With tax season in full swing, you may be wondering if you’ve overlooked something that could impact your bottom line. To help shine a light on potential blind spots, here are 8 common tax mistakes small business owners make and how to steer clear of them.

1. Filing late

One of the most important parts of managing taxes is filing on time. Filing late when you owe a balance can result in failure-to-file penalties which add to your tax bill. Plus, if you pay late, you can also face failure-to-pay penalties.

However, the IRS says filing late is common for small businesses. The deadline can sneak up on you, especially if you’ve recently switched to a new business structure with an earlier due date.

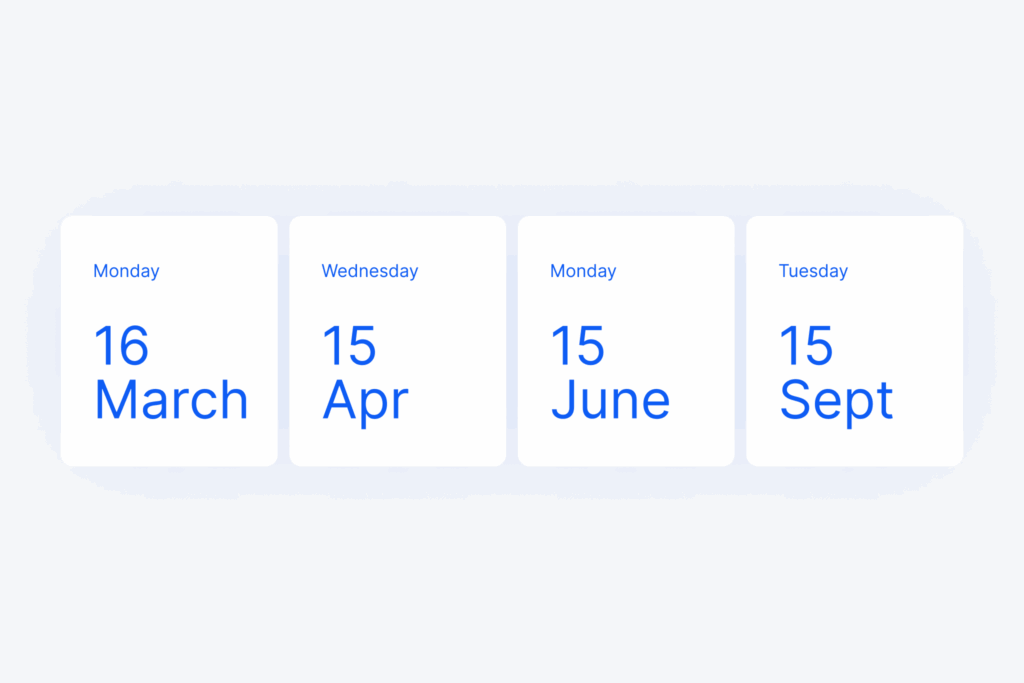

To ensure you file on time and avoid penalties, double-check your due date at the start of each year and schedule dedicated time to file well before the deadline. For reference, the filing deadlines for 2025 are as follows:

- March 16: Partnerships and S-Corporations

- April 15: C-Corporations and individuals living in the U.S. or Puerto Rico

- June 15: Individuals living outside the U.S. or Puerto Rico

2. Mistaking an extension to file as an extension to pay

If you need additional time to file your taxes, the IRS allows six-month extensions. As long as the request is made by your original tax due date and you file by the extended due date, you can avoid the failure-to-file penalty.

However, a common mistake is to assume that an extension to file means an extension to pay. The reality is that even if you get an extension to file, you’re still responsible for calculating your tax liability and paying it by the original due date. Paying late can result in interest charges and failure-to-pay penalties.

To avoid this mistake, ensure you calculate your tax liability and make the required payment by your original due date. If you can’t make the payment on time, you can often set up a payment arrangement.

3. Underpaying estimated taxes

When running a business, taxes aren’t automatically deducted from your earnings like they are for employees. Instead, you have to set aside a certain amount of revenue and make quarterly estimated payments by specific dates.

A common mistake small business owners make is underpaying estimated taxes, which can lead to penalties. To avoid underpayment penalties, you’ll need to pay your estimated taxes by the applicable due dates for your business. In 2026, they are as follows (for businesses following the calendar year):

- Payment 1: April 15

- Payment 2: June 15

- Payment 3: September 15

- Payment 4: January 15, 2027 (December 15, 2026 for corporations)

Additionally, to avoid penalties, you need to properly estimate the taxes you’ll owe. You can find directions on how to do so through the following IRS resources:

| Tax status | Form |

| Individual filers including sole proprietors, partners, and S-Corporation shareholders | Form 1040-ES, Estimate Tax for Individuals |

| C-Corporations | Publication 542, page 7 |

4. Incorrect employment tax deposits

If your business has employees, the IRS requires you to withhold a percentage of their income and deposit it at regular intervals to cover income taxes and their portion of payroll taxes. Additionally, you’re also required to deposit your share of payroll taxes for employees at regular intervals.

If you don’t deposit the correct amounts at the required times, you can face penalties. To avoid this, it’s important to be aware of your responsibilities as an employer and have a system in place to ensure the required payments get made. The IRS provides all the information you need to know on its Employment Taxes page.

5. Not selecting the best business structure

As a business owner, you can select from various business structures with differing tax treatments. However, a common mistake is to opt for an entity type that’s not the most advantageous for your business, leaving you paying more than you need to in taxes.

To avoid this, it’s important to research the various structure options and how they’ll impact your tax situation. You may also want to consult a tax professional to weigh the pros and cons of each option. For reference, here’s a brief overview of the different business structure options and what they mean for your taxes:

| Entity Type | Tax Treatment |

| Sole proprietorship | All business income is reported on your individual income tax return (on Form Schedule C). Your net profit is taxed according to individual tax rates and is subject to the 15.3% self-employment tax. |

| Partner | The partnership files Form 1065 but doesn’t pay federal income tax — the income is distributed to the partners. Your share of the partnership income is reported on your personal income tax return and taxed at individual tax rates. You also owe the 15.3% self-employment tax on your share of the earnings. |

| S-Corporation | S-Corporations file Form 1120-S to report income but don’t pay federal income tax. The profits are divided amongst shareholders and taxed at individual tax rates but aren’t subject to self-employment tax. Earnings for the services you provide to the business are also reported on your individual tax return. They’re taxed according to individual tax rates and are subject to the 15.3% self-employment tax. |

| C-Corporation | C-Corporations file Form-1120 and pay a flat corporate tax rate on net taxable income. If dividends are paid to shareholders, they’re reported on the shareholder’s individual income returns and taxed at individual tax rates. Owners working in the business must take a salary and pay payroll taxes like regular employees. The C-Corp withholds and pays payroll taxes to the IRS for owners and employees. |

| LLCs | LLCs are taxed based on their underlying structure. If you don’t elect classification as an S-Corp or C-Corp, your LLC will automatically be classified based on its number of members. The default classification for single-member LLCs is sole proprietorship while the default classification for multi-member LLCs is partnership. |

6. Missing deductions

When filing taxes as a business owner, you can deduct expenses that are necessary for your industry, effectively reducing your taxable income. However, a common mistake is to let deductions slip through the cracks, leaving you paying more than you should in taxes.

To ensure you claim every last deduction, it helps to track them as you go. Create a system for filing away deductions and the proof you need to support them in real-time. Tools like Lili’s expense management tools and accounting software can help by automatically categorizing transactions and letting you attach digital receipts on the spot.

With all your deductions consistently organized, review and summarize them at the end of each month. Then, when the end of the year comes around, you won’t have to perform a monumental scavenger hunt.

7. Mixing personal and business finances

Another common mistake, especially for sole proprietors, is mixing business and personal finances. For example, this can look like having a single bank account that you use for transferring money between friends and family members, receiving business income, and paying for personal and business expenses. The IRS says doing so can make it hard to differentiate business from personal expenses, causing problems when claiming deductions and passing audits.

To avoid this mistake, open up a dedicated business bank account exclusively for business earnings and expenses. Additionally, if you want to use credit, open a dedicated business credit account that you only use for business expenses.

These dedicated accounts help to keep your business organized and protected. Plus, they may come with helpful features specifically designed for business owners. For example, Lili’s small business bank account comes with optional accounting, tax preparation, and expense management features.

8. Misclassifying workers

If you’d like to hire someone to help you with your business, you can opt for an employee or an independent contractor. Employees come on board as part of your team and are typically given specific responsibilities and hours. Independent contractors, on the other hand, are business owners who offer their services to the public on a contract basis.

Going the contractor route can be beneficial because you don’t have to withhold and pay taxes on the worker’s behalf as you do with employees. However, ensuring that a contractor is truly a contractor is important. If the IRS decides you misclassified an employee as a contractor without a reasonable basis, you can be held liable for that worker’s employment taxes.

To prevent misclassification, review the IRS’s three-factor test, which considers behavioral control, financial control, and the nature of the working relationship, along with the labor laws for your state. Additionally, if you have any concerns, consult an employment law attorney, CPA, or tax advisor.

Stay ahead of tax season and avoid pitfalls

Taxes are an important part of running a business, but they don’t have to be a source of stress. By understanding how to avoid common pitfalls like missing deductions or underpaying estimated taxes, you can stay compliant and keep more of your hard-earned money.

The key is preparing and having the right systems in place. Lili makes it easy to stay tax-ready with a free small business bank account, and access features like automated expense categorization, the ability to attach receipts to expenses, automated tax savings accounts, and pre-filled tax forms.

Want to see how Lili can streamline your business taxes and finances? Try Lili Smart free for 30 days!

*Available to Lili Smart and Lili Premium account holders only, applicable monthly account fee applies.

Lili is not a tax preparer and does not provide tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors regarding your specific situation.