Getting paid is a fairly integral part of running a business. Many new business owners default to using peer-to-peer (P2P) apps such as Venmo or PayPal for requesting payment from clients, since they’ve used them before and they’re free and simple to sign up for. However, since these apps aren’t designed explicitly for business use, their use can cause some complications when it comes to taxes.

If you’re considering using PayPal, Venmo, or another peer-to-peer money exchange app for your business, here are a few things to be aware of.

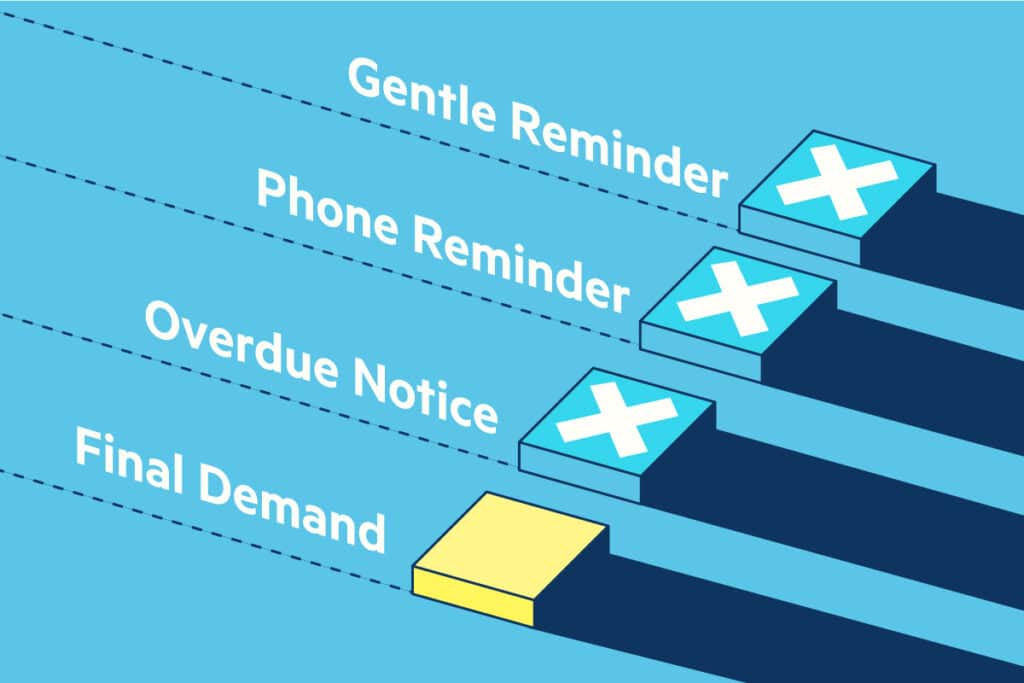

Risk of Noncompliance with Tax Laws

The Treasury Inspector General for Tax Administration (TIGTA) released an internal audit report in spring 2021 addressing challenges in tracking and monitoring peer-to-peer payment applications. Because payments made with such apps are not always reported and can often get lost in a mix of business and personal transactions, the IRS has had difficulty monitoring reporting and tax compliance with businesses using Venmo or PayPal. This has led to increased scrutiny of P2P apps. Because compliance is difficult to define in the case of P2P apps, you could be unintentionally non-compliant simply out of confusion or inaccurate tracking of expenses and revenue.

This risk is even worse for LLCs and corporations, as using peer-based payment apps puts them at risk of liability for business debts. When you’re incorporated, business and personal expenses need to be as distinctly separate as possible.

Tracking Business vs. Personal Transactions

If you’re using PayPal or Venmo, you’re responsible for manually tracking all business expenses and payments, since the apps won’t distinguish them from personal transactions the way professional banks and invoicing software do. This can lead to a major headache come tax season, as you’ll need to go through and manually report every individual business transaction.

In terms of business expenses paid through Venmo, the money requests themselves don’t qualify as formal invoices. This means you also need to collect invoices from any vendors or sellers you purchase from for your business and pay in this way.

PayPal is slightly better in this instance as they do have some invoicing capabilities for business accounts, but it is still your responsibility to manage overall tracking.

Privacy and Security Issues

Venmo has a unique functionality beyond just money exchange: it also operates a bit like social media, with a newsfeed sharing transactions between friends. Their goal is to make transactions more of an experience than just a simple transaction, but it can cause privacy issues for you and your clients if your transactions aren’t marked as private.

Think of Venmo as a social money app like Cash App or Meta Pay rather than a true bank or accounting software. Yes, you can send and receive money with it. If fraud occurs on your account, you will likely get your money back, but you can’t expect the same reliability and heightened security that you get with an app specifically designed for business. In fact, Venmo discourages transactions with anyone you don’t know personally, so it’s not necessarily ideal for a business owner.

Again, PayPal is a slightly better solution, as they offer options specifically designed for business owners, but there are still limitations and compliance issues due to the overall casual and social nature of the platform.

Tax Reporting Issues with Clients

It’s important that business owners take into account the client experience when making decisions. As the person on the receiving end of invoices or payment requests, your customers cannot pay you via Venmo without their own Venmo account! Even if you’re not an LLC and have no problem tracking your business expenses manually, this may put your client in the uncomfortable position of mixing their business and personal expenses.

PayPal doesn’t have this issue, as your clients can pay a PayPal invoice without creating an account. Yet both of these apps can lead to a dreaded tax complication if not handled properly: double reporting!

In order to maintain their own compliance with the IRS and tax laws, both PayPal and Venmo will send the IRS a 1099-K form on your behalf at the end of the fiscal year if you meet or exceed the requirement of $20,000 USD in gross payment volume from sales of goods or services and more than 200 transactions in a calendar year (this is the updated requirement for 2022). This generally will make things easier for you, but can be flagged for double income reporting if your clients issue you a 1099-MISC as well.

Basically, double reporting occurs if the IRS records both 1099s as separate records of income, meaning you’re liable for taxes on that 1099 twice. So if you don’t want to overpay your taxes, be wary of the double reporting risk when using PayPal or Venmo, and do your own tracking of expenses and income so you don’t miss errors like this on your tax return.

How to Maintain Tax Compliance

The best way to ensure compliance and properly track business transactions made with PayPal or Venmo is by creating an account exclusively for business purposes and connecting it with a business bank account. This way, you automatically keep your business and personal finances separate, solving the largest issue in terms of P2P apps and taxes.

If you prefer consolidating your banking, expense tracking and invoicing into one place, you may consider trying out Lili’s Invoicing Software. Instead of trying to juggle a combination of Venmo or PayPal and a business bank account separately, with Lili you can do all your banking and accounting in one secure location.