depending on your business, you may need multiple licenses.

For example, a food truck may need the following local and state permits:

- Food preparation permit

- Sales tax permit

- Local business license

- Vendor license

- Vehicle registration/license

But let’s not forget about federal licenses. Although there are fewer federal permits to consider, don’t overlook them.

Business License Type: Federal

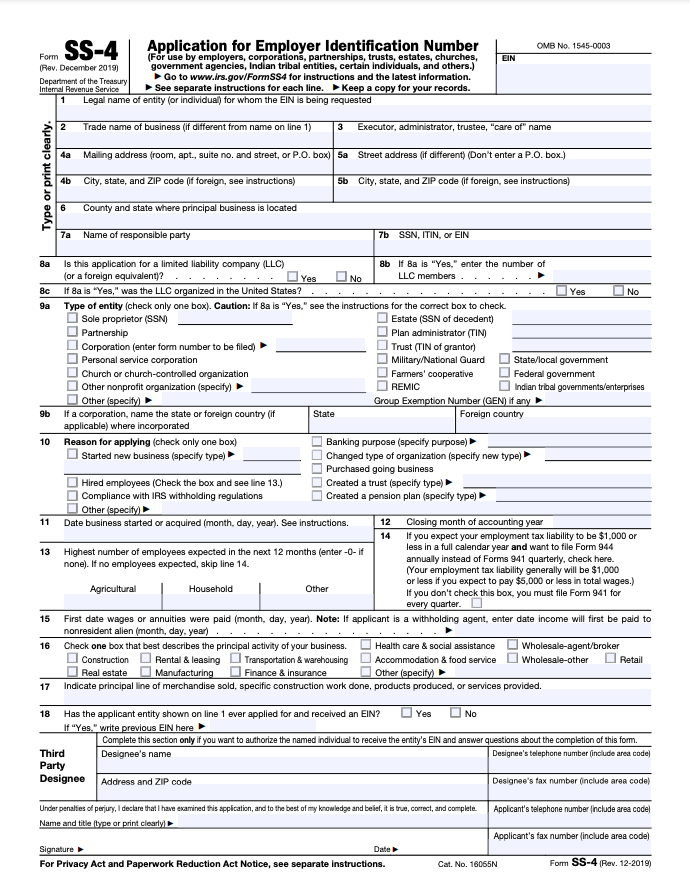

The one general federal license your company will likely need is an employer identification number (EIN).

An EIN acts like a Social Security number for your business. It’s a unique nine-digit number you’ll use for your company’s federal tax documents. And some banks may need your EIN to open a business bank account.

Getting an EIN is easy and free. You can complete the application on the IRS website in about 15 minutes. Once it’s approved, your EIN will be issued immediately.

For your EIN application, you’ll need things like:

- Company name and address

- Date of company formation

- Principal business activity

If you don’t want to get your EIN online, you can complete a paper application using Form SS-4, Application for Employer Identification Number, and mail it to the IRS.

Source: IRS.gov

There are fewer industry-specific federal permits than at the state level. Federal industrial licenses are needed in certain industries. These include:

- Agricultural

- Alcoholic beverages

- Aviation

- Firearms, ammunition, and explosives

- Fish and wildlife

- Maritime transport

- Mining and drilling

- Nuclear energy

- Radio and broadcasting

- Transportation and logistics

Getting Your Business Licensed

After filing your LLC formation application with your state’s Secretary of State, follow these steps to get the necessary licenses.

Step 1: Get Your Federal EIN From the IRS

Get your EIN immediately since you must provide it on most of your business license applications.

Step 2: Brainstorm the Different Types of Licenses You May Need

Based on what your business sells, take time to think about permits you may need. For example, a brick-and-mortar store may need:

- Sales tax permit

- Reseller permit, if you’ll be purchasing goods to resell

- Construction permit, if building out or remodeling the interior to suit your needs

- Local business license

- Elevator permit, if the store has one

- Certificate of occupancy/fire department permit to ensure the store meets local safety standards

Step 3: Research Your State’s Department of Revenue Website for General State Licenses

KEY POINT: We recommend securing local and state licenses before federal permits. With fewer federal licenses, your company may not need any beyond an EIN.

Usually, the Department of Revenue is responsible for administering most general business licenses.

In Colorado, the Taxation Division of the Department of Revenue issues sales tax licenses. And the Department of Tax and Fee Administration handles them in California.

Most states allow online applications for multiple license types. In Missouri, with one online registration, you can get your company’s:

- Sales tax license

- Vendor use license

- Withholding tax permit, if you have employees

- Unemployment tax registration, again, if you have employees

- Corporation income tax registration

Step 4: Review Your City and County’s General License Requirements

We’re still talking about general licenses, and you’ll likely need a general business license issued by your city or county.

Clearwater, Florida requires all businesses within its city limits to have a business tax receipt to operate legally. There is no fee, but annual online renewals are needed.

While discussing fees, be sure to budget a few hundred dollars for the various licenses your company will need. And open a business bank account early to keep track of your business expenses. With banking apps like Lili, you can quickly categorize costs throughout the year, so there are no surprises come tax time.

Source: City of Clearwater

Step 5: Apply For Specific Occupational or Professional State Licenses

After you have your EIN and general state and local permits, it’s time to move on to securing any professional or specialized licenses your business needs.

Go back to your brainstorming list you made earlier for occupational licenses you may need. If you already know the regulatory agency that oversees your industry, start searching their website.

For example, suppose you’re a hairstylist in Arizona ready to open your own salon. In that case, you probably know that the Arizona State Board of Cosmetology is where you need to start your research.

But a simple Google search will likely uncover the answer if you don’t know which government agency to consult.

For example, starting a pressure washing business in California means getting a Contractor’s License.

You don’t want to wing this step because failing to have the proper license can cost your company heaps of money or put you out of business.

Step 6: Research and Apply For Specialty Federal Permits

If your research suggests you’ll need any federal specialty licenses, allow extra time to submit your application. Since these industries and permits are heavily regulated, you’ll likely have to be fingerprinted at a police station or government office and have a federal background check completed.

Remember that license costs can add up quickly. And many licenses must be renewed annually, which comes with renewal fees. So budget accordingly.

While dealing with licenses isn’t your idea of fun, it’s necessary. But after you have them, you can mark the renewal dates on your calendar and forget about them until next year.