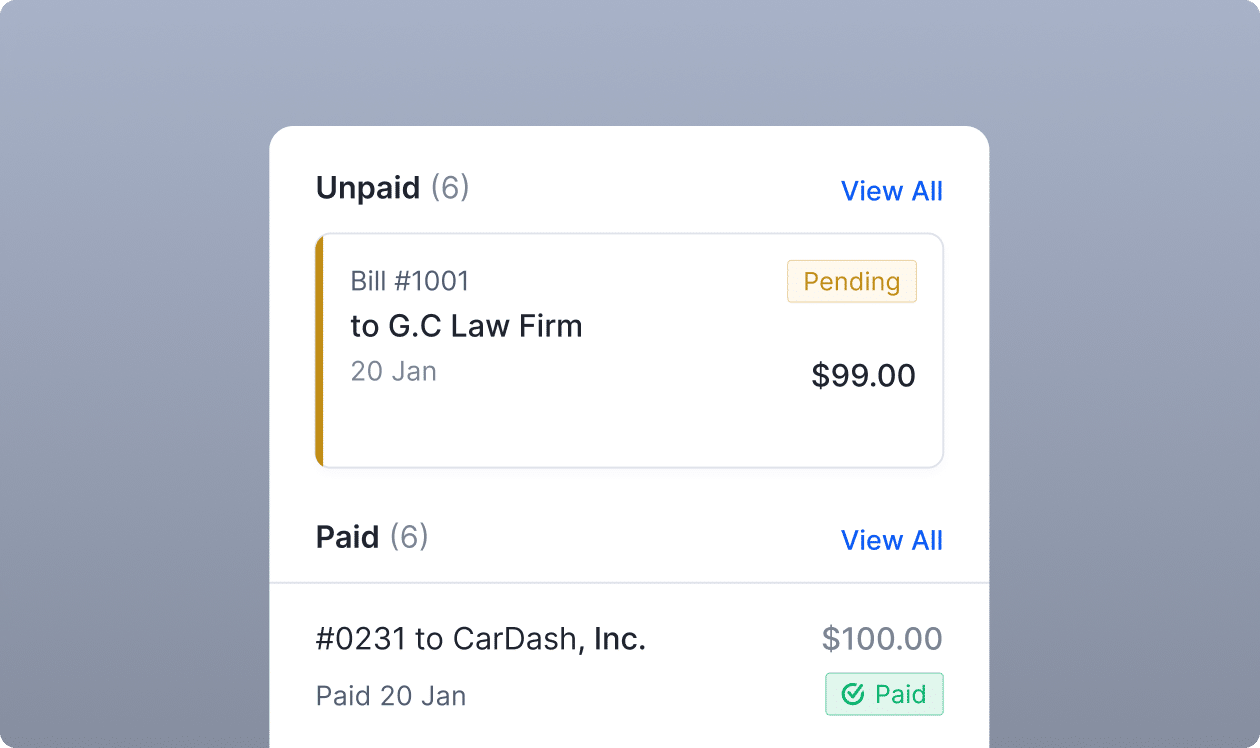

Transactions are categorized in real time by Lili AI smart suggestions, keeping your books accurate, organized, and tax-ready, without the manual work.

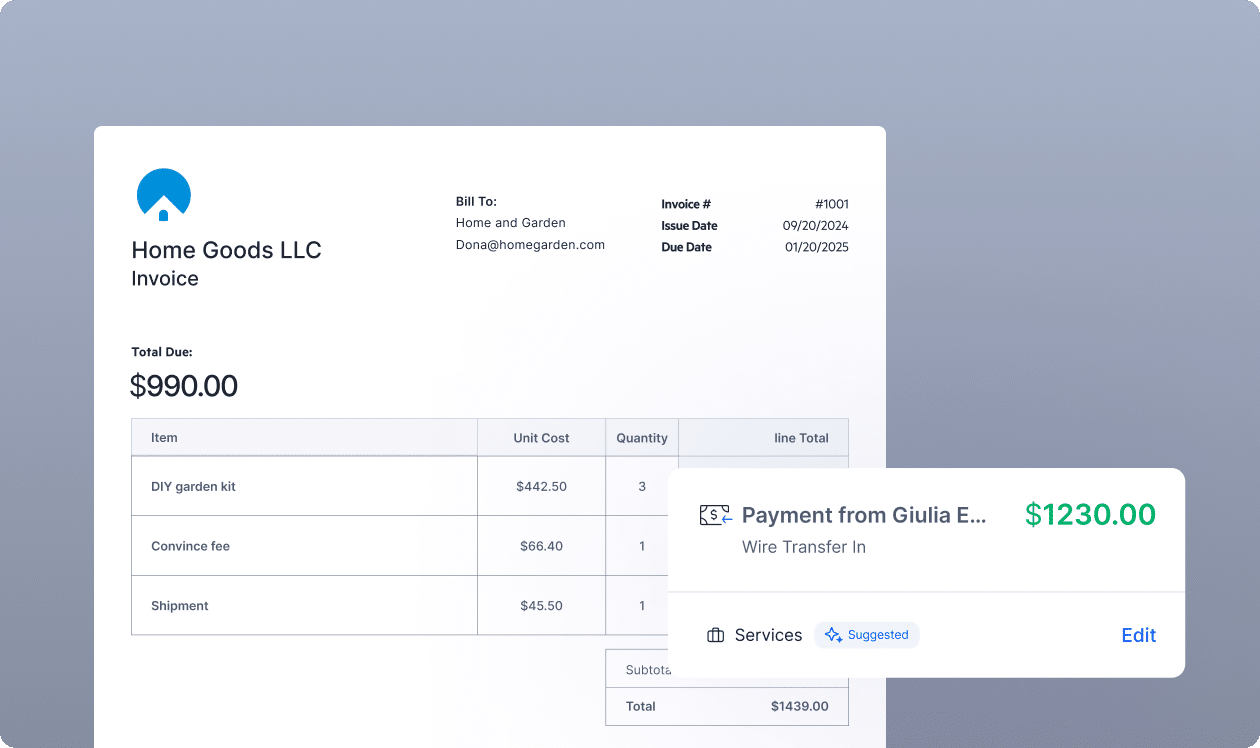

Take a quick tour of the tools inside the Lili account. Banking, bookkeeping, invoicing, and taxes, all in one place.