While I think you’d be hard pressed to find a freelancer who will openly admit they long for the days of the corporate grind, serving as your own human resources department can inevitably cause you to miss having a well oiled payroll department to handle the intricacies of taxes for you. But as you have now accepted the promotion to CEO of your own business, it’s up to you to figure out how to get the good folks at the IRS their taxes in due time. Which brings us to the issue of Estimated Tax Payments.

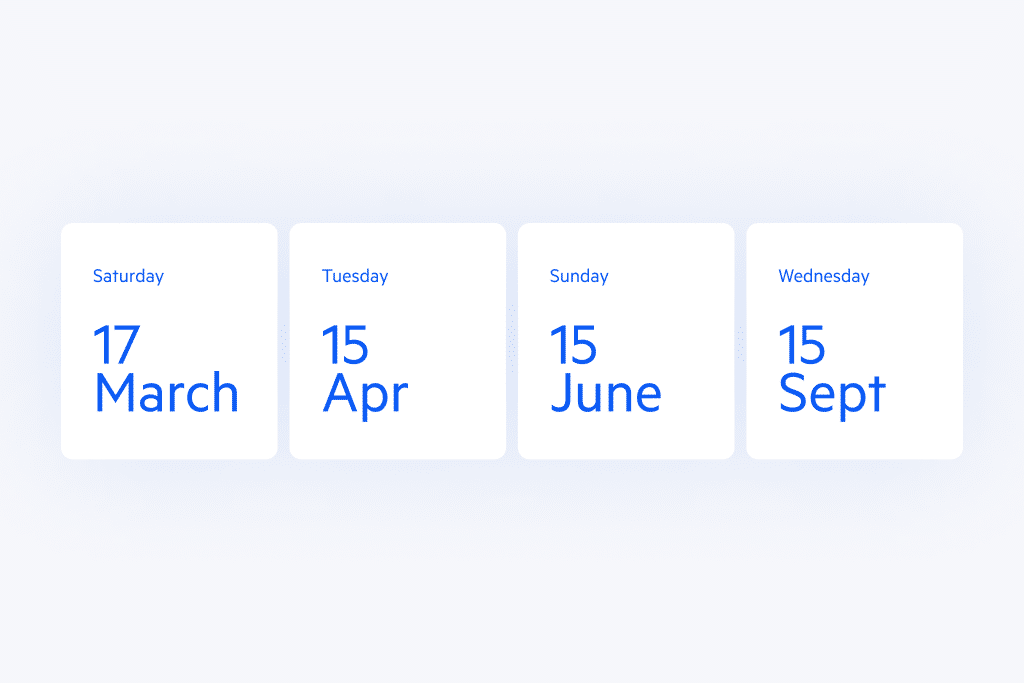

The reality is, for any freelancer who expects to pay more than $10,000 in taxes to the IRS, taxes aren’t just a once a year occurrence but rather an ongoing process requiring periodic monitoring. This is done through Estimated Quarterly Payments which requires you to predict what you’ll owe in taxes for the year and then remit the amount over the course of four quarters.

Sounds a bit like palm reading, right? Not to worry, with a little background you’ll be able to ensure your tax payments are timely and accurate while avoiding the ire of the IRS.

Why You Need to Submit Quarterly Payments

Many of you might be asking “I’ve always paid my taxes in April, why is the IRS making me jump through hoops”. In actuality, when you’re a W-2 employee, you’re still paying taxes in the form of paycheck withholdings. When an employer withholds taxes they’re actually sending a tax payment to the IRS based on what the company estimates you’ll make this year. Then come April, it’s up to you to determine what you actually owe. The difference between this figure and the amount your employer has already paid the IRS over the course of the year is either due or issued back to you in the form of a tax refund.

Now, as you don’t have an employer to do this on your behalf, it’s up to you to submit these periodic payments to the IRS and State. Thankfully, while an employer has to calculate these payments every pay period, you only need to cut the IRS a check “quarterly”. I add heavy quotes to quarterly because while the government calls them quarterly payments, they’re not due every three months.

How Do I Know How Much to Send?

As the name implies, the taxes you’re sending the IRS and State quarterly are based on what you estimate to earn during the year. For a seasoned freelancer, this shouldn’t be too tough, but for someone just dipping their toes in the self-employment pool, determining this number accurately can seem like a fruitless task.

To add additional undue stress, there are repercussions for underpaying your estimated tax payments. With that being said, there are some guidelines you can adhere to that ensure you’re not penalized. These are referred to as Safe Harbor.

Like a ship sailing through the raging seas, to be in safe harbor means you’re protected. Why the IRS deployed a nautical metaphor here is unclear but what you need to know is, if you adhere to Safe Harbor guidelines you won’t be penalized. The rules surrounding Safe Harbor are very straightforward. You’ll be in Safe Harbor if the amount of Estimated Tax Payments equals the lesser of:

- 90% of taxes due for the current year, or

- 100% of last years taxes paid (110% if your prior year Adjusted Gross Income was more than $150,000)

To illustrate: last year I had an Adjusted Gross Income of $75,000 and paid $22,000 in taxes. This year I’m making more money and I’ll ultimately end up owing $30,000. As long as my total estimated tax payments add up to at least $22,000 ($22K is less than $27K = 90% X $30,000) then I don’t have to worry about being penalized for underpayment. So again, as long as your tax payments during the current year are equal to what you paid last year, you’ll be in safe harbor.

A quick point of clarity. If you do opt to structure your estimated payments via the 90% route, this doesn’t mean you get away with paying 10% less tax. The remaining balance will still be due come April when you file your annual returns.

How Do I Estimate My Taxes This Year?

Knowing how to avoid penalties is great, but that still begs the question, how do I accurately determine what I’ll owe in taxes this year? To start, the taxes you’re prepaying with an Estimated Tax Payment are your income tax and self-employment tax. The majority of Americans ultimately pay around 30% of their total income in total taxes. So as a rule of thumb, if what you paid in estimated taxes was significantly higher or lower than 30% of what you actually earned in that respective quarter, it may be time to reevaluate.

Another common concern regarding estimating income is the simple fact that things can change dramatically over the course of the year. Say your business goes gangbusters causing you earn way more than you initially predicted. Or maybe this is your first time freelancing and you have literally zero idea what your income will look like. In both these cases the estimated income used for your quarterly payments will most likely be inaccurate.

Thankfully when it comes to estimated tax payments, your feet aren’t taped to the bicycle once you begin submitting payments to the IRS. If there’s a significant change in your income, you do have the capacity to amend your estimated income amount and adjust subsequent payments to accommodate these fluctuations. Be warned though, if you think this is a loophole to not pay taxes now and make it up later, if a quarterly payment is less than 1/4th of what the proper payment should have been based on your actual taxes due, the IRS does have the right to penalize you for underpayment. So it’s in your best interest to be as accurate as possible.

Filing with the IRS and State

At this point you ideally have a grasp on the rules and intricacies surrounding Estimated Tax Payments. So how do you actually file this information with the IRS and get them their checks? Well, that is done using Form 1040 – ES which is filed in conjunction with your first quarterly payment on April 15th. This filing walks you through the process of calculating your Self Employment tax and Income tax then determines what you’ll owe for each respective quarter. The form contains four vouchers that you’ll submit with each payment. Additionally, if you do need to amend your income amount, this can be done by submitting an updated 1040-ES and following these IRS instructions.

When it comes to determining quarterly payments on Form 1040, the IRS takes a simplified approach by dividing your total estimated taxes into four equal payments. For some freelancers who make a majority of their income during certain times of the year, this could result in paying taxes when you’re not actually producing income. If this sounds like you, consider using the Annualized Income Method when filing Form 1040. This helps you better align your tax payments with the period you’re actually earning money.

Note: the above is for filing with the IRS. Many states will require a similar quarterly payment cadence so check with your state tax board to determine if and how you need to file quarterly.

Bringing It All Home

Estimated Tax Payments are admittedly an unexpected detour from the traditional tax paying process that can confuse and frustrate both new and seasoned freelancers. Yet, by remembering how to stay in Safe Harbor, keeping good records of taxes paid and your current business expenses on Lili, and remembering to adjust your payments if your situation changes, you can continue to grow your business without the worry you’ve overpaid or underpaid your quarterly taxes.