In the delicate dance of entrepreneurship, modern small business owners face the challenge of growing their businesses while also managing their intricate business finances.

In our recent survey, nearly 80% of business owners handle their own accounting and finances. Beyond time constraints, this approach poses risks due to potential misunderstandings, leading to serious financial issues.

Perhaps one of the biggest pain points today for the modern small business owner is the expectation to manage increasingly complex business finances without having any expertise to do so. 52% of SMBs cited “getting a consolidated view of finances” as a pain point in a 2023 survey. So, we pose this question: How can we develop a solution that not only resolves the complexities of financial management for business owners, but also transforms into a potent resource, amplifying their capacity to succeed and innovate?

At Lili, we leaned into the challenge to come up with a revolutionary solution to remedy those pain points as the newest innovation of our Lili AI product, and after extensive research and development, we’ve landed on something that does just that: Accountant AI.

Introducing Accountant AI

Accountant AI is a generative AI tool that combines transaction data and the latest industry information to answer financial and accounting questions from customers in a chat-based format.

Based on the success of Lili AI initial product and on industry-wide trends, we knew that our AI initiatives would not stop with Predictive Transaction Categorization.

A natural next step in our Lili AI initiative was exploring the emerging technology of generative AI (gen AI) for the benefit of our customers. From this, the concept of Lili’s own chat-based AI model was born. Accountant AI responds to queries using its extensive training and the latest tax and accounting information, but unlike other AI chatbots on the market, it also adds in three new layers to its responses:

- Financial data about the business and similar businesses directly from the Lili platform

- The latest information and 2024 updates in the tax world

- Human accounting expertise folded into prompt engineering

Combining the above, Accountant AI revolutionizes the way businesses interact with their financial data.

From the technology perspective, we chose to partner with Amazon Bedrock for its robust privacy and security measures, crucial when dealing with business information. This way, we are ensuring we can keep data secure from potential leaks or misuse.

Driving Positive Change: Businesses Witnessing AI’s Impact in Finance

As of October 2023, 75% of U.S. small businesses are utilizing AI tools, with financial management tools ranking as the most prevalent at 40%.

We can attribute AI’s widespread adoption in finance to its adeptness at deciphering intricate data, streamlining processes, minimizing risks, and elevating customer experiences in a fiercely competitive landscape.

In August of last year, we launched Predictive Transaction Categorization, the first product of Lili AI. This feature combines business banking and accounting, utilizing an internal model integrated with genAI solutions to suggest the correct tax category for transactions.

Since we launched Lili AI, 97% of our Lili AI facilitating customers’ transactions are being categorized automatically, which in turn drives tax preparedness.

Using AI to translate financial data into a positive business impact

Lili’s value lies in how it combines customers’ banking and bookkeeping all in one place. Accountant AI goes one step further and harnesses the power of artificial intelligence on top of that already powerful combination that Lili holds.

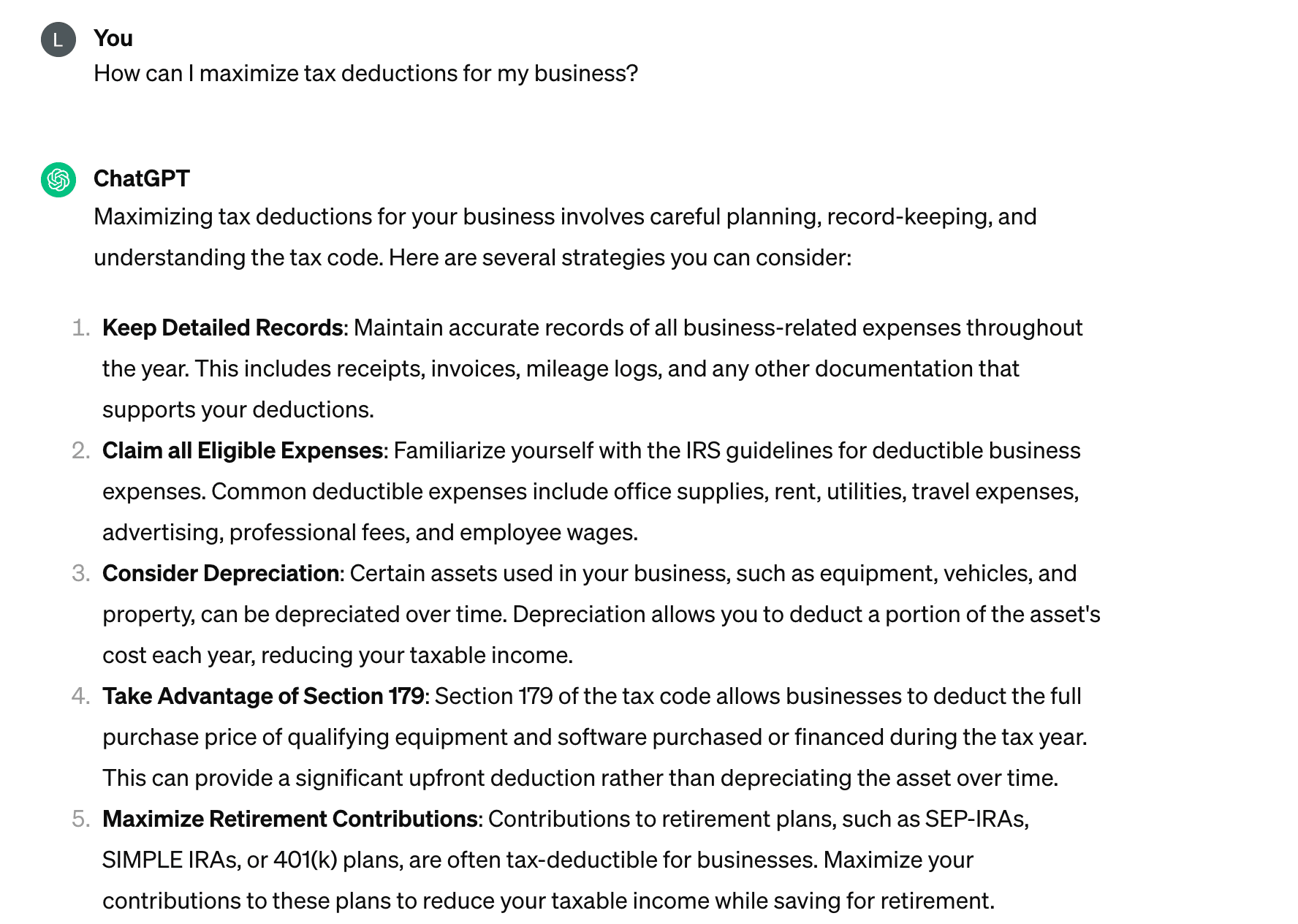

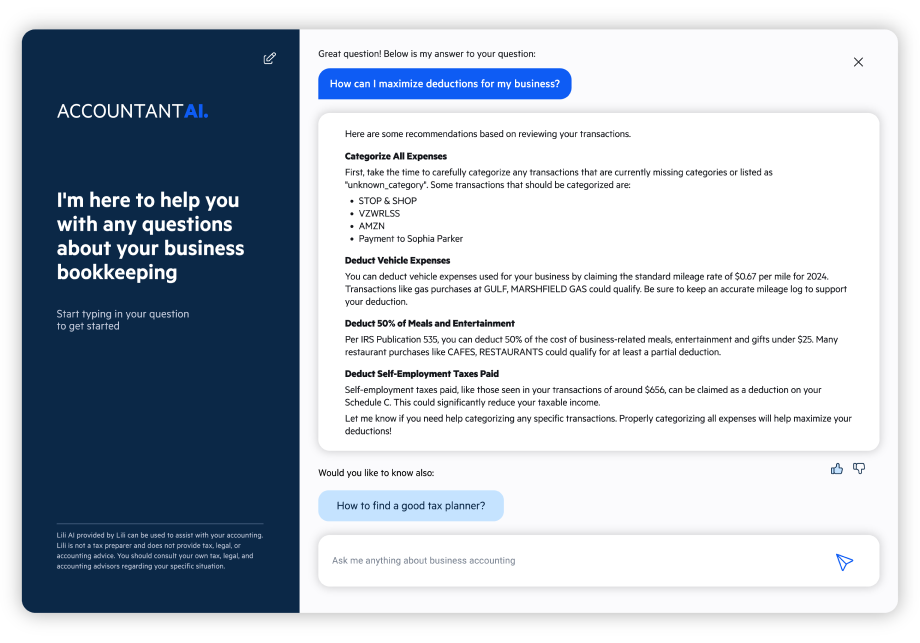

To illustrate, compare asking the top popular question to ChatGPT, which lacks historical understanding and financial training, with consulting Accountant AI. The latter has access to a customer’s transaction data, tax savings insights, and it also has tailored expertise in business finance.

Asking ChatGPT:

Now, let’s compare this to asking AccountantAI:

While Accountant AI is still learning and responses will only become more in-depth over time, the difference between ChatGPT’s response and Accountant AI’s responses to the same question here speaks volumes: One product can answer specific questions about your business and its finances and the other cannot.

As complex as accounting and finance can get, much of them are governed by a set of rules and interpretations that a machine can learn with ease, but that would take a human quite a bit of resources to confidently do the same. This holds great potential for modern business owners who must handle both operations and finances effectively. Not only does this facilitate business financial management, but it also unlocks owners’ potential to turn their businesses more profitable.

Democratizing access to advanced financial insights

Perhaps the most exciting side to Accountant AI is the empowerment it brings to businesses of all sizes. Having access to accountants at all times, or even to tools that have high-level insights about your business finances, can cost a lot more than many businesses can afford.

AI as a solution is particularly attractive because of its affordability over alternatives. Some businesses that may not be able to afford to keep an accountant on retainer can now gain access to advice that wasn’t within reach until now, and the quality of advice will just get better over time.

Lili’s Vision: Pioneering the Future of Financial Accessibility and Empowerment

We are proud of what we have accomplished for our customers so far with Lili AI and Accountant AI, and as Lili looks to the future, we plan to continue on this path forward.

Under the umbrella of Lili AI, we’ve seen huge success with the initial product (Predictive Transaction Categorization) actually prompting more customers to get ahead on tasks for tax season. With Accountant AI as the next generation of Lili AI, we expect we will bring financial insights within reach for many business owners who simply couldn’t access it before. This could bring endless outcomes for business owners and how they manage their finances differently.

Lili customers can expect that we will continue down the path of empowering customers with more access to high level business insights and practical solutions to their financial management needs.

Accountant AI is available to Lili Smart and Lili Premium Account Plan holders. Lili AI provided by Lili can be used to assist with your accounting. Lili is not a tax preparer and does not provide tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors regarding your specific situation.