Looking to streamline the way you get paid? Direct deposit is a popular choice for many freelancers and employers. But what exactly is a direct deposit, and how does it work? We’ll cover it all in this quick guide.

What is direct deposit, and how does it work?

Direct deposit is the electronic transfer of money directly from one account to another. With this method, there’s no need for a physical check or a visit to the bank. Once you send an invoice and your client pays it, you’ll receive the money directly in your account. It’s a convenient and fast way to get paid, collect your tax refund, and make online payments. So any electronic payment that goes directly from the payer’s bank account to the payee’s account counts as a direct deposit.

You might be saying: sure, I get that a direct deposit goes right into my checking or savings account, but how does it work? Direct deposits are processed via an electronic network called ACH (automated clearing house). Once your client has your banking info – routing number, account number, and name on the account – they can enter it into their payment or banking system and pay you directly.

How long does direct deposit take?

Since banks don’t tend to hold electronic payments, you won’t need to wait long for a direct deposit to clear. Usually, midnight is the time when the money hits your account, but it can take anywhere from one to two business days. Once the money is in your account, you can use it immediately, without paying a transaction fee. With Lili mobile banking, you’ll get a notification letting you know that the money has landed as soon as the direct deposit is processed. And that’s one sweet notification.

Why set up direct deposit?

If receiving your money fast with no transaction fees doesn’t give you peace of mind, there are a few other benefits to using direct deposit. For starters, it’s easy to set up, and it’s also safe. Since the payment goes directly into your account, you don’t need to worry about it getting lost along the way. For these same reasons, American Social Security benefits are paid electronically after the U.S. government stopped issuing benefits checks back in 2011. It’s also the fastest way to get your tax refund, or child tax credit, according to the IRS.

How to set up direct deposit

It’s pretty simple. Just log into your online bank account and download a prefilled form with the following info:

- Your bank name (for Lili, the bank name will show as Choice Financial Group)

- Bank Account Number

- Bank Routing Number (ABA or Transit Number)

How to accept other forms of payment

If your client insists on paying you with a check or a payment app — that’s no problem. You can show your flexibility by accepting payment methods besides direct deposit, including Stripe, Paypal, Cash App, Venmo, and even checks. And good news! It’s all possible with Lili.

When using payment apps, it’s good to know each app’s transaction fees beforehand. Here’s a quick breakdown:

- Venmo: 3% transaction fee and no charge to receive money

- Cash App: 1.5% free for Instant Deposits and no charge for standard deposits

- Stripe: 0.30 USD +2.9% per card and wallet transactions

- PayPal: 0.49 USD + 3.49% on every transaction.

- PayPal POS: To accept in-person payments, you’ll need to purchase a card reader and terminal. Then for every card swipe, there’s a 2.7% transaction fee.

- PayPal International: 1.50% (excluding American Express Payments) + fixed fee depending on the currency

How to set up direct deposit through Lili

Transferring money to and from your Lili account is entirely free, and you can accept all forms of payment in one place. To connect your Lili account make sure you have your Account Number and Routing Number, then go to Menu/Add Money/Direct Deposit. Once connected, you’re ready to send an invoice and request a direct deposit straight from your Lili app.

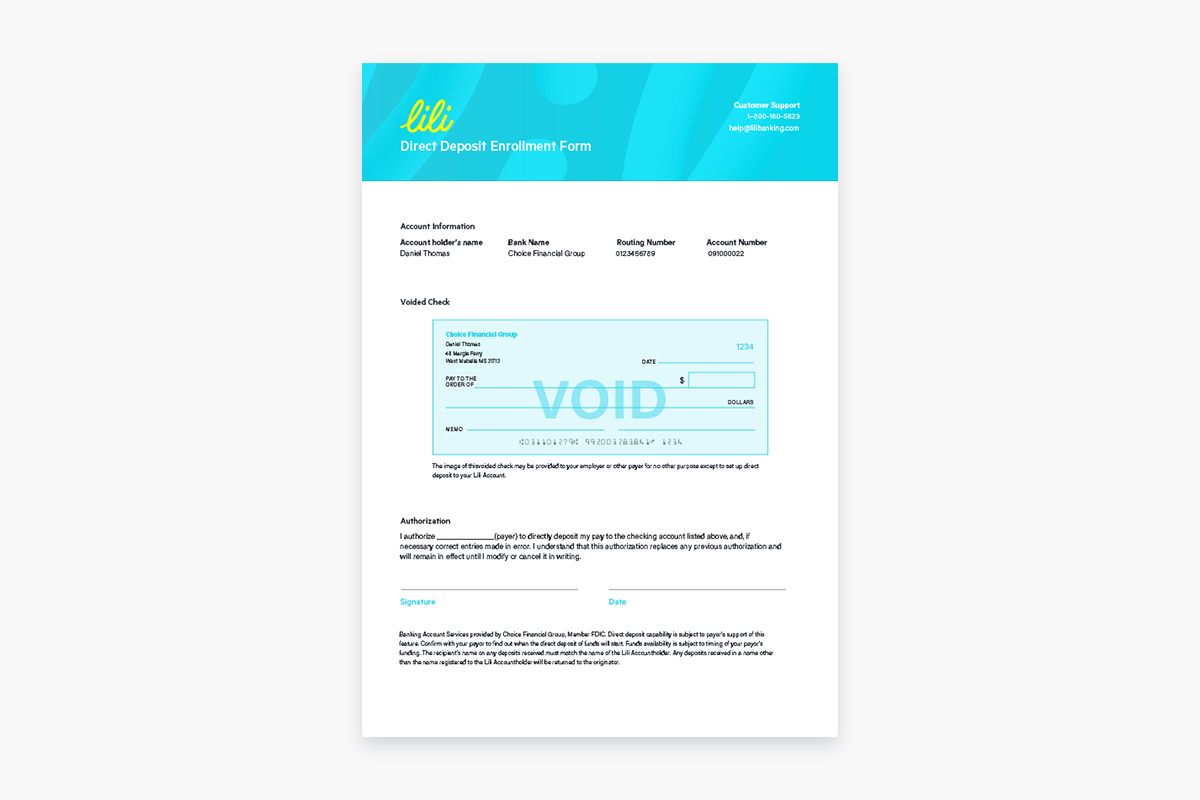

If you would like to authorize your employer to deposit your salary directly into your Lili account, you can generate a ‘Direct Deposit Enrollment Form’ via the Lili app. First, under the “Add Money” menu section, select “Set up direct deposit”. Then, in the Direct Deposit screen, select “Get a direct deposit form”. After doing so, an email will be sent to you with a pdf attached to it that will include the voided check, as seen in the example direct deposit enrollment form below:

Connecting Lili to a payment app

To connect your Lili account to a payment app, copy and paste your routing and account number from the Lili app into your payment app account. Then, one or two micro-transfers will be sent to your Lili account (usually a couple of cents). A couple of days later, you’ll need to check and confirm the amounts match. If they do, you’re linked and ready to go! Every time a client transfers money to your account, you’ll get paid up to 2 days early.

There’s no fee for all standard transfers, but if you prefer Instant Transfer, Cash App charges a 1.5% transaction fee, while PayPal and Venmo both charge a 1% transaction fee capped at $10.

Accepting checks through Lili

If your client insists on paying you with a check, don’t sweat it. Go to Menu / Add Money / More Options / Mobile Check Deposit. If you deposit the check to your Lili account before 3pm EST, it’ll get reviewed that same business day. Once approved, you’ll have access to your funds within 5 business days. Make sure to check Lili’s terms and conditions for checks deposit.

Get paid through Lili

You can set up a Lili account in as fast as three minutes and start receiving electronic payments right away. After you’ve opened an account and downloaded the Lili App, go to Menu / Get Paid / Send a Payment Request or provide your Lili routing and account number to your client. Once your job is complete, the payer will deposit money directly into your account. No fee, no limit. And if you’re using direct deposit, you’ll even get paid up to two days early (and who doesn’t love an early payday??). For Lili Pro users, you can also send an invoice directly from the app, which will include all the information your client needs to pay you. If you make it easy for them, chances are they’ll pay you on time!

Make getting paid stress-free

When you take on a project as a freelancer, getting paid should be the easy part. Direct deposit will guarantee just that, so you can spend less time stressing and more time earning.