With tax deadlines quickly approaching, you may be feeling the pressure to get all your forms and receipts in order. But a variety of factors can make that difficult, from delayed information returns and unexpected events to complicated tax situations. If you think you may need more time this year, you can likely get an extension. However, delaying filing comes with both pros and cons that are worth considering. Here’s what you should know.

How do federal tax extensions work for small businesses?

If you need extra time to file federal taxes for your small business, the IRS allows six-month extensions. If you file the extension request by your original tax due date, the extension is generally automatic—and you can avoid failure-to-file penalties as long as you file by the extended deadline. If you expect to owe taxes, the amount is still due on your original tax due date.

Note: If your tax estimate is determined to be unreasonable once you file, you can still owe interest/penalties if you underpay, and you must make a proper estimate. Additionally, you can be charged interest and penalties on the unpaid amount.

Federal tax extension forms and dates

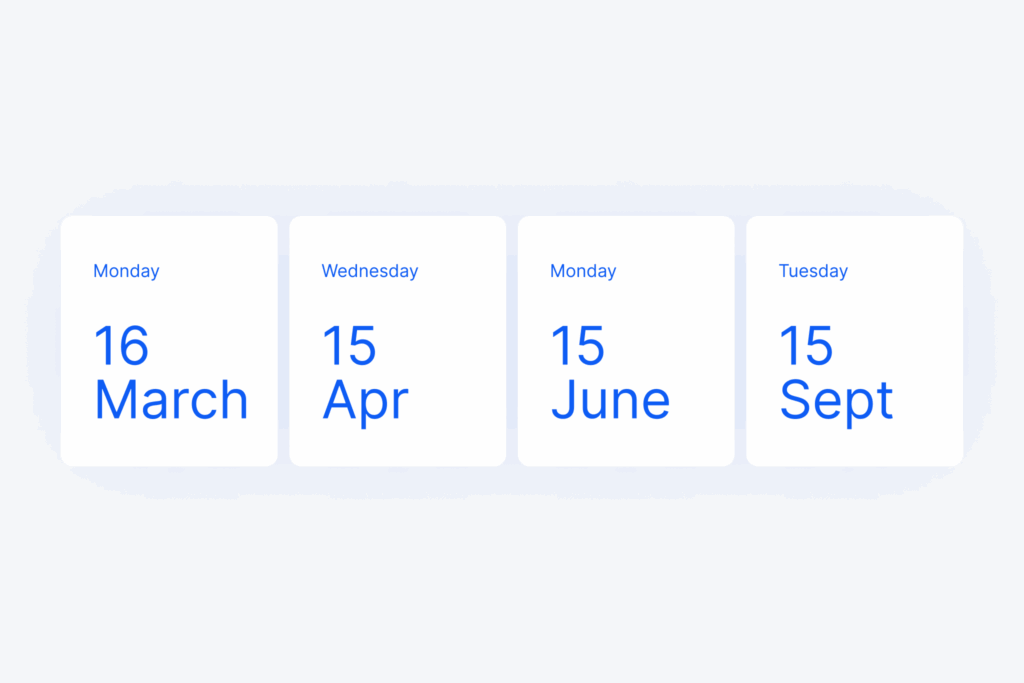

To request a tax extension, you need to file the required form for your business structure by your original tax due date. Refer to the table below to see when you need to file, your extended tax due date, and the required form.

| Business Structure | Extension Filing Deadline | Extended Tax Due Date | Required Form |

| Partnerships | March 16 | September 15 | Form 7004 |

| S Corporations | March 16 | September 15 | Form 7004 |

| C Corporations | April 15 | October 15 | Form 7004 |

| Sole Proprietorships | April 15 | October 15 | Form 4868 |

Filing federal tax extension forms

Both of the above-mentioned tax extension forms are available online on the IRS website. You can download the one you need, fill it out, and mail it to the address specified on the form by your deadline. Alternatively, you can e-file the form with an IRS e-filing partner or through your tax professional. Once accepted, you’ll receive an electronic acknowledgment you should keep for your records.

How can small businesses file extensions for state taxes?

If you’d also like to request an extension to file your state taxes, you’ll need to check with your state tax authority to find out how it works. It may accept approved federal extensions, automatically grant extensions, require a form, or offer a mix of the above. However, similar to federal taxes, the extension to file does not mean an extension to pay. You’ll again need to pay the amount you owe to your state by the original deadline.

What happens if you file federal taxes late without an extension?

If you file federal taxes after your due date without getting an extension, you can face penalties. The costs will depend on your business structure, as follows.

Failure-to-file penalties

- Sole proprietors: 5% of the unpaid tax per month, up to 25%

- C Corporations: 5% of the unpaid tax per month, up to 25%

- S Corporations: $245 per owner each month the return is late, up to 12 months

- Partnerships: $245 per partner each month the return is late, up to 12 months

Sole proprietors and C corporations only face failure-to-file fees if they owe taxes. However, S Corporations and partnerships are charged late filing fees whether taxes are owed or not.

Pros of filing a federal tax extension

Filing a federal tax extension can offer a few advantages. Here are the main benefits:

- More time to file: Get an additional six months to gather financial records, consult with your accountant, and ensure accuracy.

- Avoid late-filing penalties: Avoid costly IRS failure-to-file penalties.

- Helps if you’re missing documents: If you’re waiting on important tax forms (e.g., K-1s, 1099s, or other financial statements), an extension gives you time to get them before filing.

- Gives CPAs more time: If you have an accountant who is swamped during tax season, an extension allows them to work on your return when they have more availability, which could improve the quality of their work.

Cons of filing a federal tax extension

Filing a tax extension can also come with a few drawbacks. Here’s what to consider:

- You still have to pay on time: A tax extension only extends the time to file, not the time you have to pay. If you owe taxes, you need to estimate and pay them by the original due date to avoid interest and penalties.

- Tax underestimation risks: If you underestimate your tax liability and underpay, the IRS can charge interest and penalties on the unpaid amount. In cases where they find your original estimate unreasonable, they can also revoke your extension.

- May delay business financials: If you need a finalized tax return for business decisions, loans, or other dealings, delaying your filing can be a disadvantage.

- Delayed refund: If your business ends up qualifying for a tax refund, the payment of the funds will be delayed until after you file.

Is filing a tax extension right for you?

The real question is — do you need to file late? If you’re in a situation where you need to file your federal business taxes after the deadline, you’ll definitely want to file an extension. The extension will protect you against failure-to-file penalties and give you more time. However, you’ll want to weigh the benefits of filing late against the risks. By filing late, you’ll need to estimate your taxes which opens you up to the risk of underpayment penalties. Additionally, you’ll have the task of filing on your plate longer and may encounter the other drawbacks listed above.

Note: If you’re filing your main tax return late, you still need to send out information returns on time to employees, contractors, and other entities (e.g. W2s, 1099s, etc.). Filing these late can bring penalties of their own.

Stay ahead of taxes with Lili’s financial solutions

Tax season can be stressful, but with the right tools, you can stay organized year-round and avoid the last-minute scramble. Lili’s financial solutions platform is designed specifically to help small business owners every step of the way. Our AI-powered accounting software categorizes your expenses into tax-friendly categories and lets you upload receipts on the go. You can also automate transfers into a tax bucket so you have funds set aside to make all of your required payments. And when it comes time to fill out tax forms, you can download auto-filled forms right from your dashboard. Make the next tax season stress-free — see how Lili can streamline your taxes today!