Here’s the short version: as a self-employed individual, you pay two types of taxes – the self-employment tax and the income tax.

The Small Business Tax Hub

Free Tax Season Resources

Looking to get organized for tax season, but not sure where to start? Lili’s Tax Hub has everything you need – guides, tips, important info, and free tools! Check out our free tax resources below and avoid the headache this tax season!

And our Tax Preparation Software makes tax planning a seamless part of your business operations, so you can minimize your tax liability and simplify tax prep.

Tax Season Basics: What You Need to Know for 2025

We’ve put together a collection of articles on tax season basics, covering everything from tips for reducing your taxes, to common tax forms, to finding a good CPA, to filing your taxes accurately.

IRS Tax Season Updates

Recent tax season updates from the IRS that are relevant for business owners.

Business tax account access and capabilities expanded

December 18, 2023, IRS Notice 2023-243: The IRS announced an expansion of eligible business entities and features of the business tax account. In addition to sole proprietors, partners of partnerships and shareholders of S corporations are now eligible for a business tax account. New features include the ability to download PDFs of business tax transcripts and view certain notices.

IRS issues standard mileage rates for 2024

December 14, 2023, IRS Notice 2023-239: The IRS issued the standard mileage rate for 2024, which will be 67 cents per mile for business use, up 1.5 cents from 2023. This rate will apply beginning on January 1, 2024. The mileage rate for the 2023 calendar year (the rate applicable for the 2024 tax season) is 65.5 cents per mile, as specified previously in IRS Notice 2022-234.

Form 1099-K reporting threshold changed

November 21, 2023, IRS Notice 2023-74: The IRS announced a delay of the scheduled $600 reporting threshold for Form 1099-K for calendar year 2023. For calendar year 2023 (the 2024 tax season), third-party payment networks who issue Forms 1099-K are only required to report transactions where gross payments exceed $20,000 and there are more than 200 transactions.

Simplify Tax Season with Lili

With Lili, categorizing your transactions is quick and painless. And, when tax season rolls around, Lili generates prefilled IRS tax forms (including Schedule C, Forms 1065 & 1120-S) based on what you’ve already categorized, so you can save time and money during tax prep!

Avoid the headache next tax season and sign up with Lili today.

Business Tax Form Deadlines in 2025

When is the deadline for filing your 2024 business taxes? We’ve compiled a list of tax form filing deadlines (and extension deadlines) for each business structure.

Form Number |

Deadlines |

Extension |

|

Partnership & Multi-Member LLCs |

1065 – Return of partnership income | March 15, 2025 | September 16, 2025 |

| 7004 – Extension for business income tax | |||

S Corporation |

1120-S – Tax return (S-corp) | March 15, 2025 | September 16, 2025 |

| 7004 – Extension for business income tax | |||

C Corporation |

1120 – Tax return (corporation)

1120-W – Estimated tax for corporations |

April 15, 2025 | October 15, 2025 |

| 4868 – Extension for individual income tax | |||

Sole Proprietor |

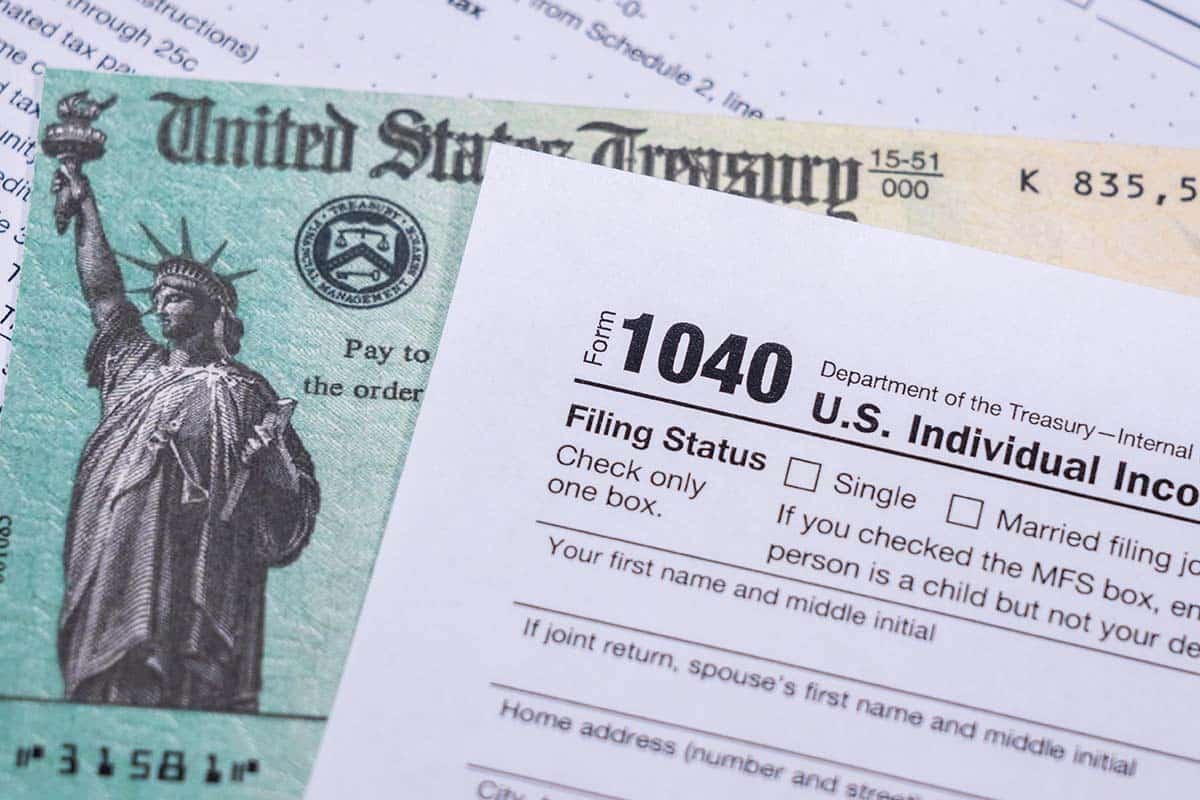

1040 – Individual tax return

1040-ES – Estimated tax for individuals |

April 15, 2025 | October 15, 2025 |

| 4868 – Extension for individual income tax | |||

Employers: Wages |

W-2 – Wage and Tax Statement | January 31, 2025 | |

| W-3 – Transmittal of Wage & Tax Statements | |||

| W-4 – Employee’s Withholding Certificate | February 15, 2025 | ||

Employers: Taxes |

941 – Quarterly tax return for employers | Q1: April 30, 2025 Q2: July 31, 2025 Q3: October 31, 2025 Q4: January 31, 2026 |

|

| 944 – Employer’s Annual Federal Tax Return | January 31, 2025 | ||

Employers: Health Coverage |

1095-B – Health Coverage | February 28, 2025 If filed on paper |

March 31, 2025 If filed electronically |

| 1094-B – Transmittal of Health Coverage Information Returns | |||

| 1095-C & 1094-C – for employers with 50 or more employees | |||

Forms 1099 |

1099-NEC – Nonemployee Compensation | January 31, 2025 | |

| 1099-MISC – Miscellaneous Income | February 28, 2025 If filed on paper |

March 31, 2025 If filed electronically |

|

| 1099-K – Payment card and third-party network transactions | February 28, 2025 |

Let us do the math for you with our Self-Employed Tax Calculator!

Get an instant estimate of your tax liability for 2023.

$Taxes

$set

$it

$sit

$20,000

in Colorado, your total estimated tax liability for 2025 is

$3,938

The self-employment tax is a flat 15.3% on your net income. It covers your contribution to Social Security (12.4%) and Medicare (2.9%). You owe self-employment tax, no matter how much money you make.

You owe taxes on your net income at the federal and the state level (unless your state doesn’t have an income tax). The percentage depends on your net income and filing status. And, it’s progressive, meaning you don’t pay the same percentage on all of your income.

Your net income is the result of your gross profit (how much money you made) minus your business expenses (how much money you spent to run your business).

Frequently Asked Questions

Whether you have a specific tax question or are just generally unsure about tax season, we clear up some of the confusion below.