You’re starting to think about enjoying the freedom of self-employment, but you’re still unsure how all this accounting stuff works. Like what the heck is a self-employment ledger, and how do you make sure you’re doing everything right when it comes down to tax season. First of all, just know that everyone has these questions, and second of all, it gets easier with time. Once you understand how all these preliminary steps work, you’ll be able to kick off your business confidently and use every mistake as a lesson learned. So, let’s take a step back, breathe, and start from the beginning.

What’s a self-employment ledger?

A self-employment ledger, or “tax ledger”, is a fancy expression to describe where you keep track of all your business income and expenses – just your standard bookkeeping! You can document in an online spreadsheet, accounting software, or handwritten “ledger” book.

After saving and organizing your expenses, invoices and receipts, you’ll fill out this ledger with the following info:

- Date: when the expense or payment was received.

- Amount: how much you paid or received for the expense or invoice.

- Intent: the reason you made the purchase.

- Type of expense: the business deductible category for the expense.

- Service/product: the reason for earning your income, and who the client is (if it’s an invoice) or the provider (if it’s an expense).

Why it’s essential to track your income and expenses

Maybe you’re asking yourself: why do I need a self-employment ledger? Chalk it up to record keeping. As a freelancer, you’ll need to know exactly how much money you’re earning a month and how much you’re spending. Having a reliable self-employment ledger will help you better manage your finances and optimize your tax refund. By keeping a self-employment ledger, you’ll be able to show proof of all your earnings and expenses when it comes down to tax season. And with every eligible business expense, your taxes go down!

Whether filing taxes yourself or working with an accountant, having one organized place with all your expenses will make the process much faster, saving you valuable time and money.

On the flip side, inaccuracies in your financial records can make life more difficult when dealing with the IRS. So you want to make sure that you’re doing this accurately and keep proof of all your income and expenses, so you don’t get hit with tax penalties or inflated bills.

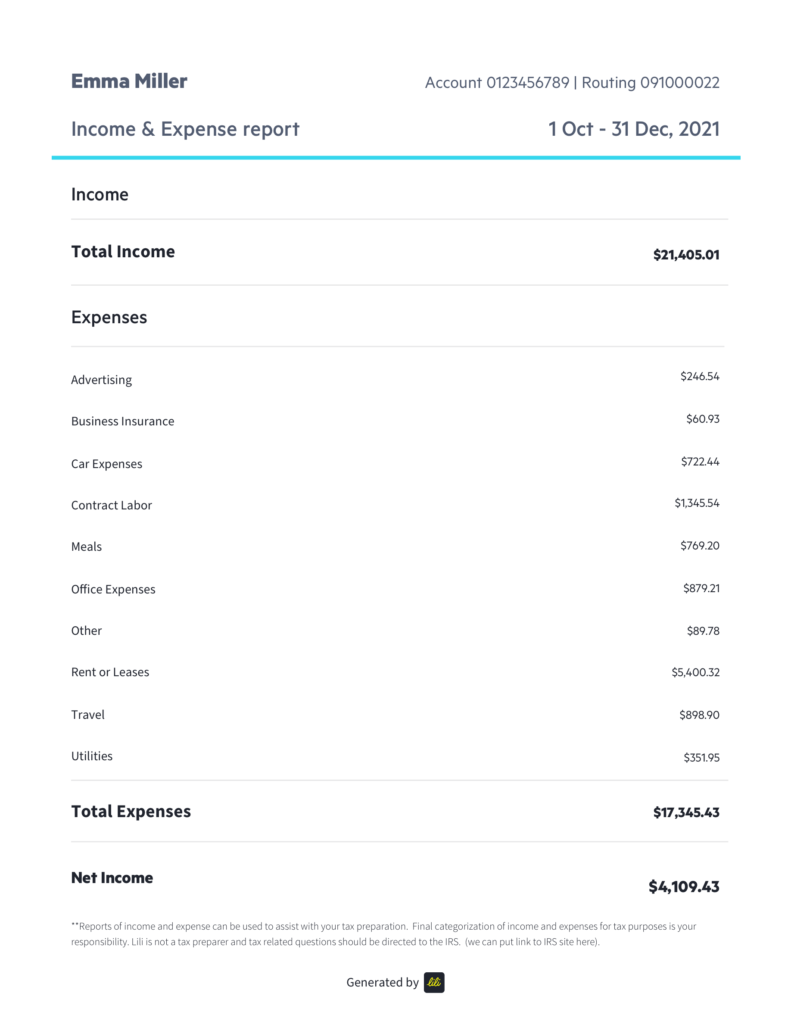

Here’s a self-employment ledger example

If you’re more of the visual type, below is an example of a simple, straightforward self-employment ledger to make things more clear:

(Tip: if you’re interested in using this type of report as your self-employment ledger, keep reading to find out how you can get one!)

Throughout the year, if you’re filling out your self-employment ledger manually, you would need to fill it out regularly and calculate the total, so you can determine how to file self-employment taxes, and especially itemize your tax deductibles.

You can find all types of different self-employment ledger templates online for free, including monthly and quarterly templates. Ultimately, it just comes down to which method works best for you. Since tracking your income and expenses is something you’ll have to do on an ongoing basis, you want to choose a process that’s comfortable for you. And if that happens to be with a pencil and a notebook, go for it! Just make sure when tax season comes along, you’ve got everything organized and in one place.

How to use a manual self-employment ledger

A self-employment ledger can be digital or handwritten, and you’ll need to fill it out throughout the year alongside keeping any online or physical receipts and invoices.

Step 1. Open a spreadsheet or download a self-employment ledger template

Step 2. Create a column for Income (money you’ve received) and Expenses (cost of running your business)

Step 3. Under Income add three columns: Date, Invoice, and Service/Product

Step 4. Under Expenses, add four columns: Date, Cost, Type of Expense, Intent

Step 5. Calculate the total income and total expenses at the bottom of the spreadsheet

Step 6. Save all your receipts (physical copy or online) and fill in your spreadsheet throughout the year

It’s a good idea to keep your ledger somewhere you can easily access it. If you’re on a computer, make sure to keep it in an organized folder online and save it in your bookmarks so you can reach it at any time. If you prefer pen and paper, keep it in your home office near your desk, so you know exactly where to find it. You’ll also want to keep a folder with all your receipts (photos or physical copies).

How to generate a self-employment ledger using Lili

If this sounds a bit overwhelming, don’t worry. There’s an easier way than recording all your income and expenses manually. Instead, there are business expense trackers that are super easy to use. With Lili, you can separate your business from your personal expenses in real time, upload pictures of your receipts, and create, send and manage all of your invoices. As well, you can generate an Income and Expense Report that will come in handy in the course of your business accounting and when filing taxes. You’ll avoid having to track expenses and tally them up manually, and also be able to quickly determine your taxable income. With Lili, all of your bookkeeping is conveniently centralized in one platform, always accessible on desktop or mobile.

Here’s how to track your income and expenses with Lili

Step 1. Categorize transactions in real-time

Swipe left or right to categorize expenses as either business or personal.

Step 2. Upload pictures of your receipts

Go to All Transactions to take a photo of your receipt directly from within your Lili mobile app or upload an image on desktop via the web app.

Step 3. Download your Income & Expense Report

Go to Statements and Sheets, then choose which period you’d like to download. You can then download the file to your phone or desktop (via your Lili mobile or web app), or email the file to your accountant.

Handling your daily bookkeeping doesn’t have to be time-consuming and frustrating – hey, it could almost be fun. Who doesn’t like to swipe right? Make things easier with Lili’s Accounting Software. As a business owner or freelancer, knowing how to manage your income and expenses is a valuable part of the job. Now that you know how to track both with Lili, you’ll save time and money when it comes to your bookkeeping, and feel confident you’ve got your business finances under control.