It’s always frustrating when a client doesn’t fulfill an invoice by its due date. Invoices remaining unpaid can affect your ability to sustain your business financially. However, an invoice being one or two weeks past due doesn’t necessarily mean the client is refusing to pay. When dealing with a client who hasn’t paid you, there are some steps you can take to collect payment and maintain the relationship before resorting to more extreme measures.

What to Do If Your Client Doesn’t Pay

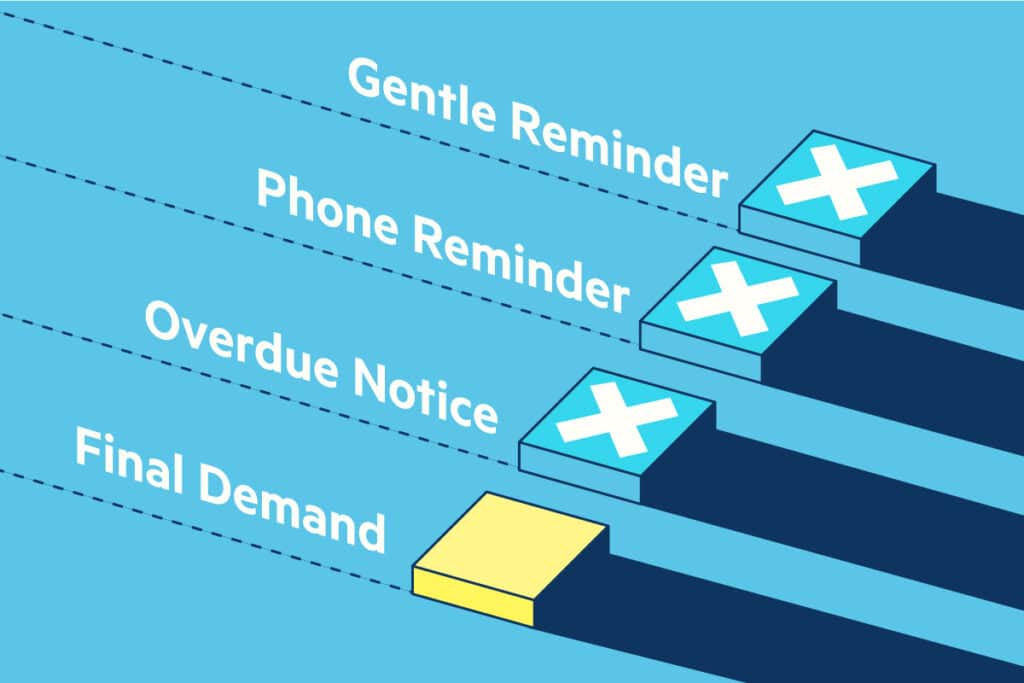

1. Send a Reminder

If your invoices have longer time frames between when you send them and when they’re due (such as Net 30 or Net 60 terms), your client may have simply forgotten about the invoice. Because an invoice is different from a bill (which calls for immediate payment collection), it’s easier for an invoice to get lost in the shuffle.

Before assuming the worst, send your client a gentle reminder one week after payment is due, stating that they have an outstanding invoice with you. When you send this reminder, attach a copy of the invoice if manually created using invoice templates in Excel or Word, or resend the invoice directly through your invoice software. This will make it easier for clients who simply forgot to be able to access the invoice and pay it in a timely manner, rather than needing to dig through their email for the original invoice.

2. Over-communicate

If another week has gone by with no word from your client, try alternative means of communication. For some clients, email just doesn’t cut it as they don’t check it frequently or your email has been lost in their overstuffed inbox. Consider what other forms of contacting your client are available, such as calling their office or messaging them directly. Then, ask them to please check their email and take care of their invoice as soon as possible. At this point, your top priority is to establish clear communication so you can find out the reasoning behind the delay and ensure the invoice is fulfilled as soon as possible.

3. Ask Why They Aren’t Paying

There are many possible reasons a client doesn’t pay an invoice. When you are able to get in touch with your client, find out if there is a reason the invoice isn’t paid beyond simple forgetfulness. Are they having financial difficulties? Are they currently vacationing with very little service and unable to get the payment through? Did they recently switch to a new billing provider or banking service and need more time to set it up before they can send payment? Or are they simply refusing to pay because of dissatisfaction with your work?

Once you understand the reasons behind the delay, you’ll have a better idea of the appropriate next steps. This may include giving your client an extension or proposing a payment schedule.

4. Terminate Service and Resend Contract

In the event of a client’s refusal to pay or failure to communicate, it may be time to escalate the situation. Let your client know that you will be terminating services and withholding deliverables until the invoice is fulfilled. If your contract outlines the consequences for failure to pay, you can resend it to reinforce that these terms were agreed upon ahead of time. Additionally, clearly explain to your client the steps you will take if they still refuse to pay, and be prepared to back this up with action.

5. Outsource Payment Collection

If you are still struggling to collect payment from your client, you should consider legal action. Depending on the amount owed, there are many options available to you to acquire payment. The most common options for this include hiring a debt collection service or taking your client to small claims court, but you can also hire an attorney to advise as to the best option for you.

If this unpaid invoice is significantly hurting your cash flow, an invoice factoring service will purchase your accounts receivable, making it possible for you to essentially borrow against your unpaid invoices. Although an unpaid invoice is never ideal, if you build a safety net into your business finances and have a solid business budget, you shouldn’t need to resort to such a costly financing solution.

5 Tips to Avoid Unpaid Invoices in the Future

Establish Clear Terms

Before you begin any work for a client, you should outline explicit terms of your professional relationship in a legal contract or written agreement. This will help your client to understand the expectations upfront so they are less likely to delay payment deliberately. Even if it’s not a formal legal contract, it can still serve as a legally binding document in any case where your client is outright refusing to comply with the agreed upon terms.

Send Invoices in Advance

Another option to ensure you are always paid for your work is to invoice clients before services are rendered. If your services will not start until the invoice is fulfilled, you don’t run the risk of performing work that ultimately goes unpaid. Some clients may not feel comfortable with this type of agreement, so make sure it’s clearly communicated to them at the start of your professional relationship.

Include Late Fees in Contract Terms

To proactively obligate clients to bear the responsibility for overdue payments, you can include late fees in the terms of your contract. This could take the form of either a flat fee or a percentage of the total balance due. Your client should be aware of the late fees from your initial written agreement. Charge late fees 15-30 days after an invoice is due, but also send your client a final warning a few days before the late fees will get tacked on so they have one last chance to pay before their balance due increases.

Make Submitting Payment Easy

The easier you make it for clients to pay, the faster they will do so! One of the most popular methods for collecting payments is through PayPal, as many people already have free accounts with the platform. However, PayPal charges fees for receiving money as a business that you should be aware of when using their service.

Choosing to only accept payment via direct deposit or check may mean fewer fees, but it also may result in delays, as it’s more complex for a client to set up (especially the first time, when they haven’t previously established a process for paying you).

Use Invoicing Software

One of the best ways to ease payment collection woes is to start using invoicing software. Lili’s Invoicing Software makes it easier to track unpaid invoices, issue corrections, and send payment reminders. In addition, you can easily integrate any payment collection method you choose with your Lili invoices, making it more convenient for your clients to pay you using their preferred payment method. And at the end of the day, getting paid seamlessly is crucial to the success of your business!

Looking to streamline your invoicing and payment collection? Interested in managing your business finances (including banking, accounting, invoices and tax preparation) in the same, easy-to-use platform? If so, then Lili is for you–open a Lili account today!