Simplify tax preparation

Tax planning becomes a seamless part of your business operations with Lili, so you can minimize your tax liability and avoid the headache during tax season.

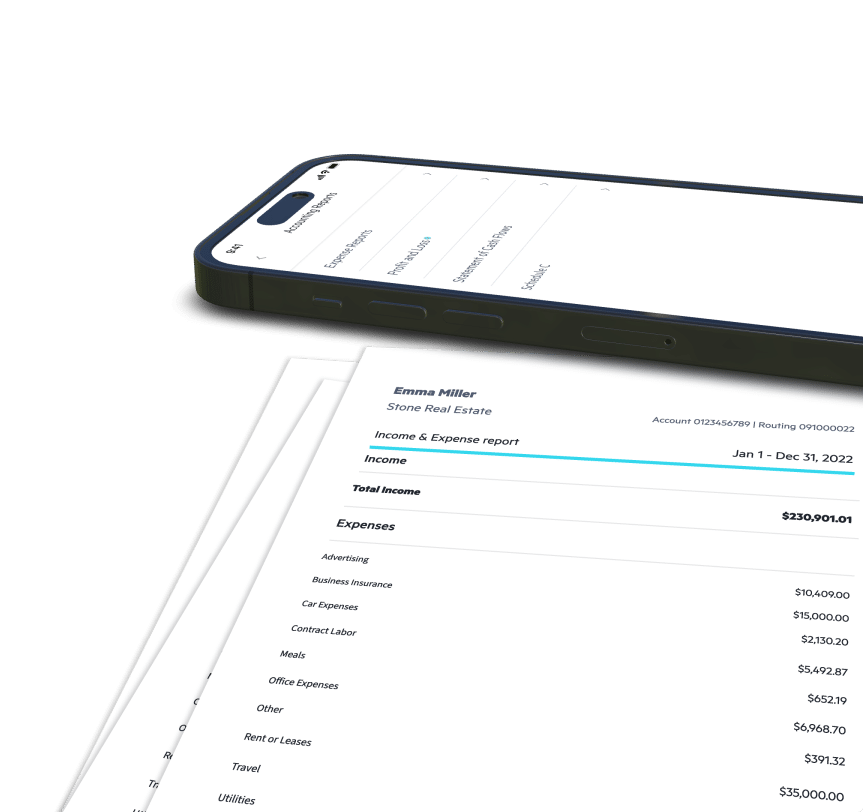

A quicker tax preparation process

Categorizing transactions as you go means approaching tax season ready to file. Your business tax deductions, expense reports1, and pre-filled tax forms2 will be available in your Lili account at the start of tax season, saving you time on tax prep.

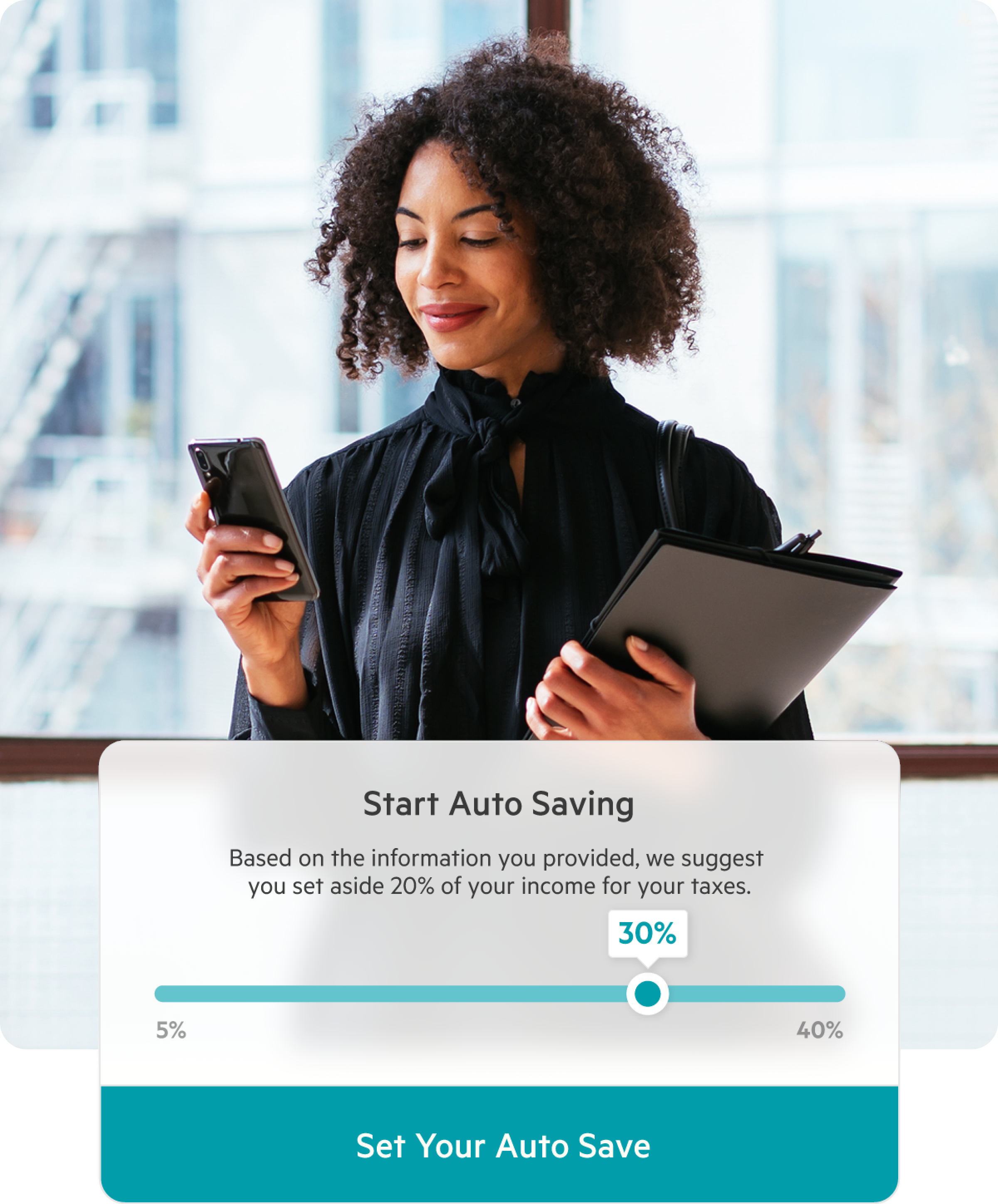

Auto-save for tax payments

Be prepared for tax season before it arrives

Preset the amount you want to automatically contribute to your tax bucket each time you get paid1. Avoid stress and a surprise bill during tax season by being prepared throughout the year.

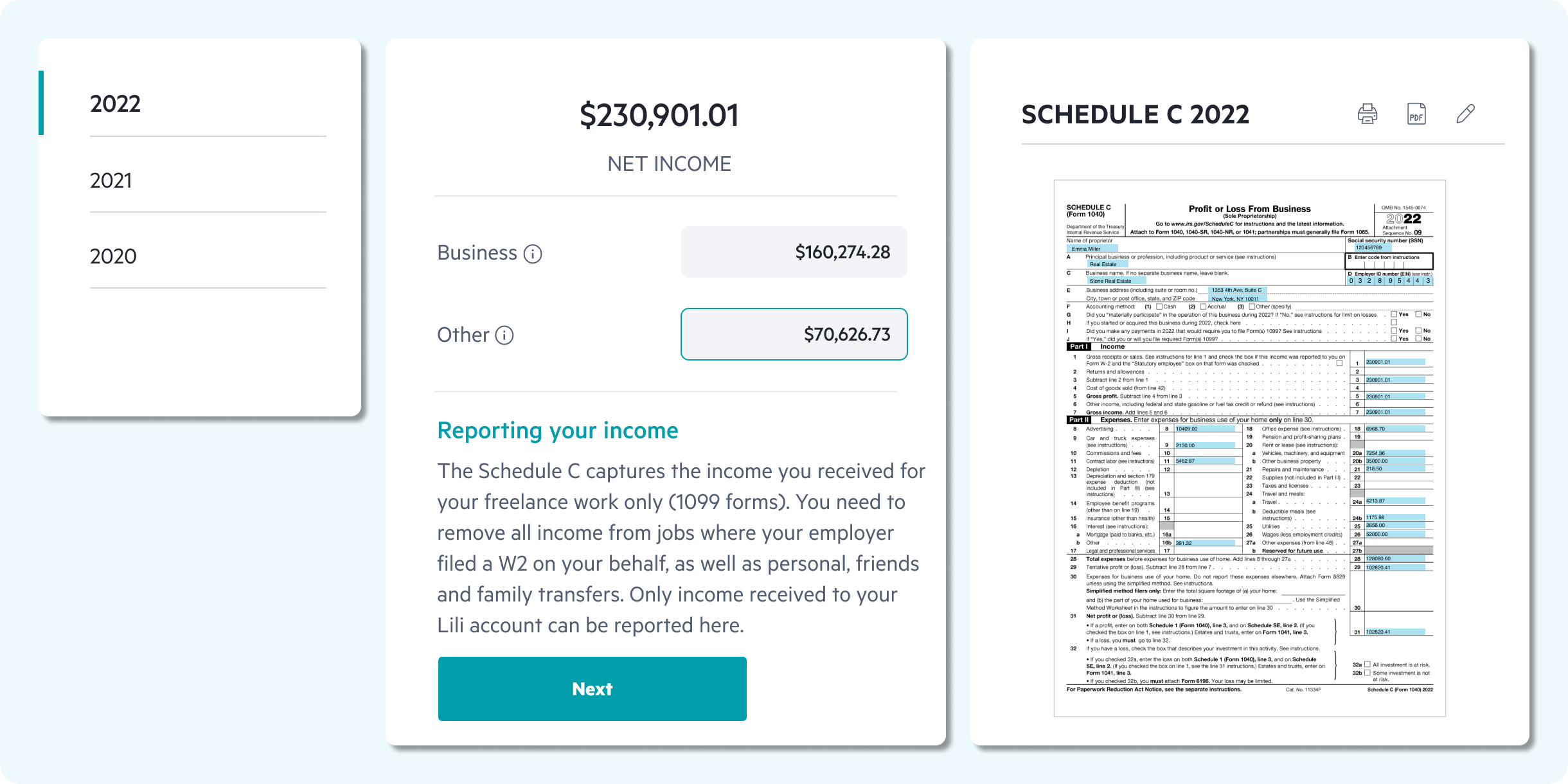

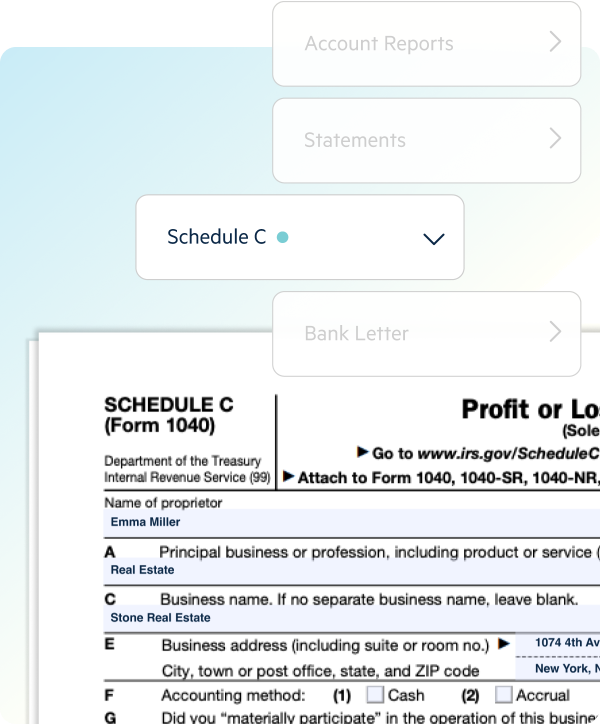

Smarter tax documents

Avoid the time-consuming and costly process of filling out IRS tax forms.

Lili provides pre-filled tax forms2 including Form 1065, Form 1120-S, and Schedule C so you can shorten your tax preparation and maximize your tax deductions.

Frequently Asked Questions

You can easily categorize business expenses in your Lili account in real-time.

Whenever you spend money from your Lili account, you can categorize the expense as business or personal simply by swiping on the Lili platform – swipe left for a personal expense and swipe right for a business expense.